Last week, the VN-Index experienced a session with significant volatility. After surpassing the 1,800-point mark, the index faced substantial downward pressure in the final two trading sessions due to an unexpected reversal by the Vingroup stocks. By the end of the week, the VN-Index closed at 1,729.80 points, up 25.49 points (+1.50%) from the previous week.

Experts remain cautiously optimistic about market dynamics ahead of the New Year holiday. The focus is on the fourth-quarter business results (BQ4) and sectors expected to show strong growth, making them suitable for medium to long-term accumulation.

Another sell-off in the VN-Index cannot be ruled out in the short term

According to Mr. Nguyễn Thái Học, a Securities Analyst at Pinetree, while the VN-Index recorded gains last week, the final two sessions’ volatility makes it challenging to determine the market’s next trend.

Thursday’s session saw the VN-Index break its historical peak, but the momentum was short-lived as the index quickly reversed, even plunging during the ATC session. On Friday, negative pressure persisted, though the index swiftly filled the gap and rebounded by 42 points. This indicates that bottom-fishing demand exists but isn’t strong enough to confirm a recovery trend.

As we enter the final trading week of the calendar year, Pinetree experts believe Vingroup stocks will remain a key factor influencing both the index and market sentiment. Their strong rebound candles, closing near session highs with notable bottom-fishing liquidity, make short-term trends unpredictable.

Possible scenarios include these stocks reversing and breaking new highs or another sell-off to absorb supply after the rebound. Other sectors are likely to remain highly fragmented. While the Oil & Gas sector shows clear capital inflows, most others lack synchronized and robust institutional participation. Thus, another short-term sell-off in the VN-Index is possible before a more significant post-New Year recovery.

An opportune time for medium to long-term accumulation, with 3 sectors expected to outperform in Q4 earnings

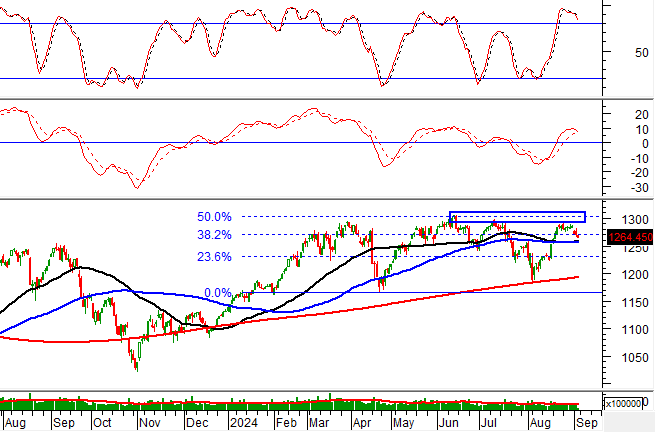

Mr. Nguyễn Anh Khoa predicts that next week’s market will likely be influenced by investor caution ahead of the New Year holiday. Liquidity may remain low as the VN-Index lacks a clear trend, fluctuating significantly in both directions. The index is expected to continue its wide-range consolidation, with short-term support at MA20 (1,715 points), MA50 (1,675 points), and the lower boundary of the Q3 2025 accumulation channel around 1,620 points.

Agriseco experts note that Vingroup stocks’ impact on the broader market is primarily psychological in the short term. While their influence on the index is undeniable, other stocks will trade independently, unaffected by these factors.

Historically, Vietnamese stock market liquidity tends to improve post-holiday, with positive performance often seen in January and extending through Q1. This period also marks the end of the information drought as companies release Q4 and full-year results, along with next year’s business plans, providing clearer investment prospects. Additionally, new macroeconomic policies, including fiscal and monetary measures, are typically announced or implemented early in the year, bolstering investor confidence.

Regarding the upcoming Q4 earnings season, Mr. Khoa anticipates listed companies’ profits to grow by approximately 20% year-on-year, driven by domestic market strength, low interest rates, and robust public investment disbursement. Key sectors expected to outperform include real estate, construction & materials, and retail.

In Q4 2025, major real estate firms’ active sales will likely boost sector profitability. For construction and materials, year-end public investment acceleration will benefit companies in construction, steel, and building materials. Meanwhile, the retail sector’s peak season during year-end holidays is expected to yield strong results for 2025.

Currently, the market is highly fragmented. While the VN-Index remains above 1,700 points, its momentum is largely driven by large-cap stocks, particularly Vingroup. Many other sectors have seen deep corrections and are now attractively valued. Mr. Khoa recommends these stocks for medium to long-term accumulation.

Entering 2026, sectors with strong Q4 earnings prospects may lead early-year rallies. Key sectors include real estate, construction & materials, and retail. Additionally, sectors benefiting from upcoming macroeconomic policies will likely attract capital inflows.

Silver Price Chaos in Secondary Market

In the thriving second-hand market, silver bullion is being traded at premiums reaching tens of millions of dong per kilogram, with buying and selling activities occurring at a remarkably brisk pace.

Vietstock Weekly 29-31/12/2025: Is the Tug-of-War Over Yet?

The VN-Index experienced significant volatility last week, forming a small-bodied candle with a long upper wick, signaling heightened selling pressure as the index approached its October 2025 peak. It is likely that the VN-Index will continue to trade sideways as the market requires additional time to rebalance before a new trend emerges.

VN-Index Plummets 40 Points, Yet Billionaires Nguyen Dang Quang and Nguyen Thi Phuong Thao’s Shareholders Remain “Loyal to the Purple”

Amidst a 40-point plunge in the VN-Index, substantial capital flows strategically accumulated shares, enabling shareholders of Vietjet Air and Masan Consumer to realize significant asset growth.

The PYN Elite Fund CEO’s “Prophecy” Comes to Fruition

“We have seen numerous reports from domestic securities firms forecasting that the VN-Index could reach 1,800 points by this Christmas, and we do not consider this an unrealistic scenario,” stated Petri Deryng, head of the foreign fund PYN Elite Fund, in a letter to investors approximately six months ago.