The End of the Electric Vehicle Incentive Era

The Industrial and Commercial Information Center, along with the Import-Export Department of the Ministry of Industry and Trade, released the Agricultural, Forestry, and Aquatic Market Bulletin on December 22, 2025.

The report indicates that global electric vehicle (EV) sales are showing signs of slowing down as key markets like China and the U.S. tighten their incentive policies, weakening the industry’s growth momentum.

According to data from Benchmark Mineral Intelligence (BMI) released on December 12, global EV sales in November 2025 reached nearly 2 million units, a mere 6% increase compared to the same period last year—the lowest growth rate in recent months.

In China, the world’s largest EV market, November sales reached 1.3 million units, a 3% year-on-year increase, marking the lowest annual growth since early 2024. China currently accounts for over half of global EV sales. BMI notes that China’s removal of EVs from its strategic industries list and the gradual reduction of subsidies by year-end are significantly impacting consumer sentiment.

BMI predicts that EV demand will continue to rise but at an uneven pace, heavily dependent on policy directions in each market. China and the U.S. are expected to see the most significant fluctuations. By 2026, the “era of EV incentives” is projected to end, with EVs beginning to incur a 5% purchase tax in several major markets.

For the entire year of 2025, the Association of Natural Rubber Producing Countries (ANRPC) forecasts global natural rubber production to increase by 1.3% compared to 2024, reaching 14.89 million tons, while demand will rise by only 0.8% to 15.56 million tons, amid geopolitical uncertainties.

Challenges for Vietnam’s Billion-Dollar Rubber Industry

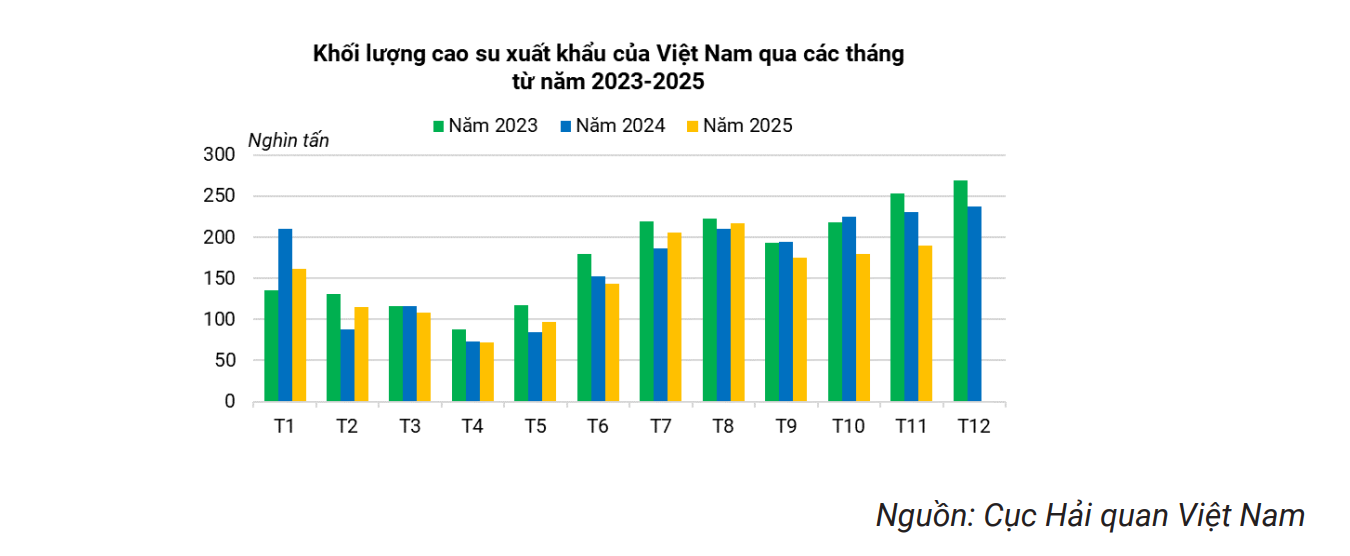

In Vietnam, Customs data cited in the bulletin shows that rubber exports in November 2025 declined compared to the same period in 2024, primarily due to weak demand from China, its largest consumer, despite growth in exports to other key markets.

Rubber exports to China in November 2025 totaled 152,067 tons, valued at $257.14 million, reflecting a 21.4% drop in volume and a 30.3% decrease in value year-on-year.

For the first 11 months of 2025, China remained Vietnam’s largest rubber export market, accounting for 73.4% of exports with nearly 1.22 million tons valued at $2.11 billion. This represents a 2.9% volume decline but a 2% value increase compared to the same period in 2024.

The average export price to China was $1,877 per ton, a 9.2% increase year-on-year.

Exports to India, the second-largest market, saw a sharp decline in the first 11 months of 2025. Exports to the U.S., Germany, Russia, Taiwan, and Sri Lanka also decreased. Conversely, Malaysia and Indonesia emerged as Vietnam’s third and fourth largest rubber export markets during this period.

The bulletin forecasts continued downward pressure on rubber exports, given the global slowdown in rubber consumption anticipated by ANRPC. In China, the largest rubber consumer, auto sales—the sector with the highest rubber usage—are weakening. Additionally, China’s trend of diversifying supply sources and increasing imports from various markets is intensifying competition for Vietnam’s rubber exports.

Chinese Customs data reveals that in the first 10 months of 2025, China increased rubber imports from Thailand, Russia, and Ivory Coast while reducing imports from Vietnam and Malaysia.

Thailand maintained the highest market share at 34.3%. Vietnam’s share of rubber imports into China by volume dropped to 14.7% from 17.7% in the same period in 2024.

In terms of pricing, Vietnam’s average rubber export price to China in the first 10 months of 2025 was $1,787 per ton, a 16.2% increase year-on-year. This price is higher than Russia’s and Laos’s averages but significantly lower than Thailand’s, Malaysia’s, and Ivory Coast’s.

The bulletin notes that China’s rubber imports primarily serve auto tire production. However, according to the China Passenger Car Association (CPCA), auto sales in China in November 2025 fell by 8.5% year-on-year, marking the second consecutive month of decline and the steepest drop in 10 months, amid weakening demand ahead of government subsidy expirations.

Furthermore, the China Automobile Dealers Association (CADA) reports that new car inventory levels at dealerships nationwide rose to 47 days’ supply in November, up from 35 days in October, clearly indicating a market slowdown.

Yamaha PG-1 Clone Debuts at Under $1,300, Priced on Par with Wave Alpha

Not only does it boast an attractive price tag, but this new manual transmission motorcycle also comes equipped with impressive features, poised to rival the Yamaha PG-1 in popularity.