After a period of stagnation due to the pandemic, Vietnam’s fast food market in 2025 has not only rebounded in terms of store numbers but also witnessed fascinating shifts in consumer behavior. According to the latest report from Q&Me, a subsidiary of Asia Plus Inc., alongside the race to expand networks, changes in dining habits are emerging as the primary driver of market growth.

Consumer Habits: Fried Chicken Combos Reign Supreme, Rice Dishes Gain Traction

The market’s recovery is vividly reflected in actual spending. Analysis of over 400 transaction receipts from Hanoi and Ho Chi Minh City in December 2025 reveals that the average expenditure per fast food visit among Vietnamese consumers hovers around 144,500 VND per group. With an average group size of 2.3 people, each order typically includes approximately 2.6 items.

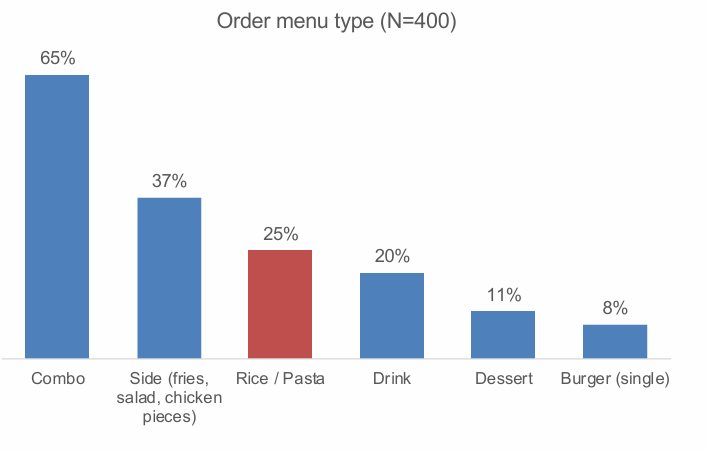

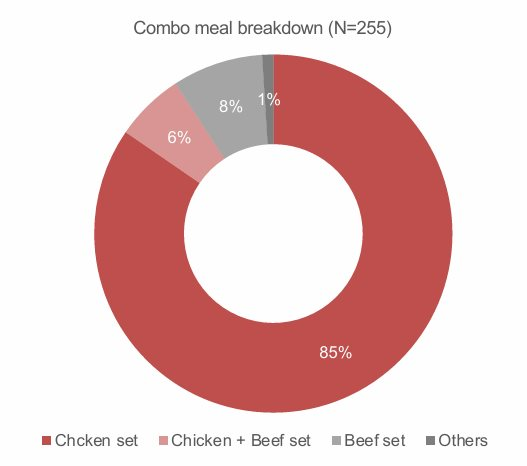

In terms of menu composition, data highlights the dominance of combo meals , accounting for a staggering 65% of orders. Within this category, Fried Chicken Combos hold an overwhelming 85% preference, far surpassing beef combos (which only account for about 8%). This underscores fried chicken’s status as the undisputed king of Vietnam’s fast food culture, explaining why chicken-focused chains like Jollibee, KFC, and Lotteria consistently outpace pure burger chains in expansion.

Beyond the dominance of fried chicken combos, another intriguing highlight is the rise of localized dishes such as rice and noodle meals. Despite being Western-style fast food outlets, these localized options are chosen by approximately 25% of diners, with rice dishes (like chicken rice and rice platters) alone making up around 20% . This success of menu localization has transformed fast food outlets into go-to destinations for main meals (lunch/dinner) among Vietnamese consumers, rather than just snack spots.

Family Diners: The High-Spending Demographic

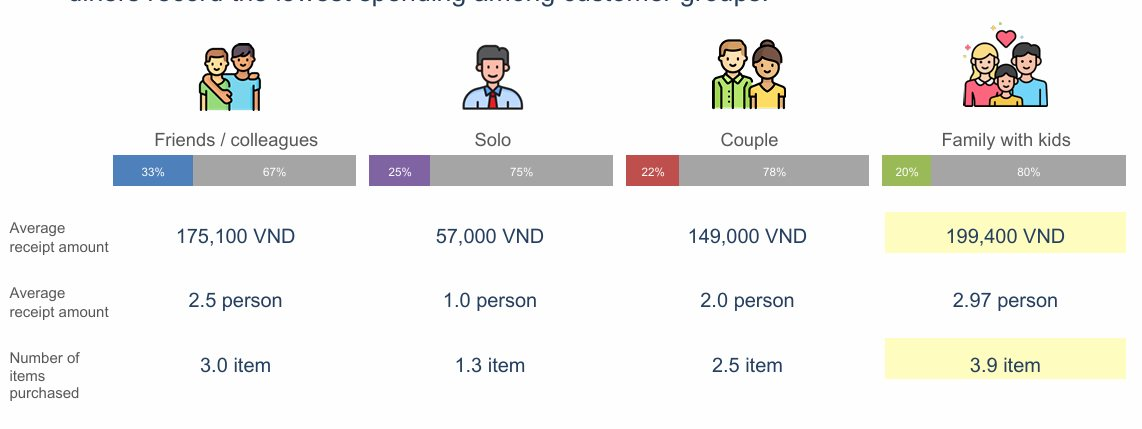

While friends and colleagues constitute the largest visitor group, families with children emerge as the highest-spending demographic. On average, a family group spends approximately 199,400 VND per visit, significantly higher than the 175,100 VND spent by groups of friends or the 57,000 VND spent by solo diners.

Choice factors also vary distinctly. While flavor and convenient location are pivotal for most customers (72% and 42% respectively), children’s preferences are decisive for 56% of family diners.

The Battle for Secondary Urban Markets

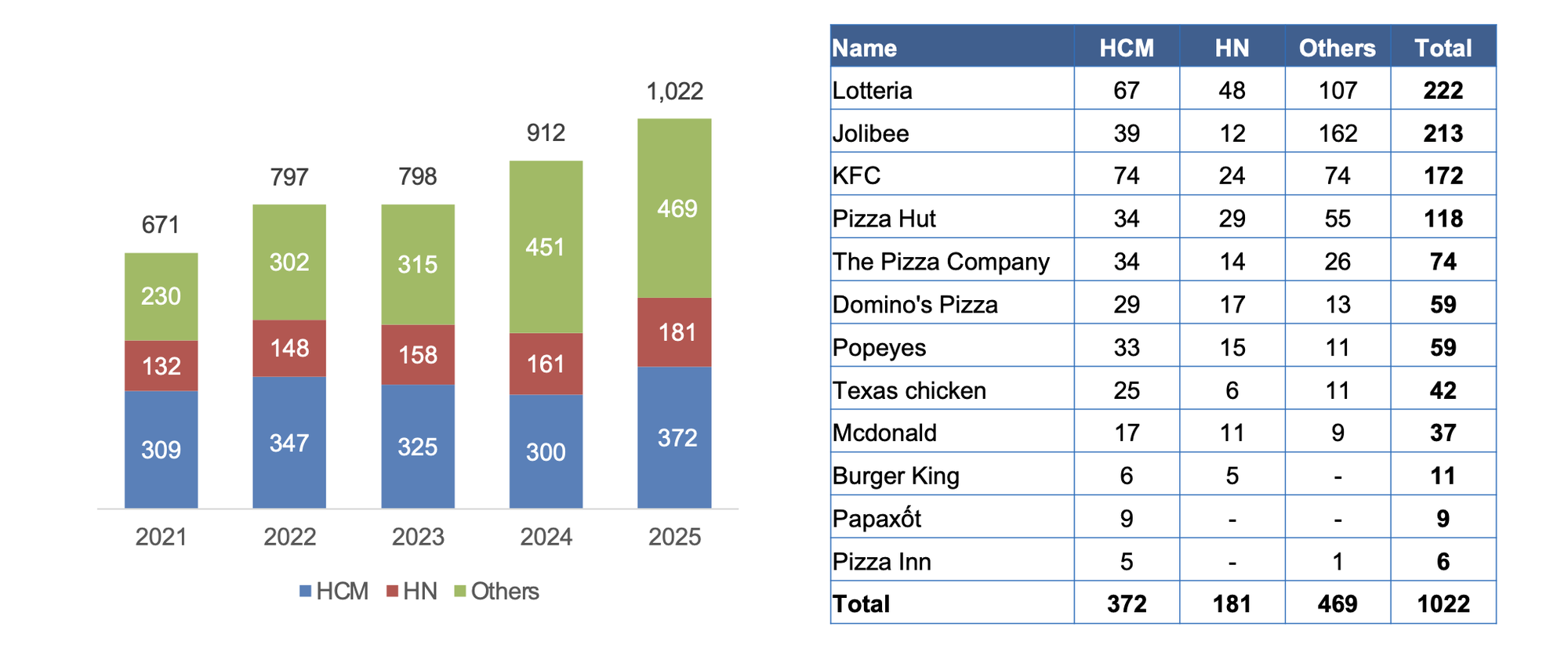

Alongside robust spending, the industry’s footprint has nearly reached 1,100 stores, marking a 12% growth from 2024.

Leading the market are Lotteria (222 stores) and Jollibee (213 stores), both aggressively expanding beyond major economic hubs. Notably, Jollibee is deeply penetrating secondary and tertiary cities, leveraging optimized logistics, cost-effective real estate, and early access to young consumer bases.

Among followers, KFC maintains its position with 172 stores, while pizza chains (Pizza Hut, The Pizza Company, Domino’s) adopt a cautious expansion approach. Conversely, Texas Chicken (42 stores) and McDonald’s (37 stores) remain focused on consolidating their presence in major cities.

Looking ahead, IMARC Group forecasts a compound annual growth rate (CAGR) of 5.65% for the sector from 2024 to 2032. Key drivers will include the synergy between physical network expansion and digital transformation, with self-service kiosks and mobile ordering apps gaining prominence.

PNJ CEO Unveils the Driving Force Behind the Brand’s Transformation into a Lifestyle Retailer

As consumer demands shift from “basic needs” to “quality and style,” coupled with the rapid growth of the middle class and young customer base, PNJ is transforming into a professional Lifestyle retailer.

Vietnam Surpasses Singapore, Philippines to Rank 2nd in Southeast Asia for Electric Vehicle Popularity

Vietnam has emerged as the second most enthusiastic market for electric vehicles in Southeast Asia, trailing only behind Thailand.