A critical announcement has been issued by numerous commercial banks: Starting January 1, 2026, Vietnamese users will be unable to withdraw funds or make payments if they continue using their Passport as the primary identification document registered with the bank. This mandate applies to all customers of banks such as Vietcombank, VietinBank, Agribank, and BIDV, who must comply with the new regulation.

According to the announcement, to prevent account “freezing” and the suspension of payment and withdrawal functions across all channels, customers must visit bank branches or transaction offices to update their information to a Chip-Embedded Citizen Identification Card (CCCD) or a new ID Card. This is not an isolated policy by individual banks but a mandatory requirement to adhere to the provisions of Circular 17 and Circular 18 issued by the State Bank of Vietnam, which will take full effect from the beginning of 2026.

Currently, customers using Passports as their primary identification document have only 3 days left to update their registration documents to avoid transaction disruptions.

Users with Passports as their primary identification document will face “frozen” payment and withdrawal functions from January 1, 2026.

This new regulation stems from the need to tighten security through biometric data. Specifically, under point c, clause 5 of Article 17 in Circular 17, all cash withdrawals or electronic payments by individual customers are only permitted once the system successfully matches the biometric data (facial/fingerprint) of the transaction initiator with the original data. This original data must be stored in the encrypted section of the CCCD or ID Card issued by the Ministry of Public Security or verified through the VNeID electronic identification account.

Meanwhile, current Passports, even the latest versions, do not meet the requirements for direct biometric verification with the National Population Database as per the technical standards mandated by banks for the new regulations. Therefore, Vietnamese citizens using Passports to register their accounts will not meet the legal conditions for transactions starting January 1, 2026.

Beyond withdrawals, Circular 18 also imposes strict regulations on new card issuance processes. Card-issuing organizations will require customers to provide a CCCD, ID Card, or Level 2 electronic identification for customer identification. This means that Passports, once widely accepted under the 2018 Circular, will officially become obsolete for domestic bank account verification processes for Vietnamese citizens.

Over the past period, several banks, including Vietcombank, VietinBank, Agribank, and BIDV, have officially announced this change.

Customers need to verify biometric data and update valid documents in compliance with the regulations.

Previously, banks had already issued official notices regarding the suspension of electronic payment and withdrawal transactions for organizational customers who failed to update the biometric information of their legal representatives after July 1, 2025. To ensure uninterrupted transactions, banks urge customers to visit the branch where their account was opened to update their information, bringing along valid identification documents.

This change represents a decisive step by the banking sector to combat high-tech crime, phantom accounts, and financial fraud. Therefore, users should proactively update their information as soon as possible to ensure their financial transactions remain uninterrupted as 2026 approaches.

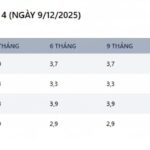

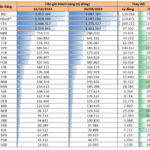

Maximize Your Savings: Compare Top Interest Rates at Agribank, BIDV, Vietcombank, and VietinBank

Unlock the highest deposit interest rate among the Big 4 banks, now at an impressive 4.8% per annum. This exclusive offer is available for customers who commit to a minimum deposit term of 12 months or more. Maximize your savings with this competitive rate, designed to reward long-term financial planning.

How Are Account Management Fees Regulated by Banks?

Customers are typically required to pay account management fees to banks for maintaining their checking accounts. However, most banks now offer fee waivers for all priority members, with eligibility criteria that are relatively easy to meet.