As we step into the post-New Year period, Vietnam’s stock market is expected to be influenced by multiple factors. However, according to Mr. Bui Van Huy, Deputy General Director of FIDT, investors should focus on three key variables likely to shape market dynamics in the early weeks of the year.

The first factor is the reaction of Vingroup stocks, particularly VIC. Approximately 3.9 billion VIC shares issued from equity will officially trade from December 31, 2025. This event significantly impacts supply-demand dynamics and market sentiment. Given the current noise surrounding these stocks, VIC’s volatility could continue to sway the index. If the supply is absorbed smoothly, the impact will be short-term. Conversely, prolonged selling pressure or new adverse information could lead to stronger market fluctuations.

The second factor is the actions of major funds and portfolio rebalancing at the start of the year. After year-end bookkeeping, investment funds and proprietary trading desks often adjust allocations based on new strategies. Given the substantial size of institutional capital, these moves can cause significant volatility, especially in large-cap stocks and index constituents. While technically driven, these shifts still strongly influence short-term index movements and market sentiment.

The third factor is Q4 earnings reports. As technical factors subside, the market will refocus on profitability. Companies exceeding expectations and with clear 2026 prospects will attract capital. Conversely, those with weaker results or lacking growth catalysts may face revaluation pressures. Thus, the market is likely to see stronger differentiation in the early weeks.

According to Mr. Huy, with prices no longer rising rapidly, investors now have time to screen companies and gradually accumulate stocks with solid fundamentals and clear narratives for 2026, rather than chasing short-term gains.

Q4 earnings growth may slow compared to previous quarter

Assessing the upcoming Q4 earnings season, Mr. Huy noted that Q3 profit growth was robust at around 40% year-on-year, reflecting improvements across sectors and a low base effect from 2024. However, this momentum is likely to slow in Q4.

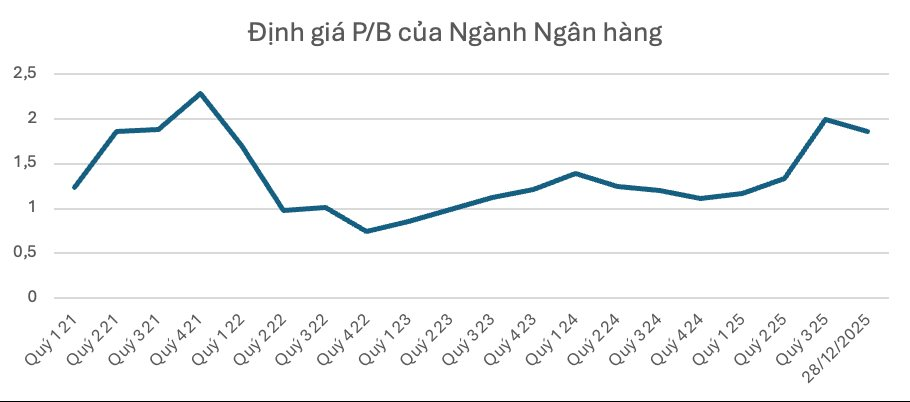

The primary reason is the banking sector—a key profit driver—facing higher funding costs amid year-end liquidity pressures. December typically sees rising deposit rates, squeezing net interest margins (NIM). Additionally, the high Q4 2024 base creates an unfavorable comparison. While absolute profits remain stable, year-on-year growth may not stand out.

For securities firms, profit pressures are more pronounced due to sharply lower market liquidity, dropping from VND 30–40 trillion per session in Q3 to VND 20–22 trillion in Q4. Weaker liquidity dampens brokerage and margin lending activities, while underperforming proprietary portfolios further weigh on results.

Conversely, the real estate sector shows more positive prospects. Many listed developers accelerated launches and handovers in 2025, positioning them for solid Q4 earnings.

The construction materials sector, including steel and stone, is expected to sustain growth. With strong construction demand and potential price/volume improvements, this cycle appears unbroken.

For other sectors, prospects will vary by industry and company. The market will focus more on profit quality, margins, cash flow, and 2026 outlook rather than growth rates alone. Thus, while Q4 reports may not drive broad market rallies, they will be crucial catalysts shaping early 2026 trends and differentiation.

Silver Price Chaos in Secondary Market

In the thriving second-hand market, silver bullion is being traded at premiums reaching tens of millions of dong per kilogram, with buying and selling activities occurring at a remarkably brisk pace.

The PYN Elite Fund CEO’s “Prophecy” Comes to Fruition

“We have seen numerous reports from domestic securities firms forecasting that the VN-Index could reach 1,800 points by this Christmas, and we do not consider this an unrealistic scenario,” stated Petri Deryng, head of the foreign fund PYN Elite Fund, in a letter to investors approximately six months ago.

Steel Stock Surges After Receiving Lifeline from Billionaire Pham Nhat Vuong

This stock has experienced a remarkable resurgence despite being under trading restrictions, with transactions limited to only Wednesdays each week.