Last night (December 26th, Vietnam time), silver prices shocked global investors by surging 10%, surpassing $79/oz for the first time in history. Since the beginning of the year, silver has skyrocketed by 170%, outperforming gold, stocks, and even Bitcoin.

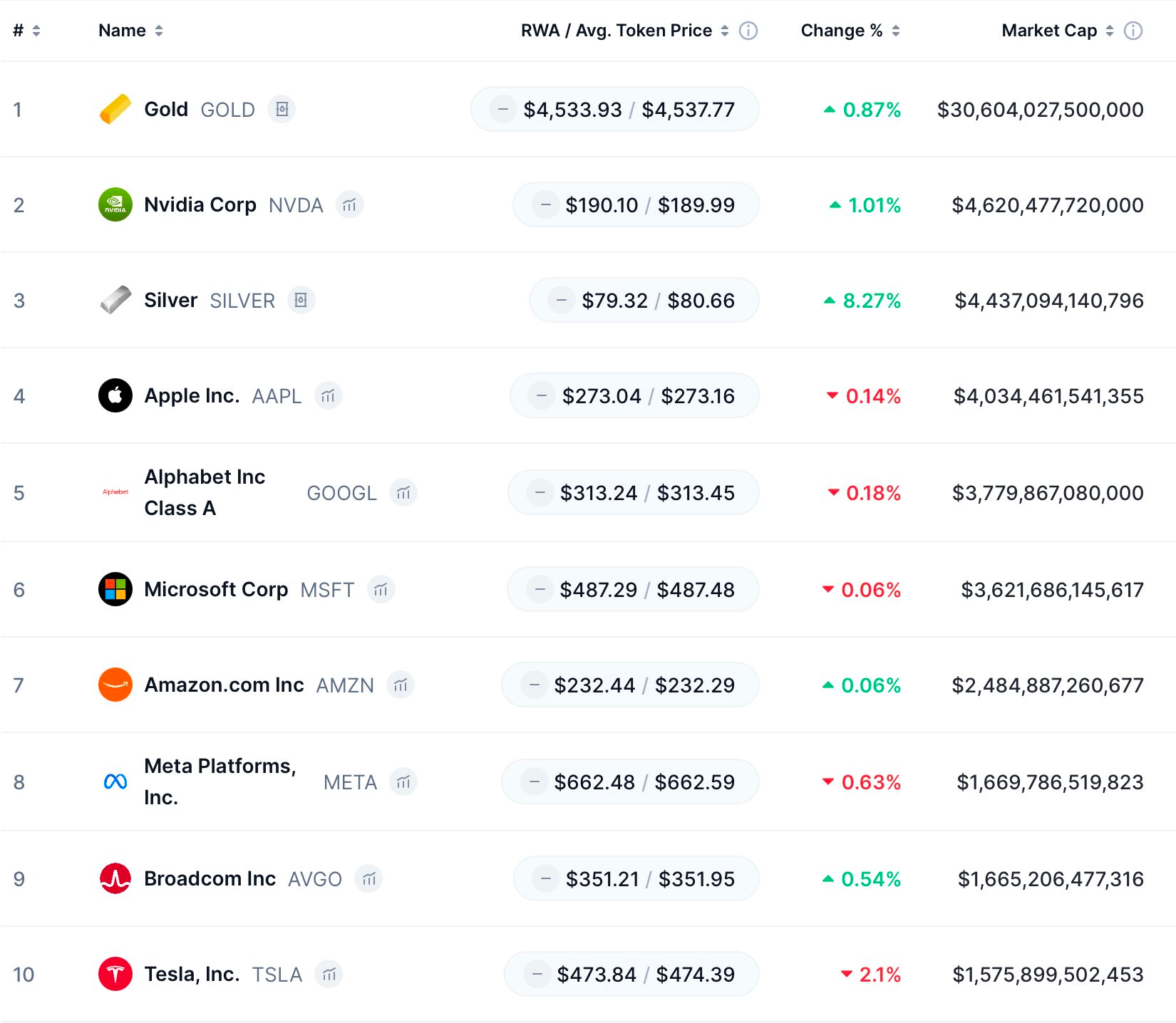

Silver’s relentless rally has pushed its market capitalization to a record high of over $4.4 trillion (according to CoinMarketCap estimates). This staggering figure propels silver past Apple, making it the third most valuable asset globally, trailing only gold and NVIDIA.

“Expectations of continued Fed easing in 2026, a weakening US dollar, and escalating geopolitical tensions are fueling price volatility amid thin market liquidity,” said Peter Grant, Senior Vice President and Metals Strategist at Zaner Metals. “Despite potential profit-taking risks near year-end, the upward trend remains robust.”

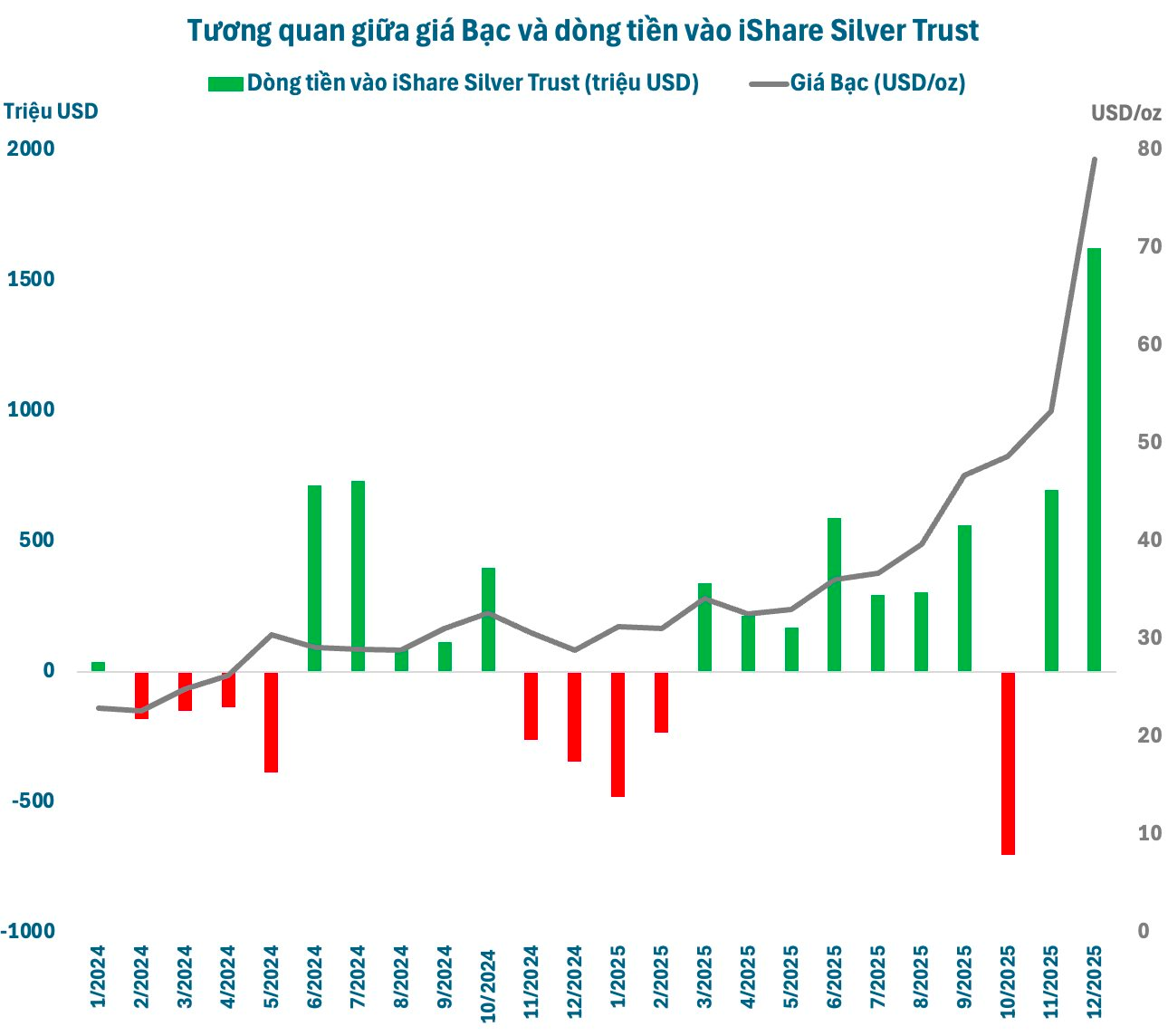

Another key driver of silver’s recent surge is the aggressive buying activity from major global silver investment funds. Since the start of December, iShare Silver Trust (SLV), managed by BlackRock, has invested over $1.6 billion in silver. Year-to-date, the fund has allocated nearly $3.4 billion to silver acquisitions.

Currently, SLV’s assets under management exceed $38 billion, an all-time high. Following this aggressive accumulation phase, the world’s largest silver fund now holds nearly 527 million ounces of silver (16,400 tons).

Another major silver fund, Sprott Physical Silver Trust USD (PSLV), has also been actively buying in December, acquiring over 4 million ounces (130 tons). PSLV currently holds approximately 209 million ounces of silver (~6,500 tons), with assets valued at over $16.6 billion. PSLV is one of the world’s largest physical silver funds, embodying Sprott Asset Management LP’s “real silver” philosophy.

Silver is no longer merely a dazzling piece of jewelry or a short-term speculative tool but has emerged as a strategic asset in the new technological era. Supply-demand imbalances and dwindling reserves have sparked a fierce global scramble for silver.

China will implement a new export licensing mechanism for silver starting January 2026, underscoring silver’s status as a critical national security asset. Domestic reserves must be safeguarded at all costs.

Previously, the US officially added silver to its “Critical Minerals List,” highlighting its growing dependence on an increasingly scarce supply. Analysts even predict the US government may soon establish a national strategic silver reserve, akin to its oil reserves, to support defense and clean energy industries.

Under Basel III banking regulations, physical silver (alongside gold) is classified as a Tier 1 asset with a 0% risk weight for capital adequacy calculations. However, silver derivative contracts must be backed by 85% high-quality collateral to mitigate risk. This has forced banks to buy back contracts, inadvertently driving up physical silver prices.

Despite its impressive 2025 gains, silver is believed to have further upside potential. Maria Smirnova, CIO of Sprott Asset Management, remains bullish on silver in the medium term. Technical models suggest silver could reach $100–200/oz in the coming quarters, according to some analysts.

Silver Prices Surge by 169% Annually: What’s Driving This Phenomenal Rise?

This morning (December 27th), silver prices surged by over 4 million VND per kilogram, reaching nearly 82 million VND per kilogram. Over the past month, silver has seen a remarkable 46% increase, and since the beginning of the year, its value has skyrocketed by 169%.