Once renowned for their “big-spending” nature and long-term vision, Thai capital now faces harsher realities. Financial data reveals a mixed bag: while some investments like Nhựa Bình Minh and Vinamilk thrive, others are mired in restructuring, losses, or declining market capitalization.

Decisive Loss-Cutting at Nguyễn Kim

A prime example of aggressive restructuring is Central Retail’s exit from the electronics retail sector. After a decade-long ambition to dominate Nguyễn Kim, the conglomerate recently sold its stake in the chain to PICO Holdings for $36 million.

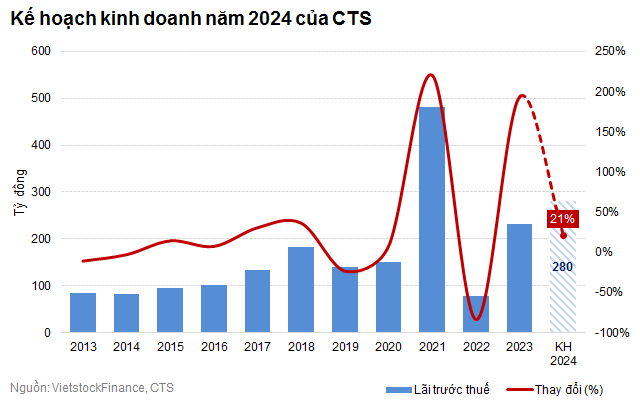

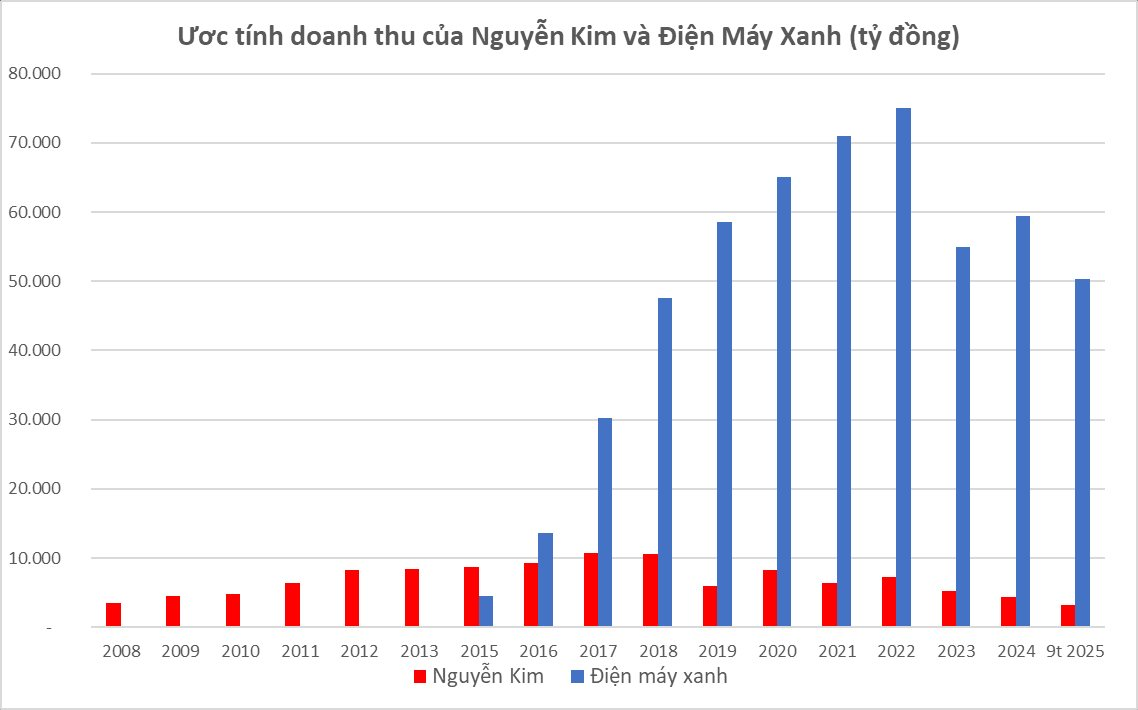

Source: Central Retail’s financial reports, MWG, cafef data aggregation

A look back at financial history shows Nguyễn Kim’s decline in the face of domestic competition. In 2015, when Thai investment began, Nguyễn Kim led with revenue of 8.778 trillion VND, double Điện Máy Xanh’s 4.482 trillion VND. However, the tide turned in 2016, and by Q3 2025, the gap widened dramatically: Điện Máy Xanh reached 59.5 trillion VND, while Nguyễn Kim shrank to 4.39 trillion VND—just 1/14th of its rival’s size.

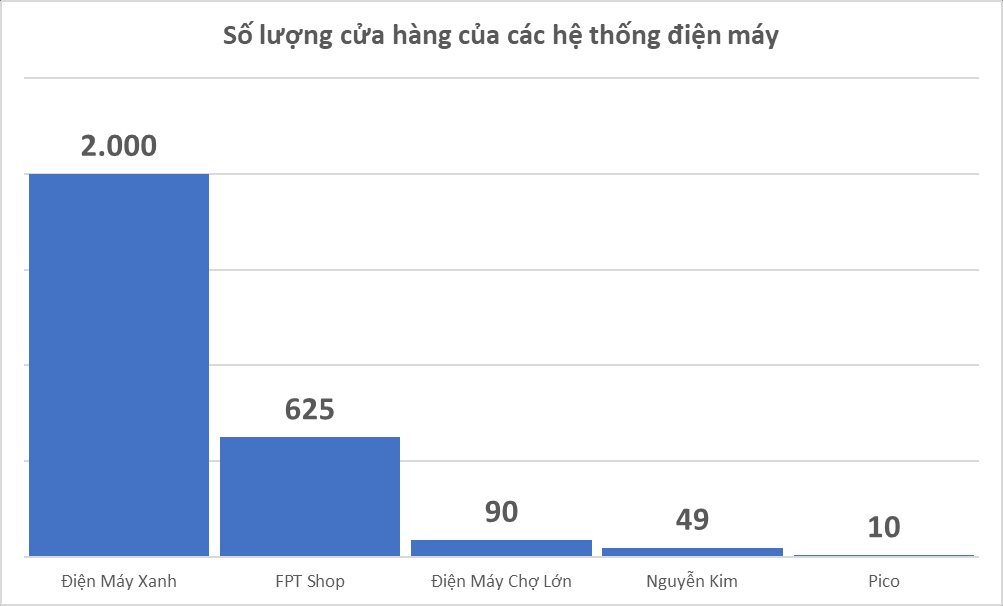

By late 2024, the chain operated only 49 stores after closing underperforming outlets—a modest figure compared to Điện Máy Xanh’s 2,000+ and FPT Shop’s 625.

Central Retail’s financial statement reflects this retreat, reporting a non-cash loss of 5.9 billion Baht ($187 million). The exit price is significantly lower than the initial investment of over $200 million, underscoring Thai investors’ resolve to shed underperforming assets and focus on food and commercial real estate.

Valuation Pressure on the Historic Sabeco Deal

On a larger scale, ThaiBev’s investment in Saigon Beer-Alcohol-Beverage Corporation (Sabeco) faces substantial valuation pressure. In 2017, through Vietnam Beverage, billionaire Charoen Sirivadhanabhakdi spent $4.8 billion to acquire 53.59% of Sabeco—Vietnam’s largest state divestment deal.

Eight years later, the investment’s market value has plummeted. At SAB’s current share price of 48,750 VND, the stake’s value has dropped 70%, equating to a $3.5 billion paper loss. Despite cumulative dividends of $1.5 billion, this falls short of offsetting the capital erosion.

Challenges in the beer industry—stricken by alcohol regulations, special consumption taxes, and fierce competition—have complicated recovery efforts. ThaiBev remains committed to Sabeco as a long-term strategic asset in Southeast Asia.

The Paradox of “Subsidiary Success, Parent Distress”

Another anomaly is Stark Corporation’s acquisition of Thipha Cable and Dovina. In 2020, Stark spent $240 million to acquire these Vietnamese cable companies. Under new management, they shifted from raw materials to finished products, boosting 2021 profits to over $70 million—surpassing listed peers.

Ironically, while these Vietnamese assets thrived, Stark’s parent in Thailand faced a massive fraud scandal. In mid-2025, Thailand’s Central Bankruptcy Court declared Wanarat Tangkaravakun bankrupt, facing a $3.8 billion lawsuit from 3,300 creditors.

Vietnam Remains a “Promised Land”

According to the Foreign Investment Agency, as of September 2025, Thailand ranks 8th among investors in Vietnam with 775 active projects totaling $14.96 billion.

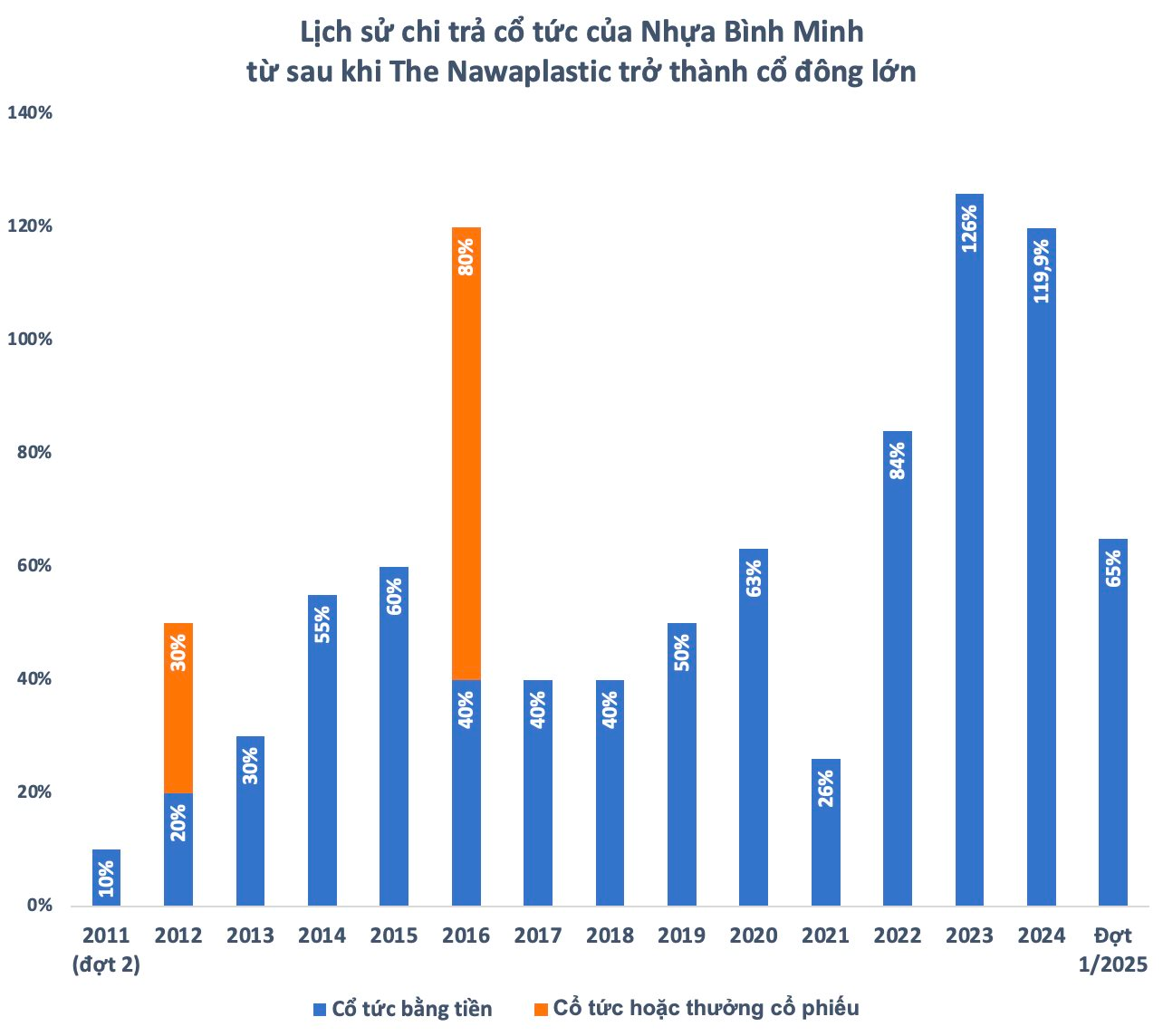

Many conglomerates continue to reap rewards from strategic investments. SCG’s stake in Nhựa Bình Minh (BMP) is a “cash cow,” recouping its investment solely through dividends within 13 years, with $110 million in cash returns from 2023–2025.

In December 2025, F&N (owned by Charoen Sirivadhanabhakdi) invested $600 million to increase its Vinamilk stake to nearly 25%. This move reinforces long-term confidence and strengthens Charoen’s position, earning him $1.65 billion in cumulative dividends since his initial investment.

2025 Import-Export: Record Trade Volume, Quality Growth Challenges

According to the General Department of Vietnam Customs, the country’s total import-export turnover in 2025 is projected to reach $920 billion, marking a 16.9% increase compared to the previous year—the highest level ever recorded. The trade balance continues to show a surplus of $21.18 billion, though this figure represents only 84.92% of the surplus achieved in 2024. These numbers vividly highlight both the resilience of Vietnam’s international trade and the increasingly evident limitations of a growth model reliant on expanding import-export volumes.

Declared and Paid Full Taxes but Still Fined Up to 8 Million VND in This Scenario

Unveiling the Penalties for Tax Declaration Errors: What Every Citizen Must Know

Navigating the complexities of tax declarations can be daunting, and errors may lead to significant penalties. It’s crucial for individuals to understand the consequences of inaccurate or fraudulent tax filings. From fines to legal repercussions, the implications of mistakes in tax declarations are far-reaching. Stay informed and ensure compliance to avoid these costly pitfalls.

Unlocking Success: International Experts Reveal the Key Factor for Vietnam’s International Financial Center

Vietnam’s ambition to establish international financial centers (IFCs) is entering a pivotal phase, shifting focus from infrastructure development to cultivating a world-class financial and accounting workforce. This strategic pivot underscores the growing significance of the UK-Vietnam partnership in finance and professional services.

Exclusive Investment Opportunity: December 20-26, 2025 – 6 Mega Urban Projects with Over $2.1 Billion in Capital

During the week of December 20-26, 2025, four provinces attracted investment in eight projects, totaling over 54.6 trillion VND. Notably, six of these projects are urban developments, with a combined investment of more than 47.2 trillion VND. The most significant project is a nearly 24 trillion VND urban area in Dien Bien province.

Silver Prices Surge: Long Queues Form in Hanoi as Residents Rush to Buy

Silver prices surged again today, December 27th, in the Asian spot market, surpassing $79 per ounce. Domestically, silver prices are nearing 82 million VND per kilogram.