On December 25th, the Hanoi Stock Exchange (HNX) approved the listing of Au Lac Joint Stock Company (ALC) with nearly 56.5 million shares registered for trading.

Au Lac is a leading private company in the maritime transport sector, specializing in oil tankers. The company is chaired by Ms. Ngo Thu Thuy.

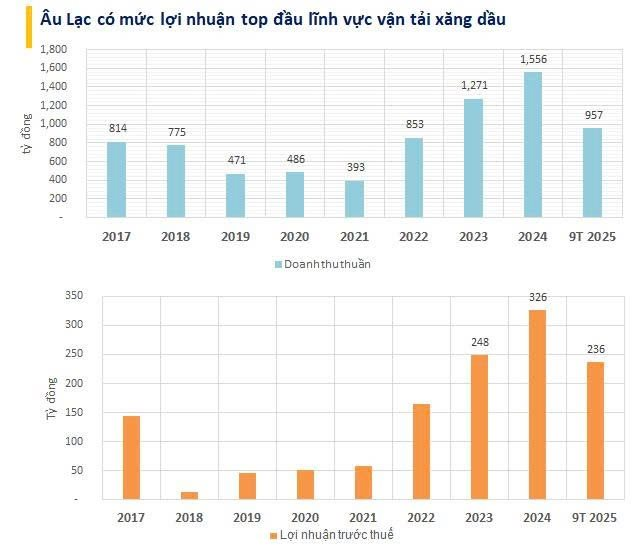

Despite a 18% decline in revenue to VND 957 billion in the first nine months of 2025, Au Lac’s after-tax profit surged 22% year-on-year to VND 191 billion.

Beyond her role at Au Lac, Ms. Ngo Thu Thuy and her family are involved in various other business ventures.

Industrial Real Estate

Ms. Thuy and her husband ventured into industrial real estate with the establishment of Vietnam Industrial Park Group (KCN VN Group) in January 2021.

Ms. Thuy serves as a Board Member and CEO of KCN VN Group, while her husband, Mr. Nguyen Duc Hinh, is the Chairman.

Initially capitalized at VND 20 billion, KCN VN Group was founded by Ms. Thuy (70%), Mr. Hinh (20%), and their son Nguyen Duc Hieu Johnny (10%).

In April 2021, the company shifted its focus to water supply and HVAC system installation, with KCN Vietnam Private Limited (Singapore) acquiring a 90% stake.

KCN VN Group’s current capital exceeds VND 2,246 billion, with KCN Vietnam Private Limited holding 94.6%.

KCN VN Group owns nearly 200 hectares of land across various industrial parks, including Phuc Dien (Hai Duong), Tan Hung (Bac Giang), An Phat (Hai Duong), Deep C (Hai Phong), Thuan Thanh 3B (Bac Ninh), and more.

Ms. Thuy is the CEO of several KCN VN Group subsidiaries, including KCN Management, KCN Ho Chi Minh City, KCN Dong Nai, KCN Tan An Thanh – Long An, KCN Bien Hoa, KCN Binh Duong, KCN Bac Son, and KCN Long Thanh Gateway.

She also leads Newtech Logistics as CEO, with her daughter Nguyen Thien Huong JENNY as Chairwoman. Newtech Logistics, capitalized at over VND 205 billion, specializes in real estate and land use rights.

Education

In education, Ms. Thuy is the CEO of Thien Huong Company, Chairwoman of Thien Huong Education JSC, and International Education Village Thien Huong JSC. She also chairs the Board of Directors at Thien Huong Investment Company and The British International School Company Limited (BIS CO.LTD).

Founded in 2009, Thien Huong Education JSC has a capital of VND 50 billion, with BIS CO.LTD holding 90% and Thien Huong Company holding 9%.

Thien Huong Investment Company, capitalized at VND 53 billion, is owned by BIS CO.LTD (61%), Thien Huong Company (2.5%), and Oasis Development Management Limited (32.5%).

BIS CO.LTD, established in 1997, has a capital of VND 72 billion, with BIS LTD holding 90% and Thien Huong Company holding 10%.

BIS CO.LTD operates the prestigious British International School (BIS) network in Vietnam, part of the Nord Anglia Education system.

International Education Village Thien Huong JSC, founded by Ms. Thuy and her husband in January 2015, has a capital of VND 1,750 billion. Diamond Crest Global (British Virgin Islands) holds 23.48%, while Mr. Hinh and Ms. Thuy each hold 3.09%.

The company is developing a VND 1,088 billion International Education Village project spanning 27 hectares in Xuan Phuong, Hanoi, with Phase 1 construction commencing in October.

Online Gaming

The family recently entered the online gaming industry with Duc Hieu Gaming, established in June 2024. Initially capitalized at VND 23 billion, the company is majority-owned by Mr. Hinh (99.92%), with Ms. Thuy as CEO.

By June 2025, the company increased its capital to VND 38 billion, with RGSV PTE. LTD (Singapore) holding 99.95%. Mr. Nguyen Thanh Binh succeeded Mr. Nguyen Duc Hieu Jonny as CEO in August.

Mr. Binh also leads other gaming companies founded by the family, including 4Gamers, Mamba Game, and THS Game.

Banking

Ms. Thuy is a prominent figure in Vietnamese banking, notably in Eximbank’s power struggle. Au Lac, a long-time Eximbank shareholder, divested from EIB and invested in ACB.

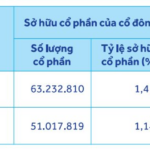

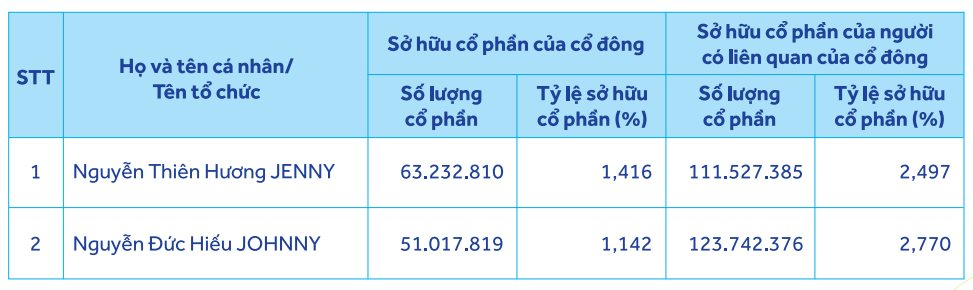

Since 2023, Au Lac has gradually sold its ACB shares, fully exiting in Q1 2024. As of April 29, 2025, Ms. Nguyen Thien Huong JENNY and Mr. Nguyen Duc Hieu Jonny hold 63.2 million and 51 million ACB shares, respectively, with related parties holding over 174.76 million shares in total.

Their combined holdings increased from 173.83 million to 174.76 million shares since September 2024, valued at over VND 4,200 billion as of April 29, 2025. ACB’s dividend payment and share issuance in May-June 2025 may further impact their ownership.

Shocking Revelations at the Company of the Mysterious Female Tycoon Who Once Held Over $175 Million in ACB Stocks

In the first nine months of 2025, despite a revenue decline of 18% year-over-year to VND 957 billion, the company’s after-tax profit reached VND 191 billion, marking a robust 22% growth compared to the same period last year.

From Capital to Management: ACB Empowers Businesses to Elevate Their Enterprise

ACB empowers the transition of businesses from sole proprietorships to corporations with a comprehensive financial solution suite, focusing on capital provision and guarantees. Coupled with government incentives, this foundation enables enterprises to seize integration opportunities and achieve robust growth.

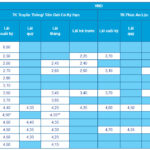

Latest ACB Bank Interest Rates for August 2025: Which Term Deposit Offers the Highest Returns?

As of August 2025, ACB introduces a new interest rate for online deposits, offering individuals an attractive opportunity to grow their savings. With this latest update, ACB is proud to provide one of the highest interest rates in the market for those who choose to invest their funds for 12 months or more.