After investing over $200 million to acquire and gain full control of Nguyen Kim over 10 years, Central Retail (part of Thailand’s Central Group) recently divested its entire stake, accepting a $190 million loss. The transfer of Nguyen Kim to domestic electronics retailer Pico Holdings was valued at just $35 million.

Large Systems No Longer Hold the Advantage

The director of an electronics distribution company in Ho Chi Minh City noted that Nguyen Kim was once a leading retailer, setting market trends and forcing competitors like Thien Hoa, Cho Lon, Ideas, Gia Thanh, and De Nhat Phan Khang to closely monitor its moves.

Nguyen Kim recently hosted a sales event in November 2025 to celebrate its 29th anniversary.

During holidays and Tet, Nguyen Kim would launch massive promotions, offering discounts of up to several dozen percent and prizes like cars and European or American travel vouchers. “Smaller retailers couldn’t compete with such aggressive campaigns, so they often launched early discounts to mitigate the impact of Nguyen Kim’s promotions,” the director explained.

Industry insiders noted that Nguyen Kim targeted affluent customers, designing its stores with a luxurious, eye-catching aesthetic and showcasing high-end products. However, this led to higher prices compared to competitors, gradually driving customers away.

The director of a major nationwide electronics retailer observed that despite Thai investors’ resources, they struggled to grow Nguyen Kim amid intensifying market competition and saturating consumer demand. “Even if large systems adjust pricing, their initially high prices make it difficult to match competitors. Additionally, smaller retailers offer year-round promotions, while larger systems focus on holidays and Tet,” they compared.

Regarding Pico’s acquisition of Nguyen Kim, industry experts highlight Pico’s strong understanding of the domestic electronics market. Already dominant in the North, Pico can now expand into the South by leveraging Nguyen Kim’s store network.

Outdated Models Are Losing Relevance

Several mid-sized and large retailers have quietly exited the market in recent years. For instance, De Nhat Phan Khang, once boasting nearly 20 electronics centers, gradually closed provincial stores, retaining only one in Ho Chi Minh City. By 2017, it ceased operations entirely.

Similarly, Ideas, which once had three centers in Ho Chi Minh City, reduced to one before closing all post-COVID-19. Thien Hoa, another retailer, maintained a golden era for years.

Nguyen Quang Hoa, owner of Thien Hoa, revealed that foreign groups offered hundreds of millions of dollars to acquire his chain, but he refused. Despite efforts to sustain operations, fierce competition reduced Thien Hoa from 24 centers nationwide to a single location on Cach Mang Thang Tam Street in Ho Chi Minh City. Even this center has downsized, now comparable to a small store.

Doan Van Hieu Em, CEO of The Gioi Di Dong (managing Dien May Xanh and The Gioi Di Dong), acknowledged that the electronics market has passed its growth phase. Amid intense competition, development requires partnerships with brands offering price support, exclusive products, or favorable policies like installment plans and after-sales service.

Pham Quoc Bao Duy, Director of Electronics at FPT Shop, noted that market saturation and competition from e-commerce have challenged traditional distribution channels. However, reputable brands with excellent service retain loyal customers.

Tran Tuan Anh, a market expert, asserted that traditional electronics retail models are outdated and no longer appeal to consumers. Customers increasingly prefer convenient, competitively priced online channels over physical stores.

Tran Anh Tung, Head of Business Administration at the University of Economics and Finance in Ho Chi Minh City, cited Nguyen Kim as a case study of foreign investors acquiring Vietnamese retailers with ambitions to integrate supply chains, management, and real estate. However, intense competition erodes profit margins.

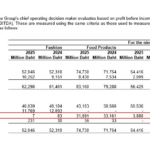

In the first nine months of 2024, Nguyen Kim’s 49 stores generated $345 million in revenue, a 17% year-on-year decline. “The market has shifted to a phase where scale alone isn’t enough to win without expansion speed, inventory optimization, and pricing power. Leading domestic chains now prioritize ultra-low operating costs and rapid inventory turnover,” Tung analyzed.

Regarding Pico’s acquisition, Tung noted that investors are acquiring not just retail infrastructure but also brand recognition at a low cost. Pico may view Nguyen Kim as a restructurable asset rather than a model to preserve. Future strategies could include closing underperforming stores, renegotiating leases, standardizing product catalogs, optimizing logistics, and leveraging Nguyen Kim’s brand in Pico’s weaker regions.

The Evolution of Electronics Retail: A Time for Strategic Filtering

Central Retail’s divestment of the entire Nguyen Kim electronics chain to Pico not only marks the end of a foreign retail giant’s ambitions in Vietnam’s electronics market but also underscores the fierce competition within the industry. Even businesses with robust retail ecosystems struggle to maintain their footing in a highly competitive market characterized by slim profit margins and rapidly evolving consumer behaviors.

Nguyễn Kim After 10 Years Under Thai Ownership: From Market Leader to Lagging Behind Domestic Competitors

The $36 million sale of Nguyen Kim to Pico Holdings marks the end of Central Retail’s decade-long foray into Vietnam’s electronics retail market. By offloading this underperforming business segment at a significant loss, the Thai conglomerate is strategically refocusing its efforts on its core strengths: food and real estate.

Vietnamese Entrepreneurs Reacquire Nguyễn Kim from Thai Owners

On December 23rd, Thai retail giant Central Retail announced the signing of a share sale agreement with PICO Holdings Corporation, a leading Vietnamese electronics retailer. This agreement marks the complete divestment of Central Retail’s direct and indirect investments in NKT New Technology and Solution Development Investment Corporation (NKT).