Global Fertilizer Prices Projected to Remain Stable by 2026

In 2025, global urea prices remained above $400 per ton. The latest fertilizer industry report from MB Securities (MBS) forecasts that urea prices in 2026 will stay at current levels due to minimal supply and demand fluctuations.

Global fertilizer supply in 2026 is expected to stabilize further compared to the 2022–2024 period, thanks to new production capacities and restructured trade flows between regions.

For nitrogen-based fertilizers (urea), supply improvements are attributed to new projects and restarts in Latin America, the Middle East, and Russia. Notably, nitrogen plants in Brazil, following Petrobras’ re-entry into the market, will reduce regional import needs.

Phosphate and potash supplies, essential for NPK production, remain abundant from North Africa, Russia, and Canada. China may gradually ease export controls if domestic prices stabilize. However, fertilizer supply faces risks from natural gas costs in Europe, trade policies (taxes, environmental fees, export restrictions), and geopolitical impacts on global logistics.

MBS forecasts a slight recovery in fertilizer demand in 2026, driven by South Asia, Southeast Asia, and South America—regions with large-scale commercial farming and high fertilizer usage. However, demand growth remains moderate as farmers remain cautious due to prolonged high fertilizer prices, shrinking profit margins, and sustainable farming practices in Europe and North America.

The World Bank and other analysts predict price adjustments as new nitrogen capacities in the Middle East, Latin America, and Russia come online, with demand recovering modestly. Price reductions depend heavily on natural gas price trends. Under the baseline scenario, urea prices are expected to range between $400–450 per ton, with minimal fluctuations.

Domestically, urea prices in 2026 are likely to stabilize or slightly decline, with low volatility due to self-sufficiency in supply (DCM, DPM). DAP and NPK prices, however, may fluctuate more due to reliance on imported raw materials.

The 5% VAT output policy, effective from July 1, 2025, applies to finished fertilizers. This allows businesses to offset input VAT on raw material purchases, reducing costs and enhancing competitiveness against international fertilizer companies.

Exports Emerge as a New Growth Driver

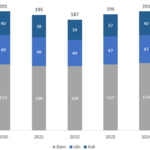

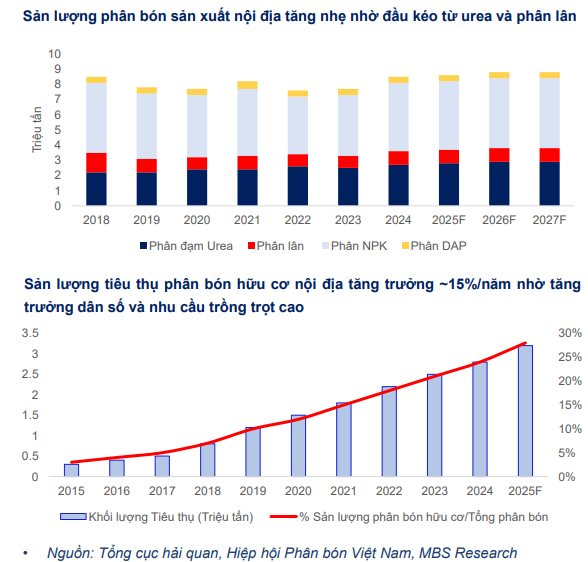

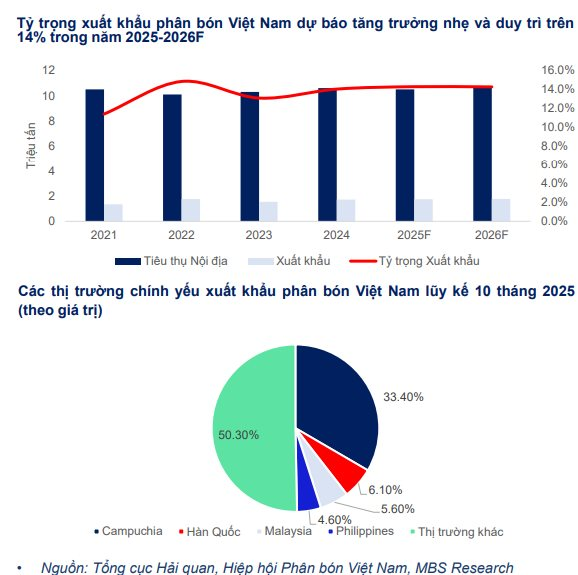

According to MBS, Vietnam’s fertilizer exports saw significant growth, particularly in 2022, driven by high global prices and stable supply. Export volumes exceeded 14% of total supply in 2022 and 2024, offering opportunities for Vietnamese companies to boost exports.

Flexible strategies balancing domestic and export sales help companies protect profit margins based on market conditions.

MBS projects export shares to remain at 14.3% in 2025–2026, supported by global demand growth of 2.2% (reaching 205 million tons) and high international urea prices. Domestic prices typically lag global prices by 3–6 months.

MBS estimates domestic consumption in 2026 to grow 2% to 10.7 million tons, with exports reaching 1.8 million tons (14.3% of domestic production), driven by stable international prices and demand from India and Brazil.

Promising Fertilizer Companies

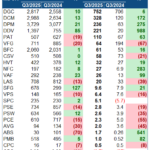

For the first half of 2026, leading urea producers like Phu My Fertilizer (DPM) and Ha Bac Fertilizer (DHB) are expected to maintain positive revenues due to stable demand. However, net profits may erode due to rising gas input costs. In contrast, NPK producers such as Lam Thao Fertilizers and Chemicals (LAS), Binh Dien Fertilizer (BFC), and diversified companies like Ca Mau Fertilizer (DCM) are projected to have more stable profit margins, less affected by gas prices.

Historically, revenue and gross profit growth are correlated, but differences between urea and NPK groups are evident. In 2023–2024, urea companies saw revenue declines due to falling urea prices, while BFC and LAS experienced slight growth due to lower gas dependence. Gross margins for DCM, DPM, and DHB are typically higher but more volatile, peaking in 2022 due to high urea prices and low-cost inventory from previous years.

However, when urea prices dropped in 2023 and gas prices surged in 2022–2023, urea companies’ margins plummeted. NPK companies maintained lower but more stable margins.

“In summary, when gas and fertilizer prices stabilize, DCM, DPM, and DHB outperform. During volatile periods, NPK companies (LAS, BFC) maintain an advantage due to greater revenue and profit stability,” the report highlights.

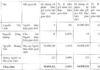

MBS favors DCM for its market expansion potential and diversified strategy. By acquiring the Viet-Han NPK plant, DCM shifts from a pure inorganic fertilizer producer to a diversified revenue generator, benefiting from NPK’s stable pricing and input costs.

The 5% VAT output policy further enhances DCM’s competitiveness against imports, opening market share opportunities.

Analysts estimate DCM’s 2025–2026 revenues at VND 18,788 billion and VND 19,449 billion (+40%/+4% YoY), with net profits of VND 2,155 billion and VND 2,618 billion (+61%/+22% YoY), driven by NPK expansion and cost control.

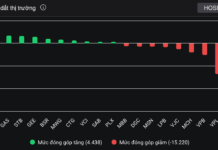

Fertilizer Companies Report Significant Profit Surge in Q3

The remarkable surge in domestic urea prices during Q3 2025 has propelled fertilizer companies to outstanding performance, further bolstered by the official implementation of the 5% VAT on fertilizers. Conversely, the chemicals sector faced less favorable conditions.