The Ministry of Finance has issued a response to voter concerns in Da Nang regarding instances where individuals, households, and businesses have been mistakenly recorded as tax debtors despite fulfilling their financial obligations. The primary causes include errors in data updates by tax authorities or malicious exploitation of personal information for business registration.

This “unjust tax debt” situation negatively impacts the reputation and honor of taxpayers. Voters have urged the Ministry of Finance to direct tax authorities to verify and cross-check data, and issue confirmation records to taxpayers before sending out tax debt notices.

Cases of “unjust tax debt” arise from data errors, synchronization issues, or identity theft for fraudulent business registration.

According to the Ministry of Finance, under the Law on Tax Administration, taxpayers are responsible for determining their tax liabilities and late payment amounts (except in cases calculated by tax authorities). If taxes remain unpaid 30 days after the deadline, tax authorities issue debt notices, primarily via electronic tax accounts or eTax Mobile.

When taxpayers dispute the accuracy of debt records, tax authorities collaborate to review and reconcile the data. If errors are found, adjustments are made, and taxpayers are exempt from late fees for mistakenly recorded taxes, with no liability assigned to citizens or organizations.

The Ministry of Finance acknowledges that “unjust tax debt” cases stem from data errors, synchronization issues, or identity theft for fraudulent business registration. Additionally, some taxpayers fail to comply with payment obligations, submit incorrect payment details, or neglect proper tax declaration procedures.

In response to voter feedback, the Ministry of Finance has implemented measures such as enhancing transparency, sending tax notices through multiple channels, automating debt alerts, enabling incorrect invoice and debt reporting on eTax Mobile, and strengthening tax code verification using population data.

Regarding the proposal to mandate confirmation records before issuing tax debt notices, the Ministry of Finance argues that this could delay processing and increase compliance costs. Modern tax management principles emphasize self-declaration, self-payment, and self-responsibility. Therefore, confirmation records should be reserved for cases with irregularities or suspected data errors.

Current tax debt notices include full contact details of tax authorities, facilitating timely communication, verification, and clarification for taxpayers, ensuring convenience and transparency.

According to the Tax Department, tax arrears by the end of this year are estimated at nearly 230 trillion VND, a 12.6% increase compared to the end of 2024. Despite recovering 65.01 trillion VND this year, tax debt continues to rise.

Tax authorities have issued over 91,600 temporary exit bans against individuals and legal representatives of businesses with persistent tax debt, recovering more than 6.001 trillion VND from over 10,000 taxpayers under exit bans, including over 3,900 taxpayers who have abandoned their business addresses.

Exposing Billion-Dollar Tax Evasion by Real Estate Giants

The Ho Chi Minh City Tax Department has released a list of over 4,200 taxpayers with outstanding debts to the state budget, totaling more than 14.369 trillion VND. Notably, several major real estate companies remain among the top debtors, with one enterprise owing over 2,000 billion VND.

90% Businesses Exempt from Tax Payments as Tax Threshold Raised to VND 500 Million

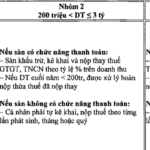

The latest draft of the Personal Income Tax Law revises the tax-exempt revenue threshold for individuals and households, increasing it from 200 million VND to 500 million VND annually.

How Does the Elimination of Presumptive Tax Impact Online Businesses?

The rise of online sales, social media platforms, and livestreaming has revolutionized commerce, giving birth to new roles like influencers (KOLs) and key opinion consumers (KOCs). Starting in 2026, the lump-sum tax system will be discontinued, with significant adjustments targeting e-commerce-related businesses.