With 28 votes representing 85.59 million shares, accounting for 84.62% of the total voting shares of An Binh Securities JSC (ABS, code: ABW, UPCoM), the company has approved two capital increase plans.

First, ABS plans to offer 202.3 million shares to existing shareholders. The offering ratio is 1:2, meaning shareholders holding 1 share are entitled to purchase 2 additional new shares. The issued shares will not be subject to transfer restrictions.

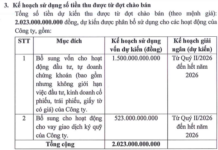

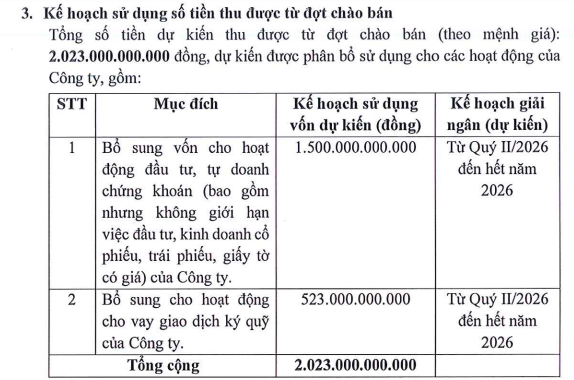

The offering price is set at VND 10,000 per share, aiming to raise VND 2,023 billion. Of this amount, ABS intends to allocate VND 1,500 billion to supplement its proprietary trading capital and the remaining VND 523 billion for margin lending. The disbursement is scheduled from Q2/2026 to the end of 2026.

Source: ABS

Second, An Binh Securities aims to issue 5 million shares under the Employee Stock Ownership Plan (ESOP). ESOP shares will be subject to a one-year transfer restriction.

The issuance is expected to take place in Q2/2026, following the completion of the offering to existing shareholders. With the anticipated proceeds of VND 50 billion, ABS will use the funds to supplement margin lending, disbursing from Q2/2026 to the end of 2026.

Upon successful completion of both issuance plans, An Binh Securities’ chartered capital will increase from VND 1,011.5 billion to VND 3,084.5 billion.

Established in 2006, An Binh Securities has Geleximco Group – JSC as its largest shareholder, holding 45.85% of the company’s capital as of September 30, 2025.

In Q3/2025, An Binh Securities reported a 59% year-on-year increase in operating revenue to nearly VND 141 billion. Operating expenses rose by 72%. As a result, ABS recorded an after-tax profit of over VND 46 billion, a significant 72% increase compared to the same period last year.

For the first nine months of the year, operating revenue reached nearly VND 341 billion, with after-tax profit at VND 105 billion, reflecting growth rates of 26% and 27%, respectively, compared to the same period in 2024.

Nguyễn Thanh Phượng Steps Down from BVBank’s Board of Directors for a Unique Reason

BVBank’s extraordinary shareholders’ meeting has approved the decision for Ms. Nguyen Thanh Phuong not to continue her tenure on the bank’s Board of Directors in the upcoming term.

PDR’s Christmas Gift: Drive, Protect, and Earn 50 Million VND Each

Alongside the millions of shares distributed to the leadership team, Phat Dat’s latest ESOP issuance extends to a broader range of support staff, including drivers, security personnel, and janitors. This inclusive approach allows these employees to realize gains of tens of millions of dong, fostering a sense of ownership and shared success across the organization.