Secondary Apartment Transactions Plummet, Speculators Retreat

According to the latest report from One Mount Group’s Market Research and Customer Insight Center, Hanoi’s secondary apartment market entered a correction phase in November 2025, reflecting a slowdown after a period of strong growth.

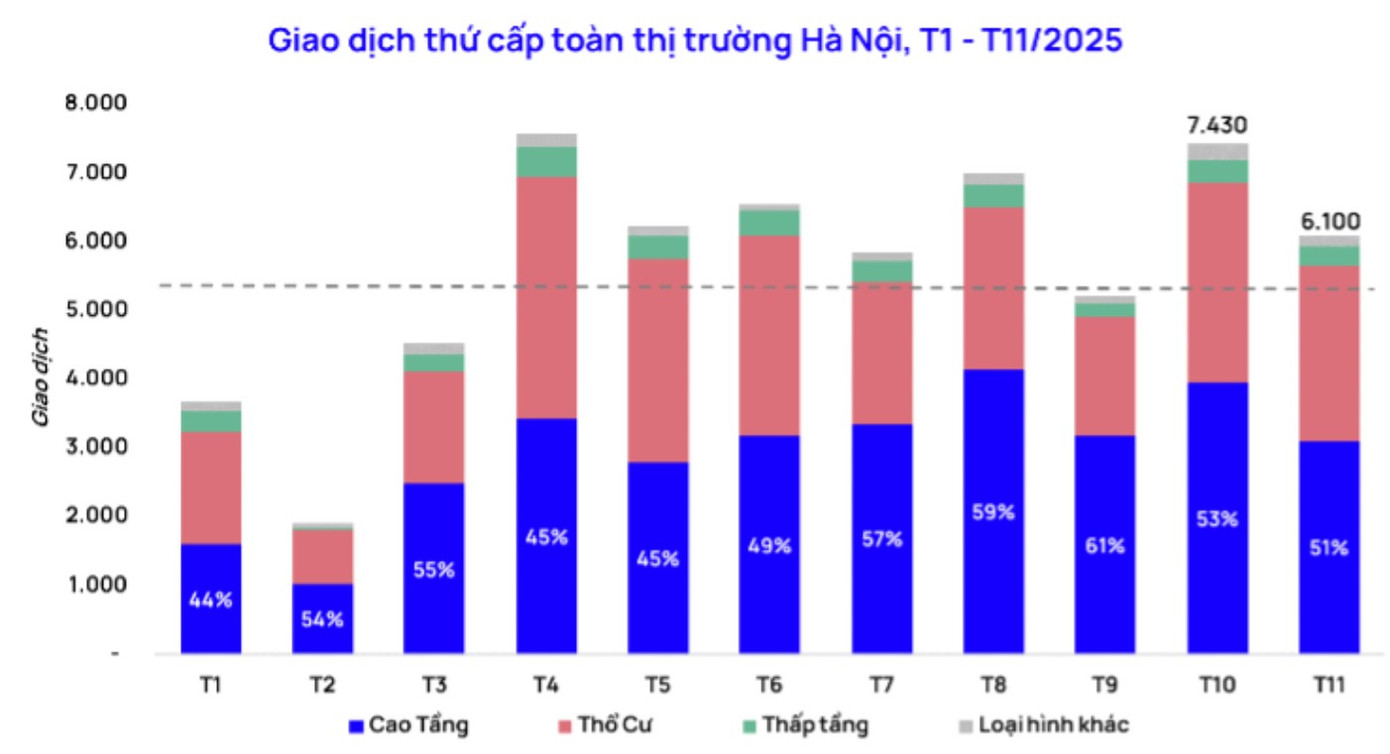

Specifically, the market recorded approximately 6,100 secondary transactions, an 18% decrease compared to October but still higher than the 2025 annual average. Notably, the decline was not uniform, showing clear segmentation by area and customer group.

Secondary apartment transactions in Hanoi recorded around 3,100 deals, a 22% drop from the previous month. Source: One Mount Group.

Within the transaction structure, the secondary apartment segment recorded approximately 3,100 transactions, a 22% decrease from the previous month. Meanwhile, the residential land and low-rise housing segments saw a slight 10% decline. Despite significant impacts, high-rise apartments remained the market leader, accounting for over 50% of total transactions and leading the secondary market for the sixth consecutive month.

According to One Mount Group, this trend indicates that the market is not broadly weakening but entering a phase of “localized filtering,” primarily in areas with high speculation and rapid price increases over a short period.

“After a period of strong speculative capital inflows from mid-year, the market is now undergoing a filtering process. Rising interest rates since October, coupled with slowing price growth, have directly impacted investors using financial leverage, leading to a wave of short-term investor withdrawals,” said Tran Minh Tien, Director of One Mount Group.

Interest Rate Pressure and Mortgage Maturity

One of the main reasons for the market cooldown is the rising cost of capital. In November, many commercial banks increased deposit interest rates by 0.8–1.2 percentage points, raising the average rate to approximately 5.64% per year. As of November 21, the banking system’s credit balance increased by 16% compared to the end of 2024, while deposits grew by only about 12%.

Interest rate pressure and mortgage maturity are key factors cooling Hanoi’s apartment market in late 2025.

Simultaneously, many home loans disbursed in late 2023 and early 2024 are reaching the end of their grace periods, causing a sudden increase in principal and interest repayment obligations. Facing capital cost pressures, some short-term investors are forced to restructure their cash flow, reducing selling prices but still struggling with liquidity.

Looking ahead, experts believe the 2025 year-end adjustment is technical and necessary. Historical data shows that the 2024 market also underwent a year-end correction, lasting until the end of Q1 2025 before rebounding in Q2–Q3.

According to Tran Minh Tien, a similar scenario could play out in 2026 but with a healthier market structure. “Short-term speculative capital will continue to diminish, with the market driven primarily by real demand and long-term investors. Reduced reliance on bank leverage will lead to more sustainable and stable liquidity in the new cycle,” Tien assessed.

One Mount Group forecasts that Hanoi’s secondary apartment market in 2026 could reach 37,000–38,000 transactions, a 4.5% increase compared to 2025.

Hanoi Apartments Overtake Land Plots as Leaders in the Secondary Market

In Q3/2025, land plot sales declined across all regions, primarily due to high average prices driving capital toward more liquid asset classes. Meanwhile, secondary apartment transactions continued to surge, reaching a two-year high in sales volume, with activity concentrated in yet-to-be-handed-over sub-districts.

The Mystery of the Apartment That Never Lights Up

Amidst the dazzling lights of the metropolis, a luxury apartment has remained dark for three long years. This silent residence stands as a testament to the hidden struggles within the high-end property segment, which has been in a deep slumber for years.