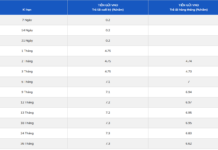

Source: VietstockFinance

|

The market is currently experiencing widespread divergence, with most sectors showing a mix of gains and losses. The primary pillars of the market are information technology and telecommunications stocks. Leading the charge in the IT sector are FPT, CMG, ITD, and SBD, all of which maintained their upward trajectory during the morning session. This positive momentum has also spread to the telecommunications sector, with notable performers including VGI, FOX, CTR, SGT, and ICT.

Conversely, the consumer services sector is lagging behind, primarily due to the decline of VPL. Other Vingroup-affiliated stocks are also in the red, with VIC, VHM, and VRE dropping by 1-2%, exerting downward pressure on the index, albeit not excessively.

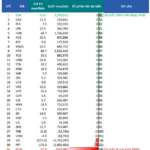

Trading activity was subdued in the morning session, with transaction values falling below 10 trillion VND. Foreign investors recorded a modest net purchase of over 20 billion VND. FPT and MWG were among the most actively bought stocks. In contrast, Vingroup stocks faced selling pressure, with VHM and VIC experiencing net sales of 84 billion VND and 60 billion VND, respectively.

| Top 10 Stocks with Strongest Net Buying and Selling by Foreign Investors in the Morning Session of December 30, 2025 |

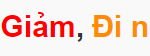

10:40 AM: Selling Pressure Intensifies in Real Estate and Energy Sectors

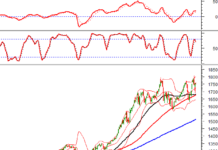

Compared to the opening, selling pressure has become more pronounced, with the VN-Index struggling around the reference point. The real estate sector has turned red, and energy stocks are also underperforming.

By mid-session, real estate stocks were predominantly declining. Vingroup-affiliated stocks saw slight decreases, with VIC down 0.8%, VHM down 0.5%, and VRE down over 2%. Other familiar stocks such as DXG, KDH, VPI, DIG, and AGG also recorded mild declines of 1-2%, negatively impacting the VN-Index.

The financial sector saw some stocks switch to the red, including TCB, HDB, SSI, STB, and VND. Overall, this sector leaned toward an upward trend in the morning session, with BID, VPB, VCB, CTG, MBB, and TPB driving the index higher. Conversely, HDB and STB exerted downward pressure.

Energy stocks experienced widespread declines, with PVD, BSR, PLX, PVS, PVT, and OIL all dropping by 1-2%.

By 10:45 AM, the VN-Index had fallen to 1,750 points, down over 4 points.

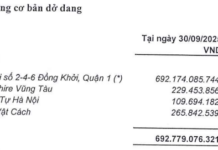

Source: VietstockFinance

|

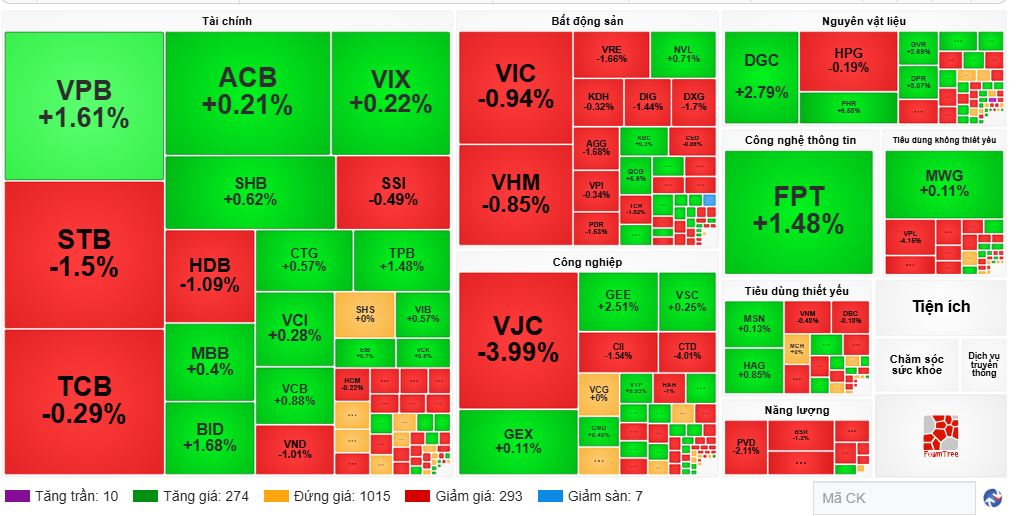

Opening: Green Dominates, but Pressure from Blue Chips Persists

The December 30 session opened with green dominating, as 240 stocks rose and 110 fell. However, pressure from several large-cap stocks constrained the VN-Index‘s upward momentum. By 9:25 AM, the index hovered around 1,760 points.

The financial sector demonstrated positive momentum early on, with widespread gains of around 1%. Banks, in particular, contributed significantly to the index’s rise, led by TCB, VPB, MBB, and STB.

The real estate sector was mixed, with VHM, KDH, and NVL advancing, while VIC and VRE declined slightly, adding pressure to the index.

The materials sector performed well, with DGC rising over 3%. Additionally, rubber stocks saw broad gains, including DPR, PHR, DRI, GVR, and TRC.

– 12:03 PM, December 30, 2025

Cash Flow Surge: Unveiling the Rally Behind a High-Performing Stock Cluster—What’s Driving the Momentum?

MBS Securities has released its estimated financial performance for the fourth quarter of 2025 and the full year, specifically for this group of stocks.

Real Estate Stocks Surge, Propelling VN-Index to Gain Over 25 Points

Real estate stocks have emerged as a magnet for investor capital, with VHM and NVL leading the charge in a stunning rally. The VN-Index surged over 25 points, inching closer to the 1,755 milestone.