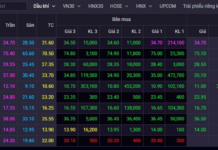

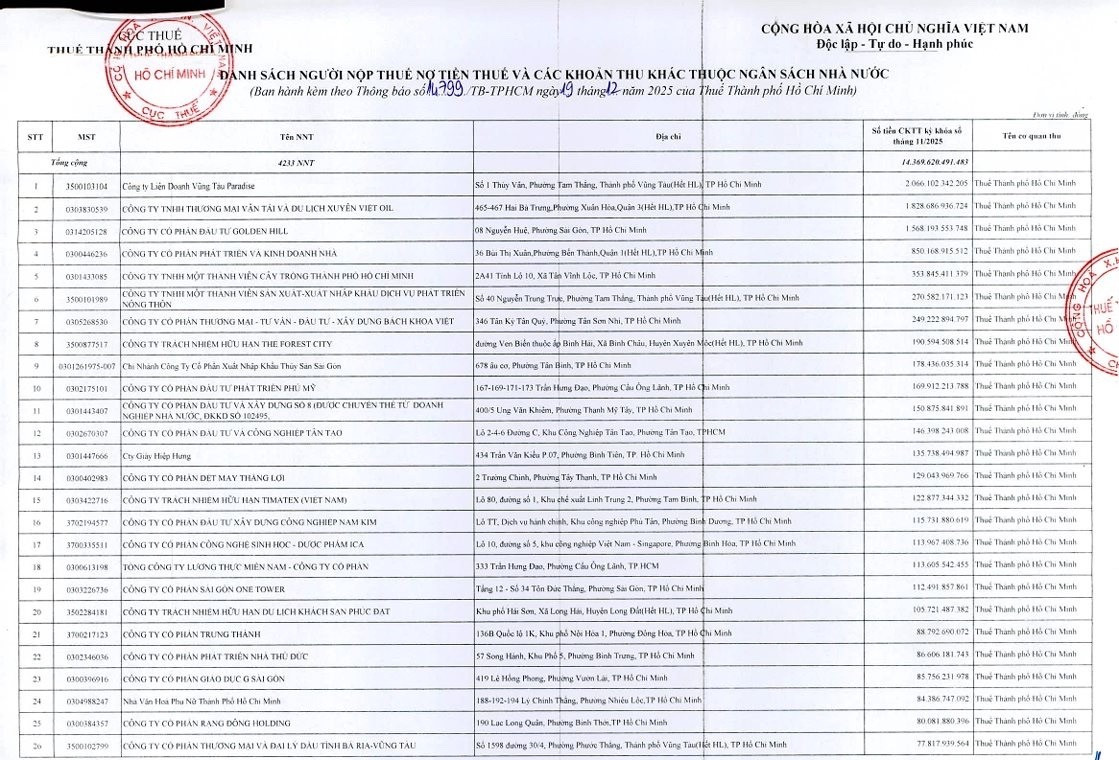

The Ho Chi Minh City Tax Department has issued Announcement No. 14799/TB-TPHCM, disclosing a list of 4,233 taxpayers with outstanding tax debts and other state budget-related dues, totaling nearly VND 14,370 billion as of November 2025.

Leading the list is Vung Tau Paradise Joint Venture Company, with a debt of over VND 2,066 billion. Established in April 1991, this real estate and tourism company is a joint venture between Ba Ria – Vung Tau International Tourism Service Joint Stock Company and Paradise Development and Investment Company (Taiwan, China). Vung Tau Paradise is the developer of the Vung Tau Paradise Resort project.

In second place is Xuan Viet Oil Trading, Transportation, and Tourism Company Limited, with nearly VND 1,830 billion in tax arrears. Golden Hill Investment Corporation, the developer of the Alpha City project at 87 Cong Quynh, Cau Ong Lanh Ward, ranks third with a tax debt of nearly VND 1,570 billion.

These top three companies alone account for VND 5,300 billion in tax debts, representing 37% of the total debt on the list.

Source: Ho Chi Minh City Tax Department

The list also includes several prominent real estate companies in the Southern region. HDTC Real Estate Development and Trading Corporation owes VND 850 billion, while Thu Duc House Development Corporation has a debt of VND 86.6 billion.

Kim Oanh Real Estate Service – Trading and Construction Joint Stock Company is also on the list with a tax debt of VND 75.8 billion. Ha An Real Estate Investment and Business Corporation, a member of Dat Xanh Group, owes VND 66.4 billion.

Other companies with debts exceeding VND 100 billion include MTX Production – Import-Export Tourism Agriculture Development Company Limited (over VND 270 billion), Bach Khoa Viet Trading – Consulting – Investment – Construction Corporation (nearly VND 250 billion), The Porest City Company Limited (over VND 190 billion), and Saigon Seafood Import-Export Corporation’s branch (over VND 178 billion).

Phu My Development Investment Corporation owes nearly VND 170 billion, Tan Tao Investment and Industry Corporation has a debt of over VND 146 billion, and Nam Kim Industrial Construction Investment Joint Stock Company owes VND 115.7 billion.

Numerous other companies are also listed with tax debts ranging from tens to over a hundred billion dong.

Top Real Estate Companies in Ho Chi Minh City Owe Massive Tax Debts, One Firm Tops VND 2 Trillion

Several real estate companies continue to top the tax debt list in Ho Chi Minh City. Notably, many of these firms are affiliated with major property developers in the Southern region, including Novaland (NVL), Thuduc House (TDH), HDTC, Kim Oanh, and others.

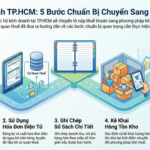

Essential Tax Transition Guide for Small Business Owners

Empower your business with seamless tax compliance. As a sole proprietorship, you can now take control by self-registering, declaring inventory, and opening a dedicated account when transitioning to revenue-based tax filing. Simplify your financial management and stay ahead with ease.