For years, payment accounts have been the most static component in the financial landscape of Vietnamese individuals and businesses. Whether personal or corporate, money in these accounts was primarily viewed as idle funds awaiting expenditure: received, transferred, and then recycled. The only way to generate safe returns from these funds was through term deposits, which required locking in capital and sacrificing flexibility. This modus operandi persisted for so long that it became the default. It shaped the financial behavior of the entire system: banks assumed payment accounts didn’t warrant interest or offered minimal returns, while customers accepted that money in these accounts was dormant.

It wasn’t until 2024–2025, with the deep penetration of digital banking, that this question began to surface more frequently. Technology enabled real-time fund tracking, instant processing, and personalized customer experiences. As technical conditions matured, user financial mindsets began to shift, and banks entered a competitive race to understand customer needs and financial pain points.

If there’s a standout representative of Vietnam’s 2025 personal finance innovation wave, it’s not a single product but a new approach to fund management. VIB’s Profit Duo exemplifies this shift, where funds simultaneously generate returns in the account and create additional value through daily spending. This is the result of a deliberate development journey by the bank, starting with individual customers, expanding to businesses and SMEs, and culminating in a profit model tied to transaction flows.

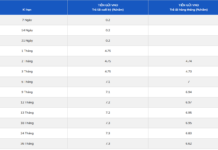

In September 2025, VIB launched the Profit Duo, combining the Super Interest Account and the VIB Smart Global Payment Card. The Super Interest Account allows individuals to earn up to 4.3% annually on balances up to 20 billion VND, while the VIB Smart Card offers up to 5% cashback on online transactions. Together, users can achieve a combined benefit of up to 9.3%. The core innovation isn’t just the combined returns but the ability to proactively optimize idle funds, whether in the account or during spending.

Continuously enhancing user benefits, VIB recently introduced installment payments directly on the international payment card. Cardholders can easily convert transactions into installments via the Max app, while still earning 5% cashback on online transactions. This feature, previously exclusive to credit cards, is now available on VIB’s payment card, making it the first and only bank in Vietnam to offer this benefit.

The Profit Duo marks a significant milestone in finance by introducing a new profit concept: small capital generating dual benefits—returns and cashback. This “capital efficiency” mindset is the latest step in VIB’s Super Interest journey, reflecting the entire product development process.

The Profit Duo is the result of VIB’s relentless focus on user behavior and real needs, creating a comprehensive, user-friendly solution that generates daily returns. Both products are built on the MyVIB platform, Vietnam’s most innovative digital bank in 2024, leveraging technologies like Cloud, Big Data, AI, and GenAI to personalize experiences and optimize funds based on actual spending behavior. This technology enables Super Interest to scale beyond individual products to businesses on VIB Business, integrating various financial behaviors while maintaining automation and consistency.

By late 2025, the “high-yield payment account + cashback card” model had become a market trend, expanding access to Vietnamese users.

“The Profit Duo—combining the Super Interest Account and VIB Smart Global Payment Card—is more than a financial product; it’s an actionable financial philosophy where technology, data, and user experience converge to create a new path: every bit of capital works, every transaction generates returns,” emphasized VIB’s leadership.

VIB’s Super Interest Account for individuals, launched in February 2025, offers daily returns of up to 4.3% annually on idle funds, with a minimum threshold of just 5 million VND—expanding profit access to most payment account holders in Vietnam, compared to the previous 10 million VND standard. The account generates returns automatically without locking funds or requiring complex actions. Users can spend, transfer, or withdraw anytime while earning daily returns.

Within 24 hours of launch, VIB set a financial industry record, with nearly 100,000 accounts activated, recognized by the Vietnam Records Organization. This isn’t just a numerical achievement but a validation of VIB’s strategy: awakening idle funds nationwide, fostering smart personal finance management. More importantly, it changed user behavior: instead of dormant accounts, customers now embrace active, profit-generating funds, yielding higher returns. This record demonstrates market readiness for a new payment account standard where liquidity and profitability no longer conflict.

The market impact was swift. Within two months, competing auto-profit products adjusted to enhance customer experiences, showcasing VIB’s influence.

While individual users were “awakened,” business, SME, and household funds remained largely overlooked. Paradoxically, these groups held the largest payment account balances. From sales revenue to partner payments, employee salaries, and short-term reserves, trillions of VND sat idle daily in bank systems. Yet, for years, banking products assumed business transaction flows were for spending, not profit.

For individual businesses, the issue was starker. Mr. Manh Hai, a Hanoi construction materials retailer, shared that his store collected hundreds of millions daily, but funds sat idle for 5–7 days awaiting restocking. “Can’t save it because it’s needed anytime. But leaving it idle means ‘sleeping money’ while profit margins thin,” he said.

VIB identified this massive gap. If individuals benefited from profit accounts, businesses and SMEs deserved the same. When vast business capital generates returns instead of idling, the impact extends beyond individual firms to the entire economy’s capital efficiency.

In May 2025, VIB expanded Super Interest to businesses, SMEs, and households, offering up to 4.5% daily on working capital up to 5 billion VND, with activation thresholds from 10 to 100 million VND. Crucially, funds remain liquid, supporting normal business operations. This expansion, without compromising flexibility, highlights Super Interest’s innovative design.

Super Interest for businesses marks a shift in corporate finance: working capital is no longer a cost but a daily profit asset. This isn’t just a banking product but a new solution for capital efficiency in a fast, flexible economy.

By Q2 2025, this solution was scaled further, expanding profit access for businesses, SMEs, and households.

“Super Interest is VIB’s breakthrough to bring fund mobility and idle fund optimization directly to every Vietnamese user. It’s not just a pioneering financial solution with a mission to ‘awaken idle funds,’ turning dormant money into profit opportunities, but a financial mindset revolution. It’s a call to action for individuals, businesses, and communities to unlock financial power, optimize capital, and build a prosperous future,” said VIB’s leadership.

VIB is setting new market standards. Transaction funds and working capital can now generate daily returns while remaining fully liquid. Customers no longer see payment accounts as temporary parking but as dynamic financial tools: flexible, profitable, and always ready.

VIB’s success is internationally recognized. In six months, it won three global awards for its profit account products, confirming its innovation, experience, and operational excellence.

More importantly, VIB’s impact is market-wide. By late 2025, customers embraced the idea of idle funds and working capital generating automatic returns.

“VIB isn’t just offering a product but shaping financial mindsets for modern Vietnamese—those seeking proactive, secure, strategic financial control. Through the Profit Duo, we aim to bring Vietnamese closer to smart finance standards, where every bit of capital creates value, and every financial action contributes to sustainable freedom,” VIB’s leadership affirmed.

The new standard combines attractive financial benefits, seamless experiences, and deep technology for large-scale operations. With AI optimizing daily balances and GenAI offering personalized advice, payment accounts are no longer static but dynamic systems, continuously learning and improving. In this new paradigm, competitive advantage lies not in higher returns but in redefining the game—where technology, data, and operational philosophy drive long-term value for banks and customers.

FChoice is CafeF’s annual awards program, launched in 2021. It’s not just an awards ceremony but a “map of achievements” highlighting breakthrough stories impacting Vietnam’s economy, especially in finance. In 2025, FChoice returned with the theme “Vietnam Rising,” featuring four major categories.

Explore the Hall of Fame now for inspiring stories of resilience, innovation, and national pride in this new development phase HERE.

From Digital Banking to Comprehensive ESG: TPBank’s Journey in Integrating Technology into Operations

TPBank, a pioneer in digital banking, seamlessly integrates ESG principles into its core operations rather than treating them as isolated initiatives. By leveraging digitalization, automation, and data-driven solutions, the bank embeds Environmental, Social, and Governance factors into its daily activities, ensuring a holistic and sustainable approach to growth.

Frontline Focus: Banks Prioritize Technology Investments

The banking industry is entering an era where competitive advantage no longer hinges on acquiring new accounts, but on deeply understanding and precisely serving the needs of its long-accumulated customer base. This shift explains the surge in AI investments, transforming vast data repositories into enhanced service revenues and superior customer experiences, rather than relying solely on credit growth as in the past.

Mandatory Bank Transfer Halts Operations Across Multiple Branches and Transaction Offices

VCBNeo, a leading digital technology bank, has recently announced the closure of several transaction offices and branches. This strategic move marks a significant shift in the bank’s operational model, focusing more on digital services to enhance customer experience and efficiency.

VPBank Solidifies Leadership with Cutting-Edge, Convenient, and Sustainable Services

VPBank solidifies its pioneering position by consistently enhancing service quality and integrating cutting-edge technology. Through a comprehensive digital transformation strategy, the bank not only streamlines operational processes but also delivers an exceptional customer experience, meeting demands with speed, convenience, and security.