Market Landscape Post-Correction

While the VNIndex hovers near its historical peak of 1,780 points, a significant portion of stocks have undergone notable corrections. This creates an intriguing paradox: the benchmark index remains high, yet investment opportunities are on the rise.

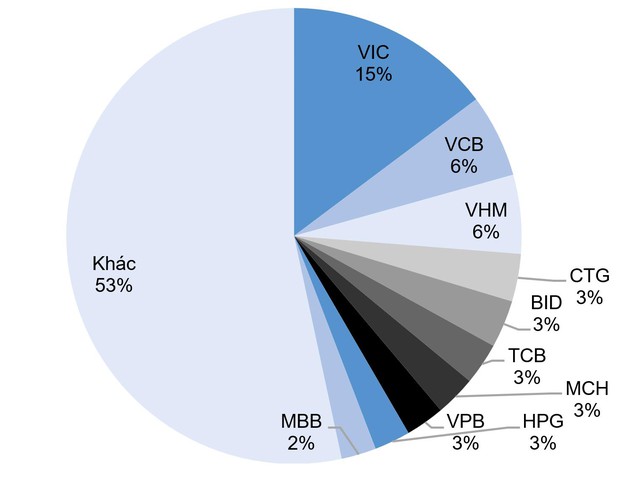

The recovery from the November 2025 lows was primarily driven by a few large-cap stocks, most notably VIC. This stock surged over 60% during this period, accounting for 14% of the VNIndex’s capitalization. Its strong performance lifted the market, creating an illusion of overall market strength. However, in reality, most stocks have corrected substantially compared to their trading levels between August and October 2025.

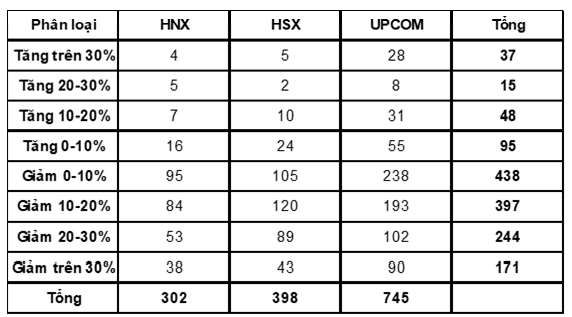

Data from KIS Securities provides a clearer picture of this correction. Over 30% of stocks on the HSX have declined by 10-20% from their August-October peaks, while another 32% have corrected by more than 20%. This means over 62% of stocks have experienced significant adjustments, despite the benchmark index remaining elevated. This is when market valuations become most attractive.

Correction levels of stocks from September-October peaks (Source: FiinproX, KIS Research)

Capitalization weights of large-cap stocks (Source: FiinproX, KIS Research)

Increase in Low-Valued Stocks

A deeper analysis of valuations by KIS Securities reveals an encouraging trend. The number of undervalued stocks—those with potential upside of over 15%—has surged recently. While only about 40% of stocks were considered undervalued in August-September 2025, this figure has now risen to 65%.

This significant increase in undervalued stocks stems from two main factors. First, the recent price correction has created a gap between intrinsic value and market price for many companies. Second, improved business performance among listed companies is evident in their impressive nine-month 2025 results.

Listed companies’ profits for the first nine months of 2025 reached approximately VND 499 trillion, a remarkable 30% year-on-year growth. This far exceeds the 16% growth recorded in the same period in 2024 and sharply contrasts with the 13% decline in 2023. This robust recovery highlights Vietnam’s economy and businesses’ positive growth trajectory.

Notably, KIS Securities observes that the current 65% ratio of undervalued stocks is comparable to late 2024 and early 2025 levels. The rise in undervalued stocks not only signifies more investment opportunities for investors but also indicates that the overall market is undervalued relative to its intrinsic worth.

Number of undervalued stocks over time (Source: Fidana.vn, KIS Research)

January Effect: The Year’s Most Profitable Period

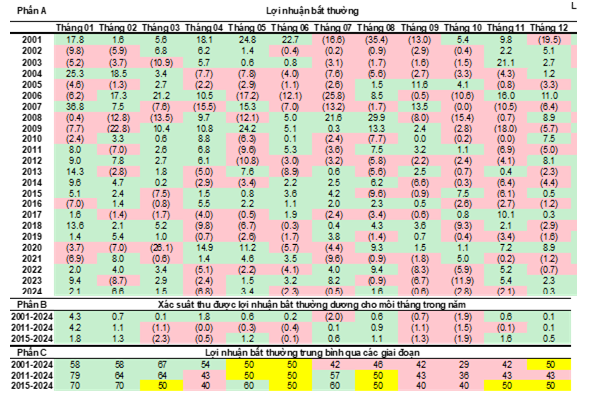

Beyond attractive valuations, KIS Securities identifies another crucial factor supporting market prospects: seasonal effects. Historical data analysis shows that January and February are the most profitable months for investors in Vietnam’s stock market.

To scientifically validate this effect, KIS Securities employs abnormal return analysis. Abnormal returns are calculated by subtracting the annual average return from the monthly return. For example, if the VNIndex gains 6.4% in November 2023 and the 2023 annual average return is 1% (monthly), the abnormal return would be 5.4%. This approach isolates seasonal patterns by removing the market’s long-term trend.

Abnormal return data from 2001 to 2024 is analyzed across various periods, including the entire 2001-2024 span, 2011-2024, and the most recent 2015-2024 period. The goal is to assess the January effect’s consistency over time, especially as the market evolves in structure and size.

The research conclusively confirms the January effect in Vietnam’s stock market. January and February consistently exhibit higher positive abnormal returns than other months. This effect persists across different analysis periods, indicating it is a systematic market feature rather than a random occurrence.

Statistical analysis of monthly abnormal returns (Source: Fidana.vn, KIS Research)

Several hypotheses explain the January effect. A common reason is the influx of new capital from year-end bonuses and investors’ optimistic sentiment at the start of the year. Additionally, many funds and institutions rebalance their portfolios early in the year, further boosting market activity.

Thus, the combination of attractive valuations and positive seasonal effects presents a compelling investment opportunity. However, investors should note that not all stocks are equally appealing.

UPCoM-Listed Bank Stocks Gear Up for HoSE Migration Starting 2026

The stock market is poised for fresh developments starting in 2026, as several bank stocks currently listed on UPCoM prepare to transition to HoSE listings, in line with previously announced plans.

Convergence of Internal and External Forces Makes 2026 a Prime Year for Stock Market Investment

During the “2026 Investment Outlook – Balancing Opportunities” livestream hosted by DNSE Securities on December 29th, experts delved into the prospects of the stock market as it approaches the threshold of 2026. Despite lingering macroeconomic challenges, there was a consensus among the specialists that this year is undoubtedly “a must-invest year.”

“Riding the Wave”: Which Stock Groups Are Expected to Attract Investment in Q4 Earnings Season?

According to Mr. Huy, with the current market conditions where prices are no longer skyrocketing, investors now have the opportunity to carefully evaluate companies, gradually accumulate stocks with strong fundamentals, and identify clear narratives for success in 2026.

The PYN Elite Fund CEO’s “Prophecy” Comes to Fruition

“We have seen numerous reports from domestic securities firms forecasting that the VN-Index could reach 1,800 points by this Christmas, and we do not consider this an unrealistic scenario,” stated Petri Deryng, head of the foreign fund PYN Elite Fund, in a letter to investors approximately six months ago.