The market concluded 2025 with exceptional price growth. The VN-Index closed the year at 1,784.49 points, marking a 40.9% increase compared to the end of 2024. This remarkable performance was driven by standout stock groups, notably GEE (+800.8% YoY) and VIC (+736.5% YoY). Liquidity surged in 2025, with matched order trading volume on HOSE rising 32.9% year-over-year. Foreign investor activity was a highlight, with net purchases totaling approximately 700 billion VND.

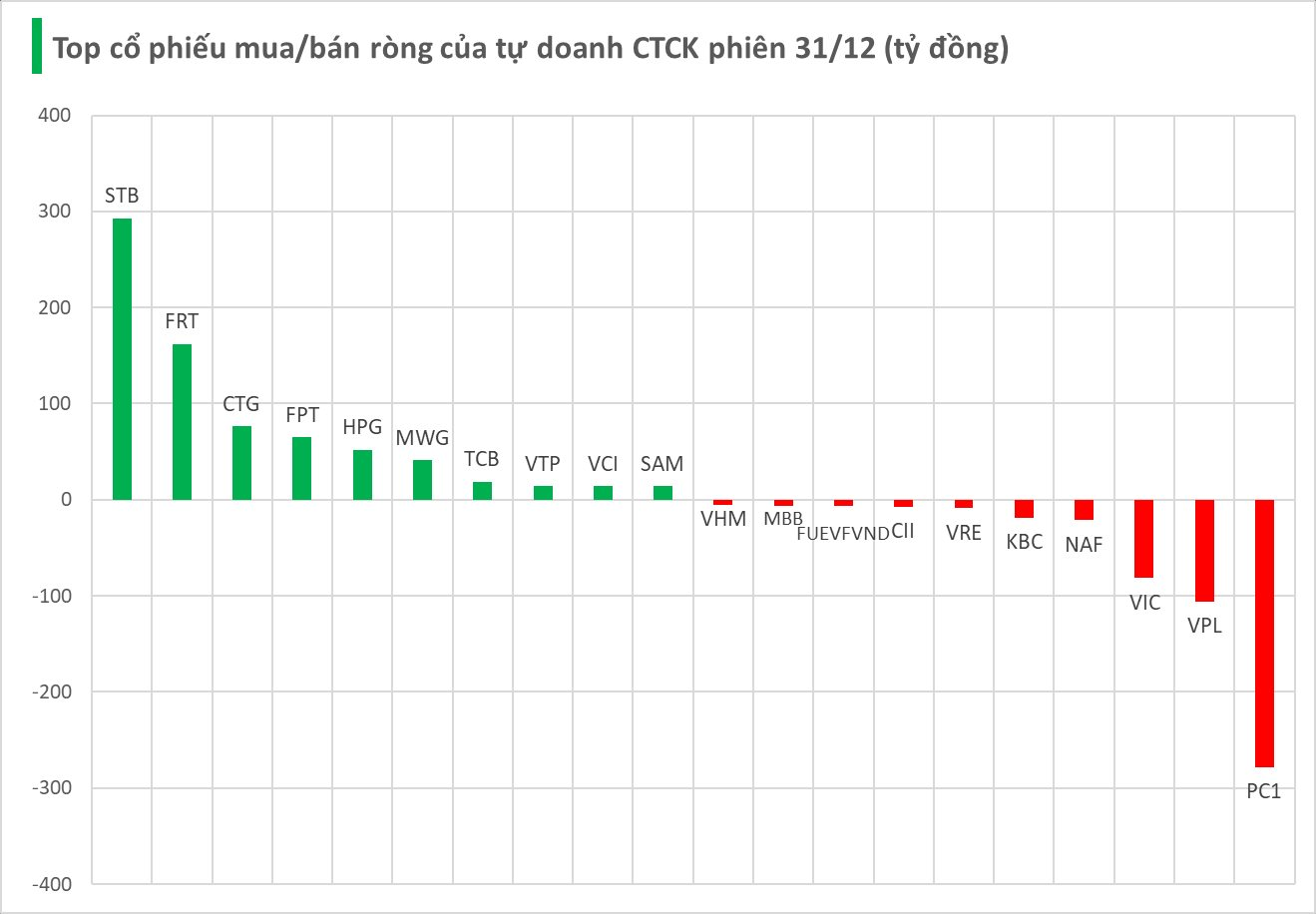

Securities firms’ proprietary trading desks recorded net purchases of 308 billion VND.

Specifically, STB led with the highest net purchases at 293 billion VND, followed by FRT (162 billion), CTG (76 billion), FPT (65 billion), HPG (52 billion), MWG (41 billion), TCB (19 billion), VTP (14 billion), VCI (14 billion), and SAM (14 billion VND)—all among the actively purchased stocks by proprietary trading desks.

Conversely, the most significant net selling by securities firms was observed in PC1, with -279 billion VND, followed by VPL (-106 billion), VIC (-81 billion), NAF (-21 billion), and KBC (-19 billion VND). Other stocks with notable net selling included VRE (-9 billion), CII (-7 billion), FUEVFVND (-7 billion), MBB (-6 billion), and VHM (-5 billion VND).

“Capital Withdrawal Wave” Expected to Drive Stock Market in 2026: Major Enterprises in Focus

A dedicated resolution on the state economy is set to be issued in 2026, aiming to establish a flexible framework for state-owned enterprises. This framework will empower these entities to restructure, expand investment partnerships, and ultimately enhance operational efficiency and governance capabilities.

Market Pulse December 31: Vingroup Stocks Boost VN-Index by Over 17 Points

At the close of trading, the VN-Index surged by 17.59 points (+1%), reaching 1,784.49 points, while the HNX-Index dipped by 1.73 points (-0.69%), settling at 248.77 points. Market breadth showed a near-even split, with 352 gainers and 352 decliners. Similarly, the VN30 basket reflected balance, featuring 14 advancers, 15 decliners, and 1 unchanged stock.