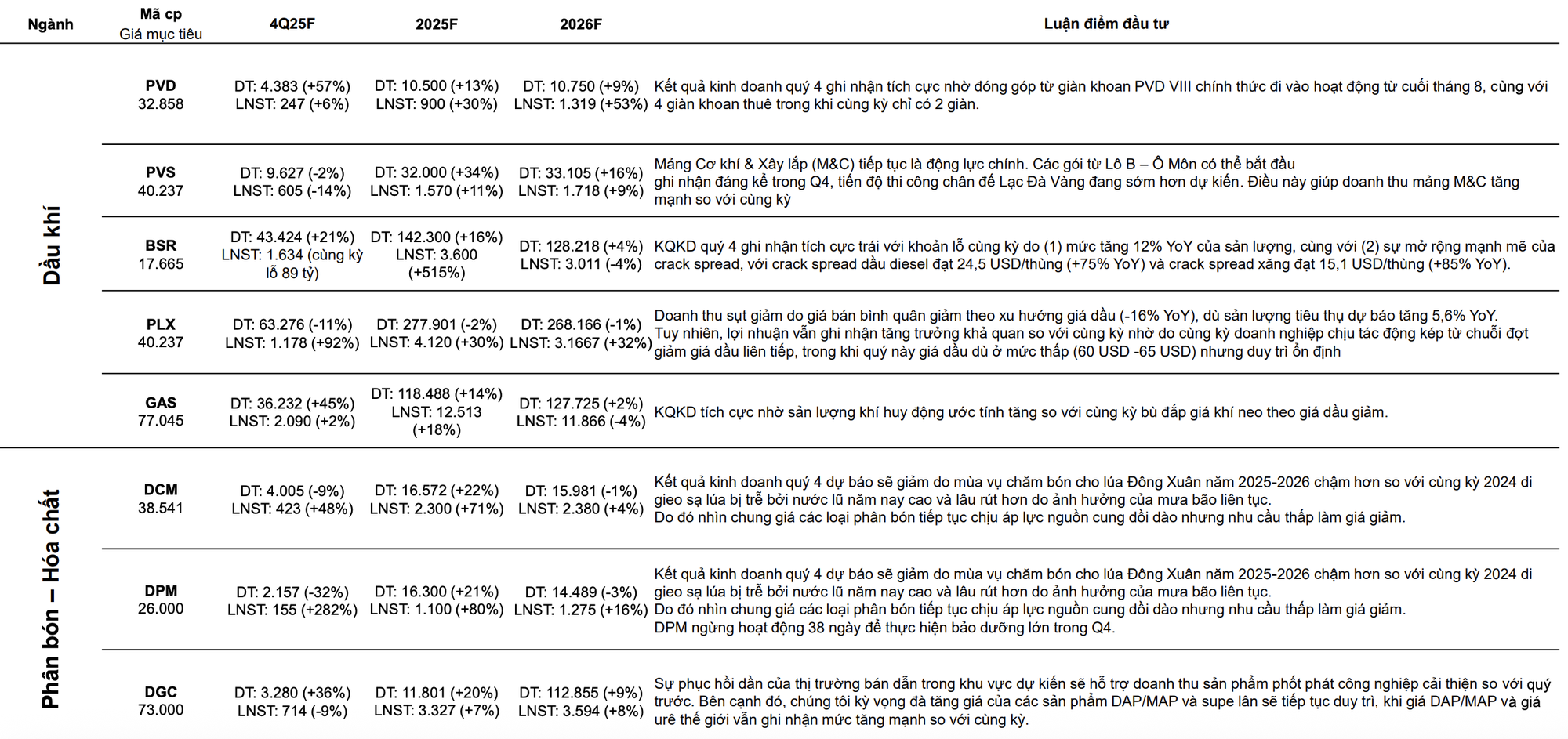

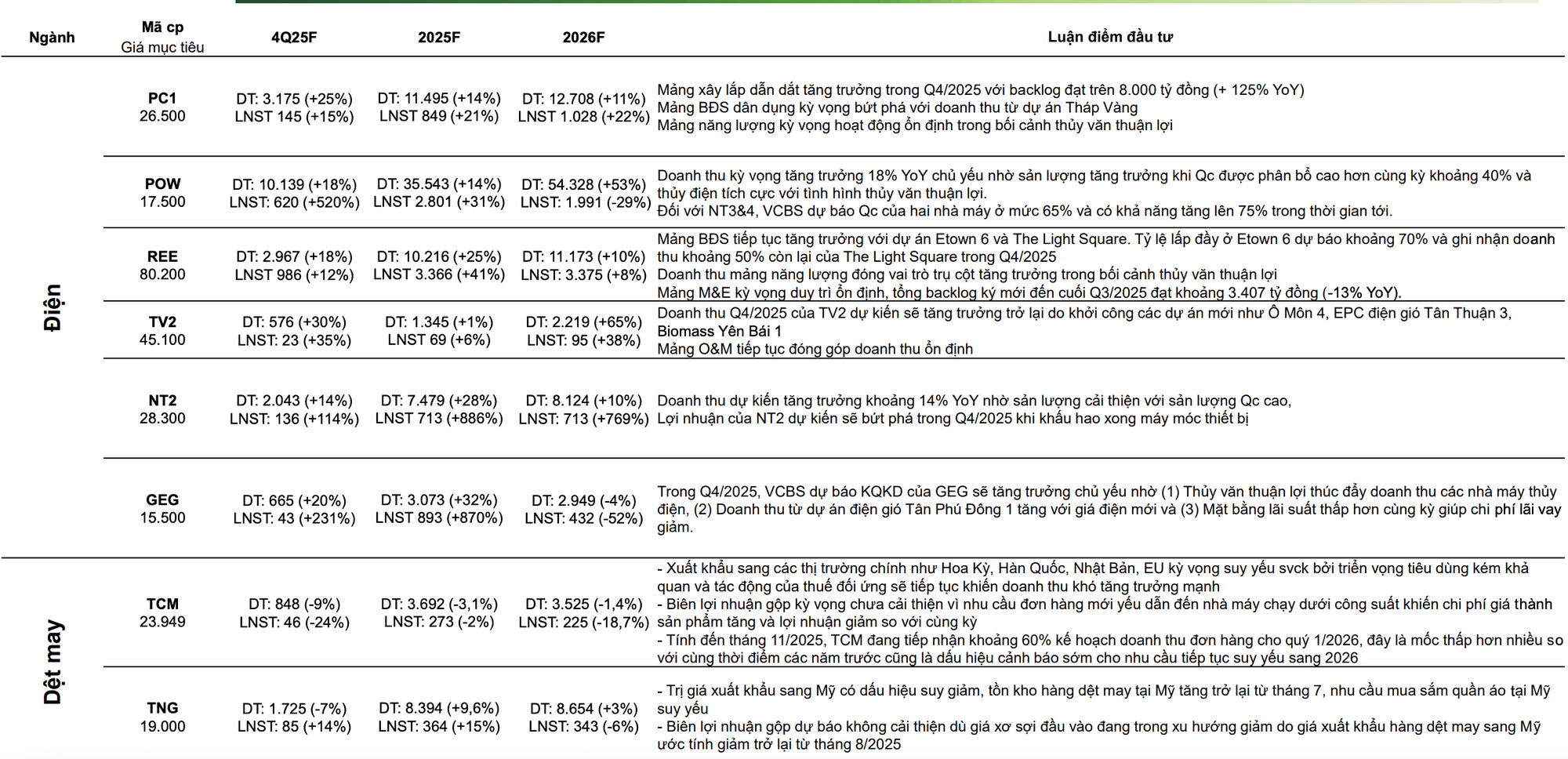

Vietcombank Securities (VCBS) has released its forecast for the profit landscape of various industries and specific companies in Q4 2025.

Numerous companies are projected to achieve significant profit growth in Q4, with increases ranging from several dozen percent to even doubling compared to the same period last year. These include MSB, TCB, VPB, SSI, VCI, HDG, HDC, KBC, HHV, NKG, MWG, PLX, BSR, DPM, POW, NT2M, and GEG.

Conversely, several companies are expected to report negative profit growth in this quarter, such as STB, NLG, PDR, DXG, BCM, VCG, QNS, PVS, DGC, and TCM.

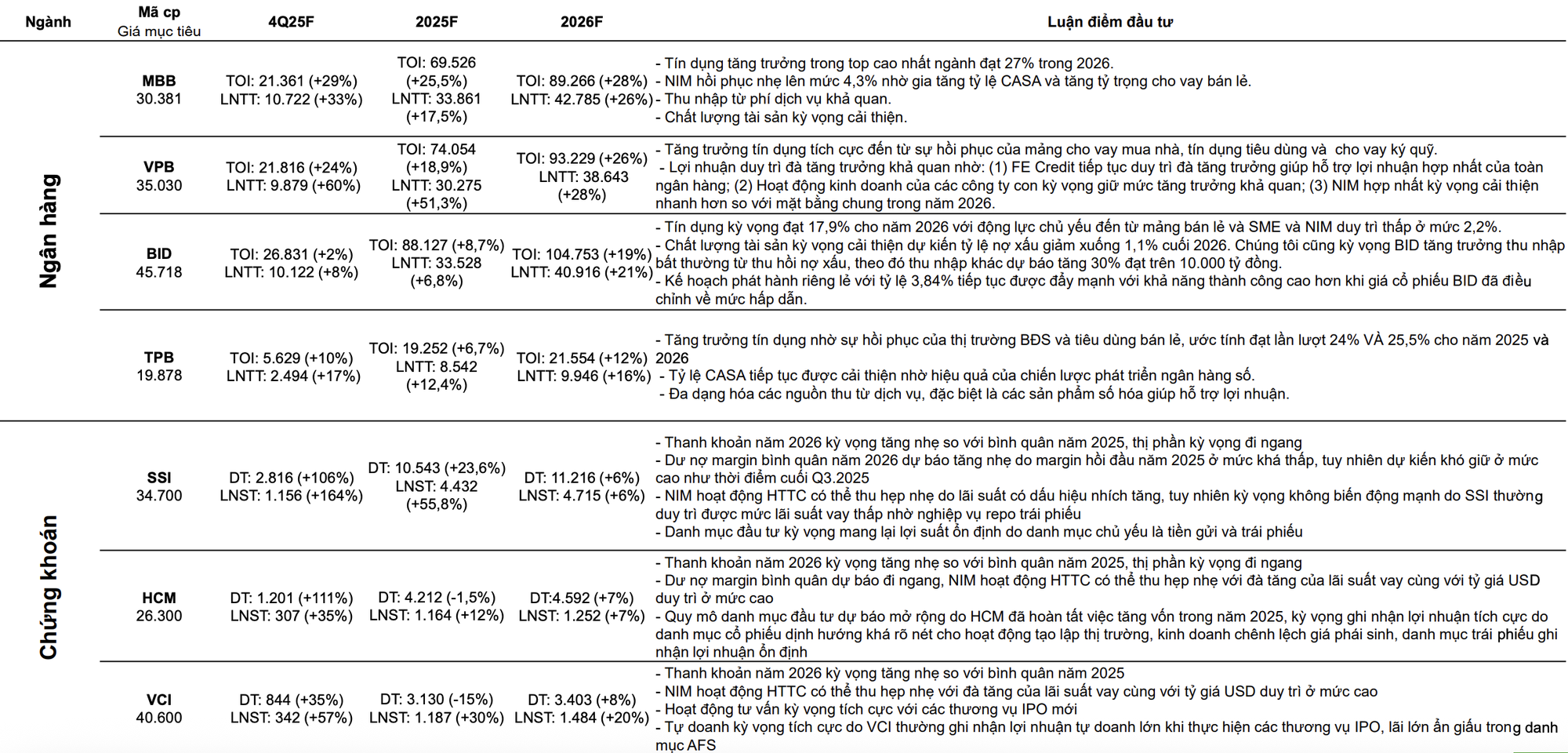

For the banking sector, VCBS predicts that MSB and VPB will be the standout performers in Q4 profit growth, with increases of 72% and 60%, respectively. For MSB, VCBS highlights strong credit demand, anticipating a credit growth rate of 21.8% for 2026, and an improving NIM from the second half of 2025. MSB’s non-performing loan ratio is also expected to decrease to 2%, driven by robust credit growth and increased debt recovery. The bank is further strengthening its ecosystem through capital restructuring plans, including the divestment from TNEX Finance and the acquisition of a securities company and a fund management company.

VCBS also commends VPB’s positive credit growth momentum, fueled by the recovery in home loans, consumer credit, and margin lending. Profit growth is expected to remain strong due to (1) FE Credit’s continued growth supporting the bank’s consolidated profit; (2) positive growth prospects for subsidiaries; and (3) a faster-than-average improvement in consolidated NIM in 2026.

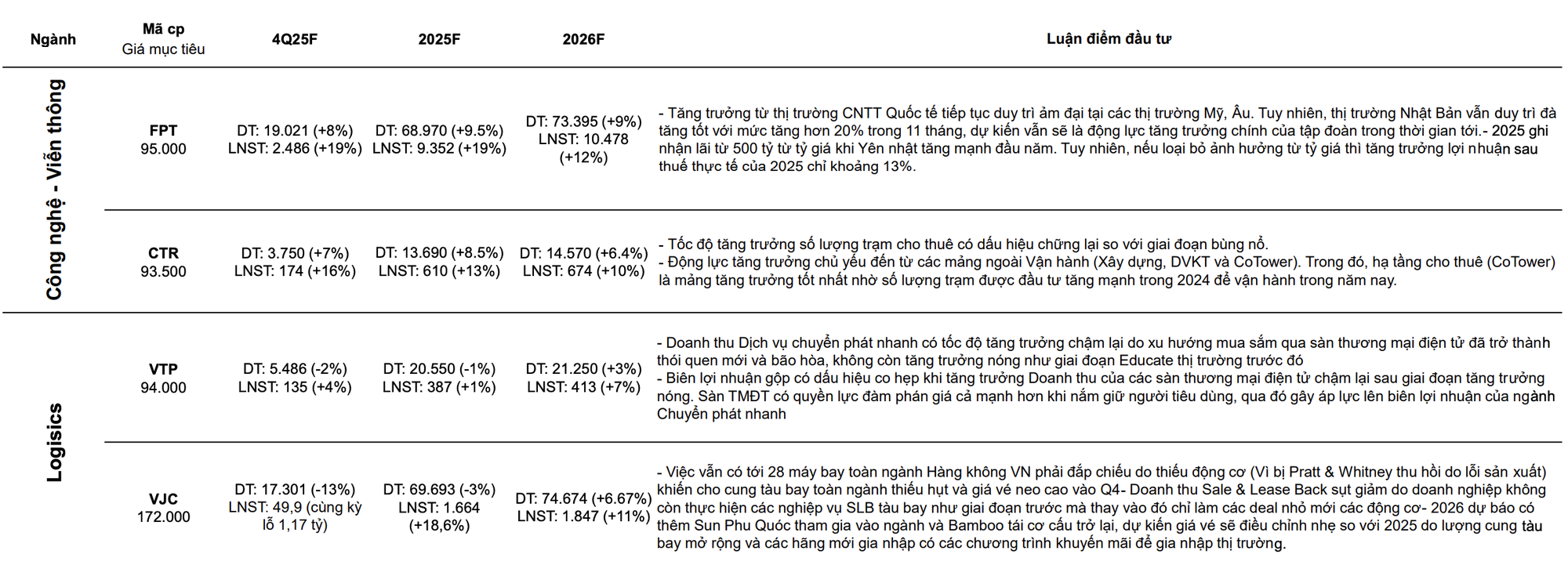

In the securities sector, industry leader SSI is forecast to see a 164% surge in Q4 profit to VND 1,156 billion, bringing its full-year 2025 after-tax profit to over VND 4,400 billion, a nearly 56% increase year-on-year.

Two other sector players, HCM and VCI, are also expected to post positive Q4 profit growth, at 35% and 57%, respectively.

In the residential real estate sector, HDC is projected by VCBS to achieve a “double” growth rate in Q4, with net profit reaching VND 60 billion (+590%). Consequently, full-year 2025 net profit is forecast to be 10 times higher year-on-year, reaching nearly VND 670 billion. VCBS expects HDC to launch 40 new products in The Light City Phase 1 in Q4. In 2026, the company will also recognize revenue from projects like Thong Nhat, The Light City, and Ecotown. Additionally, the Vung Tau real estate market is entering a new growth phase, boosted by infrastructure investments and Sun Group’s mega-projects, which will benefit HDC’s business results.

Vinhomes (VHM) is expected to achieve a Q4 net profit of VND 16,588 billion, an 18% increase year-on-year. Meanwhile, Dat Xanh (DXG) is projected to earn VND 170 billion in Q4 2025, a 19% decline compared to the same period last year.

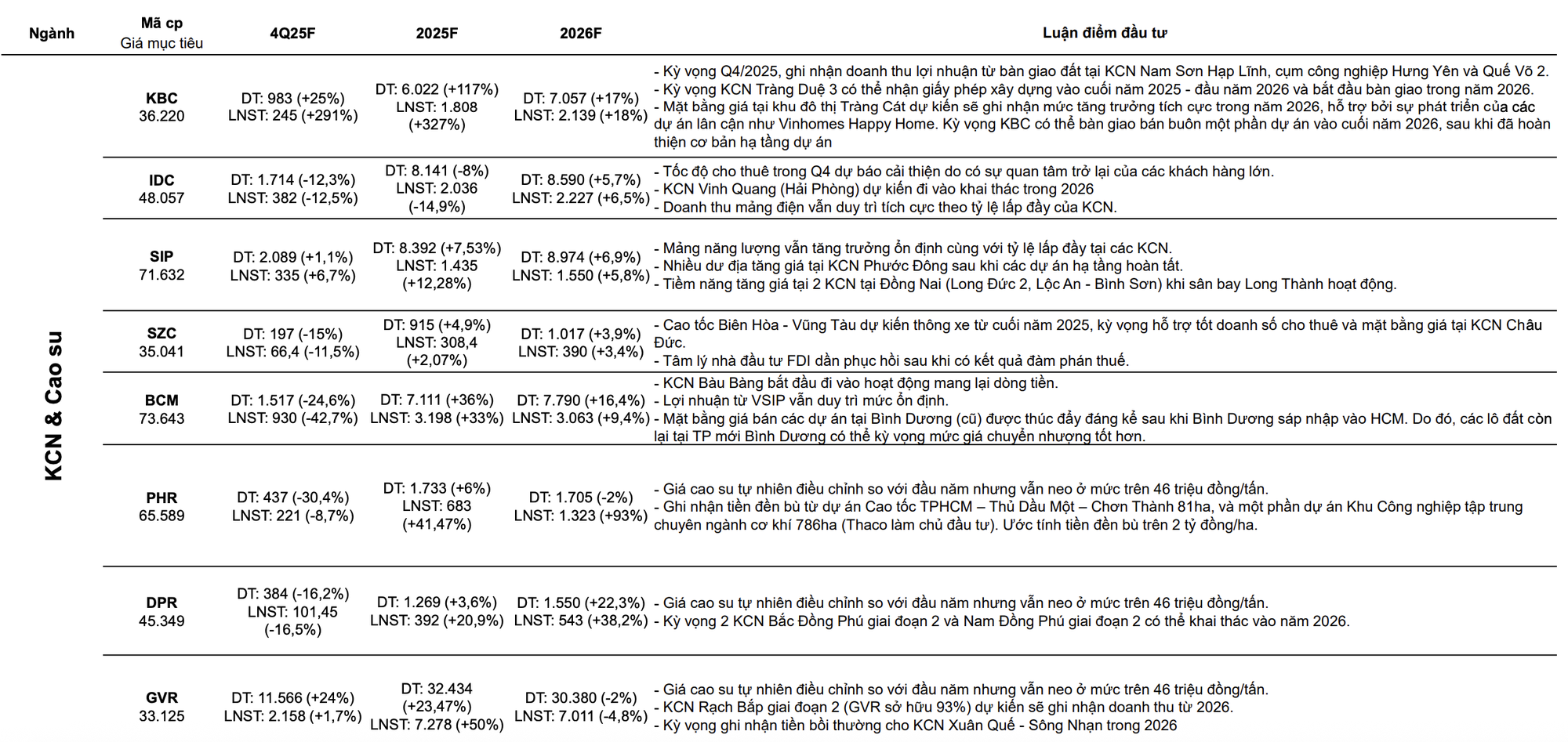

Among industrial zone and rubber companies, KBC is expected to record revenue and profit from land transfers in Nam Son Hap Linh Industrial Zone, Hung Yen Industrial Cluster, and Que Vo 2. Revenue is projected to reach VND 983 billion, with Q4 net profit soaring 291% to VND 245 billion.

In contrast, BCM is forecast to see a 43% decline in after-tax profit to VND 930 billion in Q4.

GVR is projected to achieve Q4 revenue and net profit of VND 11,566 billion and VND 2,158 billion, up 24% and 2% year-on-year, respectively.

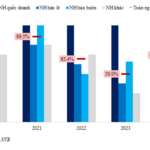

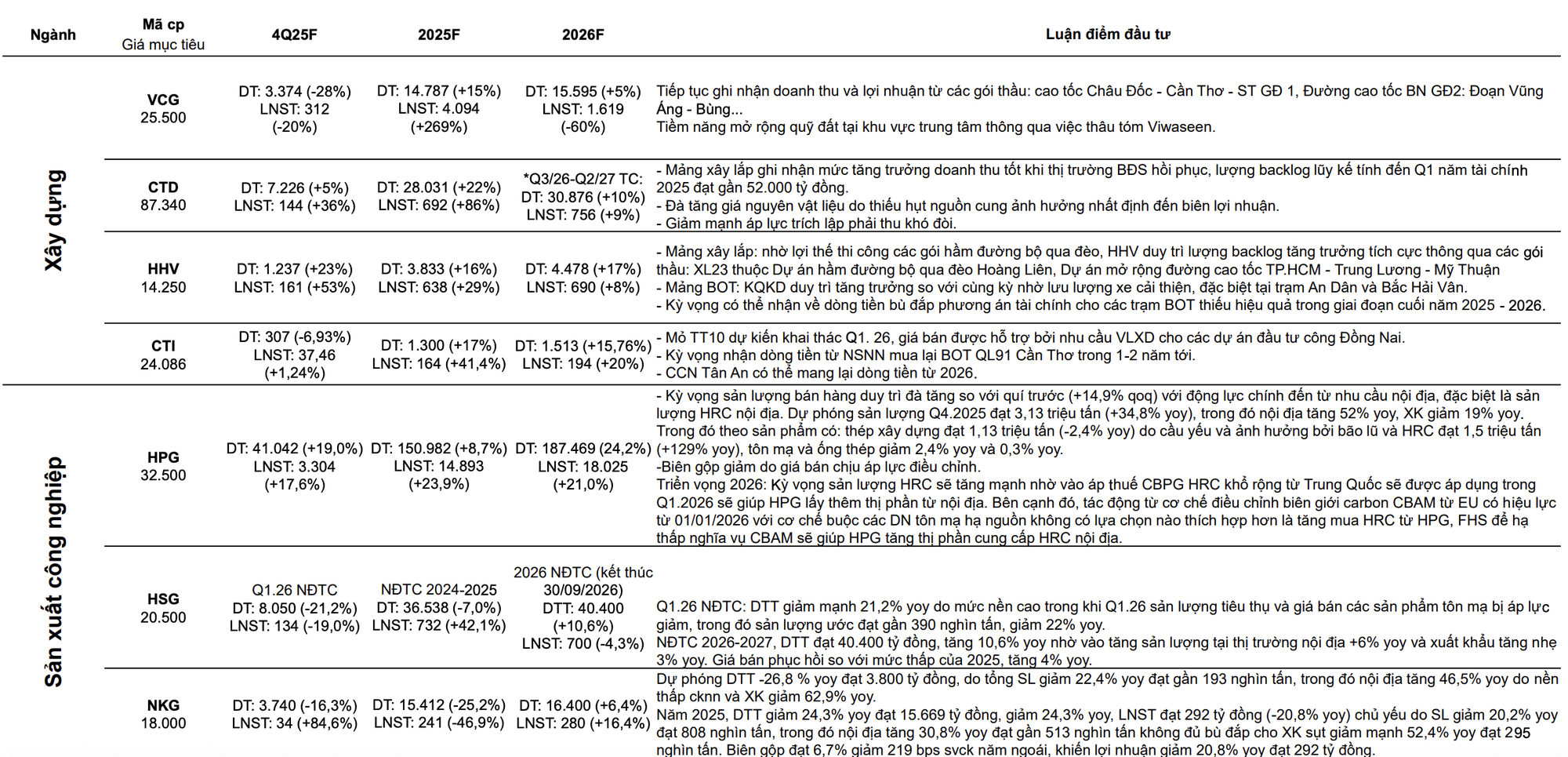

In the steel sector, HPG is expected to see a 18% profit growth in Q4 to over VND 3,300 billion. According to VCBS, Q4 production volume could reach 3.13 million tons (+34.8% YoY), with domestic sales increasing by 52% and exports decreasing by 19%. By product, construction steel is expected to reach 1.13 million tons (-2.4% YoY) due to weak demand and the impact of storms and floods, while HRC is projected to reach 1.5 million tons (+129% YoY). Galvanized steel and steel pipes are expected to decline by 2.4% YoY and 0.3% YoY, respectively. Gross margin is expected to decrease due to price adjustment pressures.

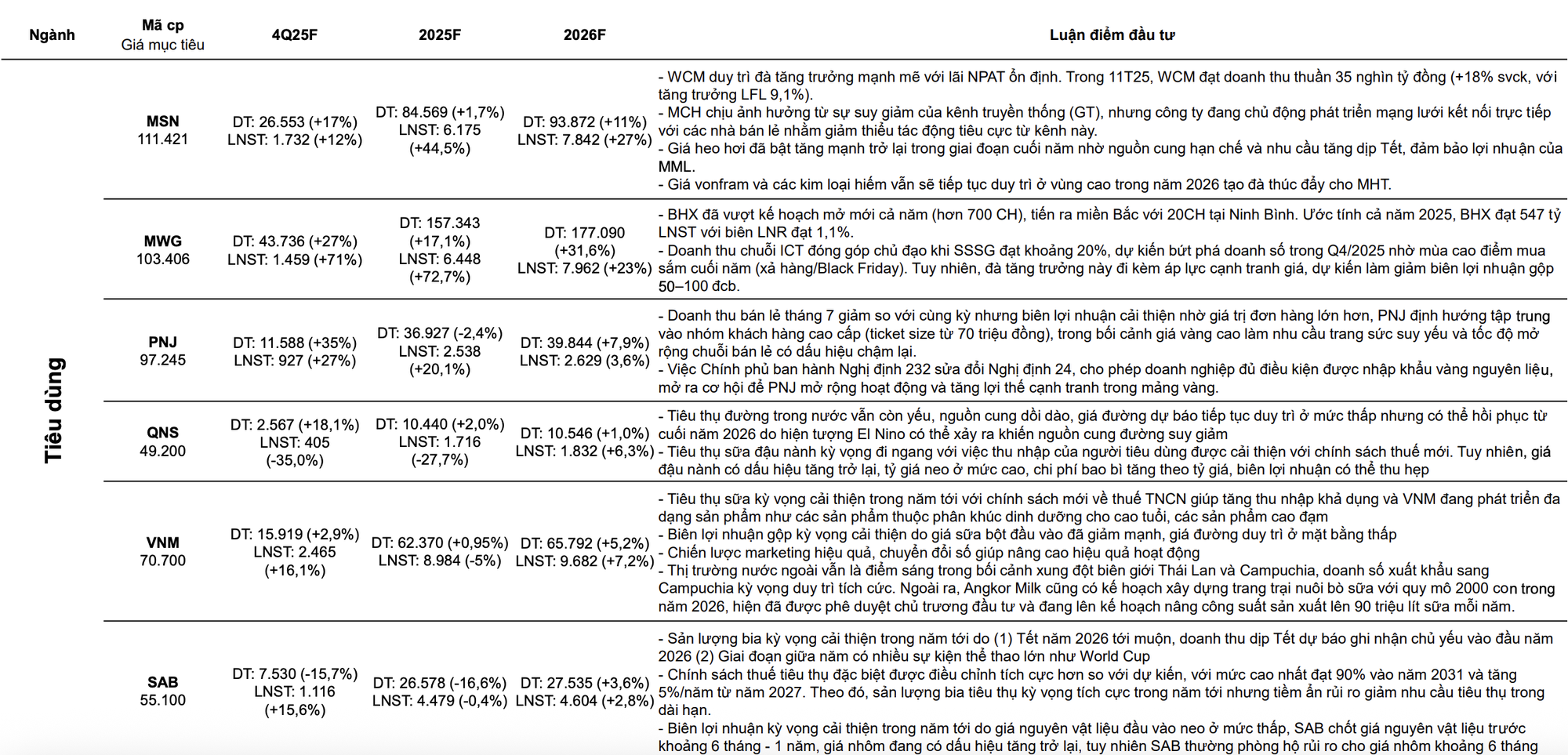

In the consumer sector, MWG and PNJ are forecast to achieve strong Q4 profit growth, at 71% to VND 1,459 billion and 27% to VND 927 billion, respectively.

VCBS predicts a relatively positive outlook for the power sector, with GEG expected to achieve a Q4 net profit of VND 43 billion, a 231% increase. This growth is primarily driven by (1) favorable hydrological conditions boosting revenue from hydropower plants, (2) increased revenue from the Tan Phu Dong 1 wind power project with new electricity prices, and (3) lower interest rates compared to the same period last year, reducing interest expenses.

Tracking the Whale Money Flow on December 30: Proprietary Traders Heavily Accumulate Bank Stocks, Foreign Investors Return with Nearly 1 Trillion VND in Net Buying

Proprietary trading firms extended their buying streak to a fifth consecutive session, while foreign investors reversed their trend, injecting a substantial 943 billion VND into the market. This significant inflow provided crucial support, bolstering market performance on December 30th.

The Race to Achieve Profit Targets Among Banks

The final weeks of the year mark the most intense period for the banking sector, as annual targets for profitability, growth, and financial stability are all finalized. This isn’t merely a race to boost numbers; every growth step is constrained by credit limits, capital costs, and the challenge of managing non-performing loans. Consequently, a bank’s year-end acceleration not only determines its current performance but also serves as an early indicator of its growth quality and prospects for the following year.

Riding the IPO Wave: Navigating Post-Deal Risks with Caution

The initial public offering (IPO) market is experiencing a resurgence after a prolonged drought. This renewed vigor stems from regulatory reforms and economic stimulus efforts by authorities, particularly within the securities sector. However, investors must exercise caution when participating in IPOs, as losses often arise from overenthusiasm leading to inflated pricing.

Stock Market Reaches New Highs, Investors Celebrate Early Christmas Gifts

As the Christmas Eve trading session (December 24) approached, the VN-Index extended its upward streak, primarily driven by the momentum of blue-chip stocks. While the index reached a new peak, market polarization became increasingly evident, with a cautious sentiment prevailing among investors.