Technological Commercial Joint Stock Bank Securities (TCBS, code: TCX, HoSE) has announced the results of its private bond issuance to the Hanoi Stock Exchange (HNX).

On December 25, 2025, TCBS issued 5,000 bonds under the code TCX12504, with a face value of 100 million VND per bond, totaling 500 billion VND. These bonds have a 15-month term, maturing on March 15, 2027, with a combined interest rate of 8% per annum.

According to the HNX announcement, this is the fourth bond issuance by TCBS since the beginning of 2025.

This bond issuance is part of a larger plan to issue private bonds with a maximum face value of 3,000 billion VND, which has been approved by TCBS.

The bonds are non-convertible, unsecured, and do not include warrants. They are sold at 100 million VND per bond, aiming to raise a total of 3,000 billion VND, which will be used for the company’s debt restructuring.

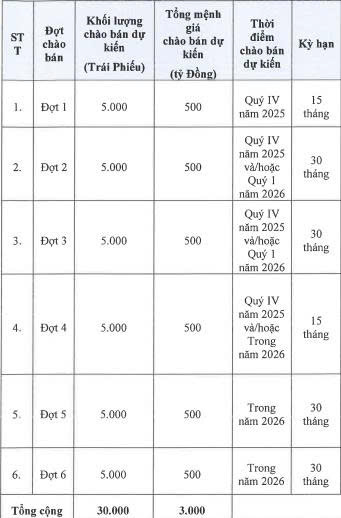

TCBS plans to issue 30,000 bonds in six tranches, with specific volumes, issuance values, terms, and issuance dates as follows:

Source: TCBS

Regarding interest rates, for the first and fourth tranches, the interest rate for the initial interest period is 8% per annum. Subsequent interest periods will apply the reference rate plus 2.5% per annum.

For the second, third, fifth, and sixth tranches, the interest rate for the initial interest period is also 8% per annum. Following interest periods will apply the reference rate plus 2.7% per annum.

Conversely, TCX has been actively settling maturing bond issuances. On December 29, 2025, the company paid nearly 20 billion VND in interest and 500 billion VND in principal for the bond code TCXCH2425003. This bond was issued on June 28, 2024, with an 18-month term, maturing on December 28, 2025, and a combined interest rate of 7.92% per annum.

Previously, on December 26, 2025, TCBS settled 14.3 billion VND in interest and the full 361.7 billion VND principal for the bond code TCXCH2425002. This bond was issued on June 26, 2024, with a value of 361.7 billion VND and an 18-month term.

Earlier, on December 15, 2025, TCBS paid 500 billion VND in principal and nearly 20 billion VND in interest for the bond code TCXCH2425001. This bond had an issuance value of 500 billion VND, was issued on June 14, 2024, and completed issuance on July 10, 2024, with an 18-month term.

MBS Unveils Surprising VN-Index Forecast for 2026

Our team of analysts has revised their outlook for the VN-Index, lowering expectations from the 1,860-point range in the first half of the year to a projected 1,670–1,750 by the end of 2026.

Macroeconomic Stability Goals for 2026 and Monetary Policy

Stabilizing the macroeconomy is a cornerstone of Vietnam’s development strategy, as outlined in Resolution 244/2025/QH15 by the National Assembly for the 2026 socio-economic development plan. This goal is not limited to 2026 alone; it has been a consistent priority for the government over many years, underscoring its indispensable role in the nation’s overall growth trajectory.

Why People Are Rushing to Deposit Money in Banks

After lingering at record lows for an extended period, the financial markets are witnessing a fierce interest rate battle as the year draws to a close. Not only are private banks joining the fray, but even the “Big 4” institutions are actively participating, prompting a significant shift in idle cash held by residents.