|

VNM ETF Treasury Stock Changes During the Week of December 26-31, 2025

|

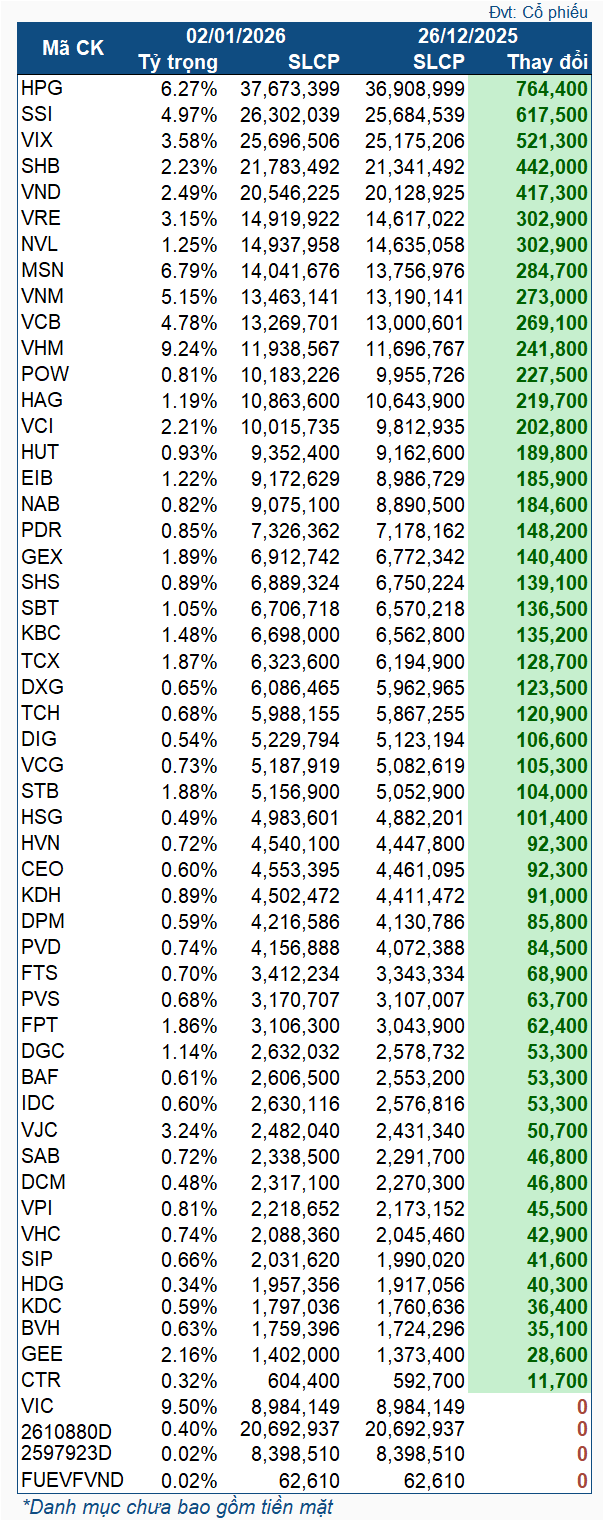

Due to the New Year holiday, the market reopened on January 5, 2026, making the actual trading period for VNM ETF end on December 31, 2025. During this period, only VIC remained unchanged, while the fund net bought all other stocks.

Among these, HPG saw the strongest buying in terms of volume, with 764,400 shares. SSI and VIX followed, with net purchases of 617,500 and 521,300 shares, respectively. SHB and VND were also heavily bought, with over 400,000 shares each.

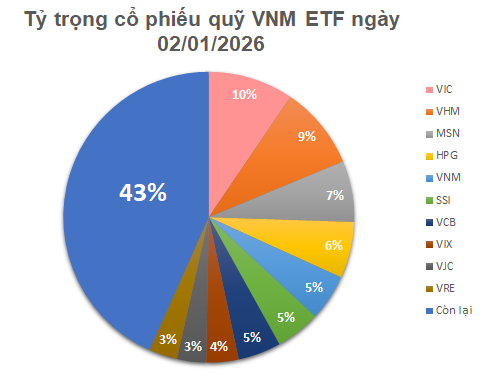

As of January 2, 2026, the total asset value of VNM ETF exceeded 600 million USD, up from over 593 million USD on December 26. The assets are allocated across 52 stocks, 2 stock warrants, and 1 fund certificate. The top two holdings by weight are VIC (9.5%) and VHM (9.24%), significantly ahead of MSN (6.79%), HPG (6.27%), and VNM (5.15%).

– 12:00 PM, January 7, 2026

Foreign Block Reverses Flow, Injects $12.5M to Scoop Up Blue-Chip Stock as VN-Index Surges 25 Points

Foreign investors’ transactions were a notable drawback, as they net sold approximately VND 144 billion.

BVBank: 11-Month Profit Hits VND 515 Billion, Board of Directors and Supervisory Board Elected for 2025-2030 Term

On the afternoon of December 26th, Ban Viet Commercial Joint Stock Bank (BVBank, UPCoM: BVB) held an extraordinary shareholders’ meeting. The agenda included proposals to increase the bank’s chartered capital, amend and supplement its charter, and elect members to the Board of Directors and the Board of Supervisors for the 2025-2030 term.

How Do Hundred-Million-Dollar ETFs Trade During Portfolio Rebalancing Week?

During the period of December 12-19, the VanEck Vectors Vietnam ETF (VNM ETF) exhibited significant trading activity in the stocks within its portfolio. This coincided with the effective date (December 19, 2025) of the fourth-quarter 2025 review of the MarketVector Vietnam Local Index, the benchmark index for the Fund.