Converging Forces Drive Capital into the Stock Market

In a discussion with the author about the 2026 stock market outlook, a KIS expert expressed significant optimism, citing multiple positive factors.

From a macroeconomic perspective, the completion of ring roads, highways, and connections between neighboring provinces and major hubs like Ho Chi Minh City, Hanoi, Hai Phong, and Can Tho has improved infrastructure. This enhancement facilitates smoother goods transportation, reduces costs and time, accelerates capital turnover, and delivers products to consumers faster. Consequently, businesses achieve higher revenues and profits, while citizens enjoy improved living standards.

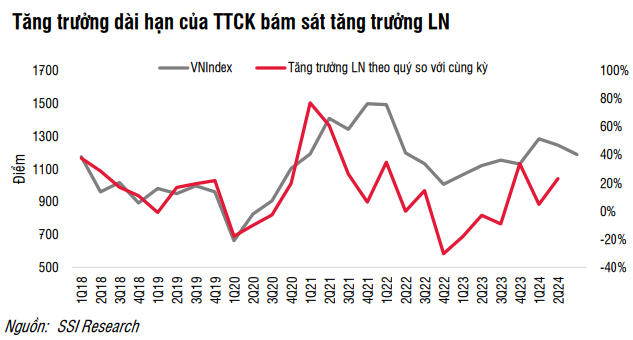

This positive momentum fuels Vietnam’s economy in 2026. Listed companies on HOSE, HNX, and UPCoM report impressive results, with 2025 growth projections surpassing 2024 significantly. This fosters investor optimism for the new year.

Secondly, government policies and reforms benefit businesses. Notably, Resolution 68 underscores state support for the private sector, a major GDP contributor. This reassures investors about profit margins and growth prospects.

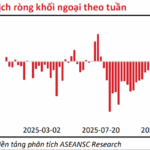

A third critical factor is capital flow. Vietnam’s upgrade to an emerging market will attract large-scale funds through new FTSE indices, far exceeding current frontier market investments.

Strong foreign capital inflows will boost demand and domestic investment. As a result, the VN-Index could surpass 2,000 points in 2026, exceeding previous expectations of 1,700 or 1,800.

Foreign Capital Set to Surge

The expert notes that major foreign funds may invest earlier to avoid higher stock prices post-upgrade. Thus, capital inflows may gradually increase before the official announcement, peaking when the new indices launch.

Regulatory initiatives further stimulate investment. The Vietnam Securities Depository and Clearing Corporation (VSDC) is implementing T+1, T+0, and short-selling mechanisms. Exchanges are developing new indices for ETFs, while HOSE’s KRX system is enhancing multi-product operations and infrastructure.

The government encourages listings on HOSE and HNX, promotes privatization, and improves market quality. The State Securities Commission (SSC) aligns regulations with international standards, targeting higher FTSE Russell and MSCI classifications.

Collaborations with the New York and London Stock Exchanges provide access to advanced expertise, products, and tools, enhancing Vietnam’s market transparency and international alignment.

Regarding the US Federal Reserve’s rate cuts, the expert predicts continued but reduced adjustments. Vietnam’s monetary policy will focus on internal factors like exchange rates, trade balances, and liquidity.

Exchange rate concerns remain manageable, according to the expert.

Promising Sectors for 2026

The expert highlights securities as a top sector for 2026. Market upgrades will attract substantial capital, potentially tripling daily liquidity to VND 40-60 trillion. Increased leverage and listings will boost brokerage profits.

Industrial real estate is another key sector, benefiting from Vietnam’s appeal as a manufacturing alternative to China, supported by political stability and strategic partnerships.

Public investment stocks will thrive as the government accelerates infrastructure projects, benefiting construction and material suppliers.

Residential real estate is recovering, aided by government support and Vietnam’s property investment culture. Resolved bond issues and reasonable stock prices present opportunities.

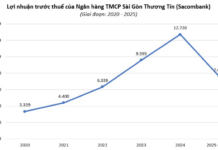

Banking will benefit from credit limit removals in 2026, enabling increased lending and profits as corporate demand rises.

Consumer and energy sectors will gain from economic growth and recovery. Blue-chip stocks, especially VN30, will attract foreign funds targeting large-cap equities.

– 08:01 08/01/2026

Convergence of Internal and External Forces Makes 2026 a Prime Year for Stock Market Investment

During the “2026 Investment Outlook – Balancing Opportunities” livestream hosted by DNSE Securities on December 29th, experts delved into the prospects of the stock market as it approaches the threshold of 2026. Despite lingering macroeconomic challenges, there was a consensus among the specialists that this year is undoubtedly “a must-invest year.”

Market Experts Warn: This Isn’t a Smooth Growth Cycle—It’s a Volatile Climb with Intense Filtering

Mr. Ho Sy Hoa, Director of Research & Investment Consulting at DNSE, offers his insights into the 2025 stock market outlook, highlighting two contrasting factors poised to shape the 2026 landscape: rising interest rates and opportunities arising from market upgrades.

How Do Rising Interest Rates Impact the Stock Market?

The VN-Index is on an impressive 8-session winning streak, inching closer to the 1,750-point resistance level. This upward momentum fuels optimism but also heightens profit-taking pressures. Next week, investor focus will shift to monitoring cash flow dynamics amidst rising interest rates, as the market seeks a retest of its resilience before establishing a new trend.

What Impact Does the Heat of Capital Withdrawal Have on Stocks?

The VN-Index extended its gains today (December 2nd). Amid a market lacking clear catalysts, several divestment stocks heated up, notably Giày Thượng Đình and VTC Telecom, both surging to their 10th consecutive upper limit session.