According to the Hanoi Stock Exchange (HNX), BIDV Securities Corporation (BSC) has officially announced the results of its bond issuance. Specifically, on December 30 and 31, 2025, BIDV Securities successfully issued 3,000 domestic bonds under the code BSI12501.

Each bond has a face value of VND 100 million, totaling VND 300 billion for the entire issuance. The bonds have a one-year maturity and are expected to mature on December 30, 2026.

BIDV Securities retains the option to repurchase all or part of the issued bonds from bondholders six months after the issuance date.

Illustrative image

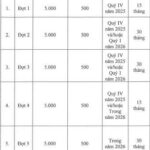

Previously, BIDV Securities approved a private bond issuance plan for 2025. The company plans to issue up to 5,000 non-convertible, unsecured bonds without warrants, each with a face value of VND 100 million, aiming to raise a maximum of VND 500 billion.

The bonds will be issued in two tranches. The first tranche, BSI12501, will have a maximum face value of VND 300 billion, while the second tranche, BSI12502, will cover the remaining value, ensuring the total issuance does not exceed VND 500 billion.

The bonds will be offered in Q4 2025, with a one-year maturity for each tranche. The issuer may repurchase all or part of the bonds six months after each issuance date.

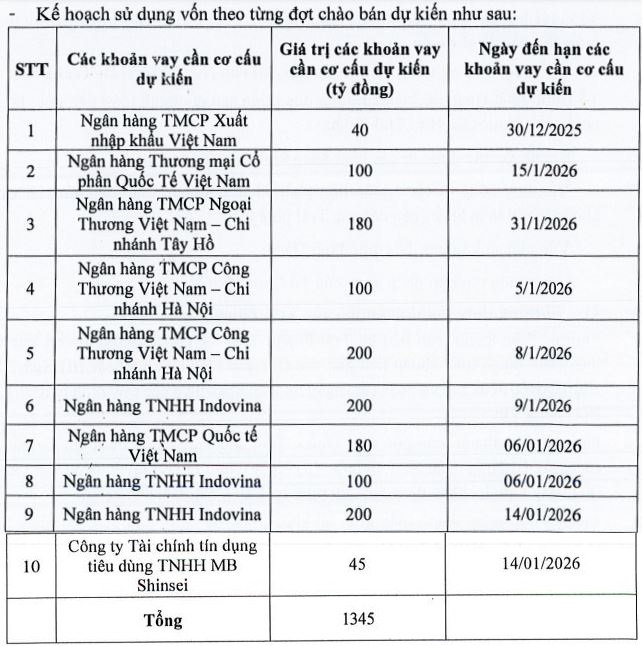

Proceeds from the bond issuance will be used to restructure the issuer’s debt, specifically bank loans with a maximum term of 12 months, as detailed below:

Source: BSC

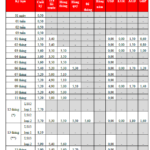

As of September 30, 2025, BIDV Securities had no outstanding bond debt. Short-term financial liabilities totaled over VND 9.9 trillion, doubling since the beginning of the year. Of this, VND 8.7 trillion was bank loans, and nearly VND 1.2 trillion was from individuals and other organizations.

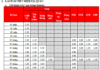

In Q3 2025, BIDV Securities reported operating revenue of nearly VND 688 billion, doubling year-on-year. Pre-tax profit reached VND 269 billion, 2.8 times higher than Q3 2024.

For the first nine months of 2025, BSC recorded operating revenue of VND 1,531 billion, up nearly 40% year-on-year. Pre-tax profit stood at VND 496 billion, a 23% increase compared to the same period in 2024.

Corporate Bond Issuance Surges as Businesses Seek Capital

Leading Vietnamese corporations including THISO International Trading and Services JSC, Trung Nam Renewable Energy JSC, Nam A Bank, and Saigon Real Estate JSC have successfully raised hundreds of billions to trillions of Vietnamese dong through recent bond issuances.

VPBank Suspends Issuance of VND 4 Trillion in Bonds for 2025

VPBankS has not yet implemented its plan to issue VND 4,000 billion in bonds in 2025, as there is currently no need for capital mobilization.