With just 2 days left, the new tax regulations for household businesses are set to take effect. However, from small vegetable vendors in local markets to large stall owners in major markets across Ho Chi Minh City, many are feeling the heat due to concerns about technology, proof of origin, and cost calculations.

Do You Issue an Invoice for a $0.10 Bunch of Vegetables?

Mr. Nguyen Thai Phuong, a vegetable vendor in Tan Dinh Ward, Ho Chi Minh City, shared that his small-scale business currently pays only a few hundred thousand dong in taxes monthly, with simple procedures. Now, with the shift away from lump-sum tax, he feels anxious. “My wife and I sell vegetables, with some items priced as low as $0.10 or $0.20. We’re unsure if we need to declare or issue invoices for these. If so, how do we do it correctly?” Mr. Phuong worries.

He also mentioned that both he and his wife are elderly and struggle with technology. Therefore, he urges the government to find the simplest way for small traders like him to comply with tax regulations while maintaining stable business operations.

After accepting payment for a $1.20 plate of Hanoi-style steamed rice rolls, Ms. Le Thi Mung, owner of a steamed rice roll stall on Tran Khac Chan Street (Tan Dinh Ward), remarked, “I’ll likely have to raise prices soon due to increased costs, including taxes.”

Ms. Mung noted that she has kept prices unchanged for the past 10 years but will have to increase them in 2026. The exact amount is unclear, but she plans to split the additional costs equally between herself and her customers.

A clothing stall at Tan Dinh Market, Ho Chi Minh City. Photo: AN NA

Ms. Mung runs her stall alone, with occasional help from her husband, and operates only in the mornings, earning about $40 daily. She is not tech-savvy, does not use social media, and relies solely on print newspapers. “Recently, to pay taxes via the eTax Mobile app, I had to buy a new smartphone because my old phone couldn’t support the app,” she said, highlighting her preparation for the upcoming tax regulations.

She added that while authorities have invited her to meetings to explain the transition from lump-sum tax to tax declaration, she remains unsure how to declare, especially for small purchases of raw materials costing only a few thousand dong. “I don’t know if handwritten invoices will still be accepted,” she said. However, Ms. Mung remains optimistic, believing that “any new system will be challenging at first but will become easier over time,” as the policy applies to all businesses, not just hers.

Sharing similar concerns, Ms. Yen, a vegetable vendor at Do Dac Market, also worries about price adjustments and invoicing. She hopes the new regulations will allow for a grace period and flexibility to accommodate the realities of traditional markets. “Customers buying a few cents’ worth of scallions or vegetables for soup shouldn’t require electronic invoices. Juggling sales and invoicing would be overwhelming. Hiring someone just for invoicing isn’t feasible, given the slim profit margins on vegetables,” Ms. Yen explained.

Inventory Concerns

While food and vegetable vendors worry about outgoing invoices, wholesalers at major markets like Binh Tay and An Dong are grappling with “proof of incoming goods” and “inventory” issues. Mr. Binh, a trader at An Dong Market, noted that most goods are sourced through traditional methods without proper documentation. Although training on generating electronic invoices from cash registers has been provided, traders remain uncertain about correct implementation.

The situation is even more dire for Mr. Tran Van Thang, a handbag vendor at Binh Tay Market. He is burdened with a massive unsold inventory lacking proof of origin and a $120,000 debt incurred seven years ago to acquire his stall. “Business is slow, expenses exceed income, and I haven’t repaid any interest. With the new regulations requiring proof of origin, I’m unsure how to handle this inventory. Authorities need to provide leeway, allowing us to sell off stock, recover capital, and repay debts,” Mr. Thang pleaded.

At Binh Tay Market, Mr. Truong Phat, a packaging stall owner, has invested in cash registers for electronic invoicing but remains anxious. “With January 1, 2026, approaching, I’m unsure how to input data correctly. Will mistakes result in penalties? What about inventory from a decade ago still in storage? No one has guided us on declaring it,” Mr. Phat said.

Market managers are equally perplexed. Ms. Dam Van, Deputy Head of the Dien Hong Ward Market Management Board, admitted they are in a “wait-and-see” position. “When traders ask about taxable revenue thresholds—$8,000 or $20,000—we can’t provide definitive answers as we await detailed guidelines. While training has been provided, it remains vague. Installing apps, opening accounts, handling inventory—everything hinges on specific instructions from tax authorities,” Ms. Van explained.

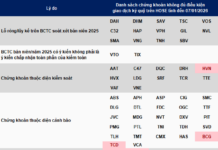

Addressing public concerns, Mr. Nguyen Tien Dung, Deputy Director of Ho Chi Minh City’s Tax Department, stated that the Ministry of Finance plans to issue a new decree on declarations, taxation, and electronic invoices for household businesses. The core principle is that all businesses must declare revenue. Tax authorities will calculate taxes based on actual revenue rather than fixed lump-sum amounts.

Regarding tax thresholds, Mr. Dung clarified that businesses with annual revenue up to $20,000 will be exempt from VAT and personal income tax (PIT). “For instance, if revenue reaches $20,040, VAT applies to the entire amount. However, for PIT, the first $20,000 is exempt, and tax is levied only on the excess ($40),” Mr. Dung detailed.

On the critical issue of undocumented inventory, the Tax Department advises businesses to audit, count, and document their stock. “Traders should record item names, codes, affirm the legality of goods, and explain the absence of invoices. They must then complete an inventory schedule as per Circular 78/2021/TT-BTC. This will legally enable them to issue sales invoices and declare taxes validly in 2026,” Mr. Dung emphasized.

Call for Government Support

Ms. Thanh Mai, owner of a grocery store in An Hoi Tay Ward, shared that her daily profit ranges from $8 to $12, despite operating from 6 a.m. to 10 p.m. “If we must invest in electronic equipment for declarations, the cost could reach millions of dong, not to mention the time spent entering data for dozens of low-value items. We hope the government will subsidize equipment costs for small businesses like ours,” Ms. Mai appealed.

Declared and Paid Full Taxes but Still Fined Up to 8 Million VND in This Scenario

Unveiling the Penalties for Tax Declaration Errors: What Every Citizen Must Know

Navigating the complexities of tax declarations can be daunting, and errors may lead to significant penalties. It’s crucial for individuals to understand the consequences of inaccurate or fraudulent tax filings. From fines to legal repercussions, the implications of mistakes in tax declarations are far-reaching. Stay informed and ensure compliance to avoid these costly pitfalls.

Understanding the Regulation: “Pursuing Members’ Assets When a Business Household Lacks Funds to Pay Administrative Fines”

Individual business households are now included as entities subject to the new regulations on the enforcement of administrative penalty measures.

Navigating VAT Calculations for Sole Proprietors

For businesses with annual revenue below 500 million VND, VAT exemption applies. However, exceeding this threshold by even a marginal amount, such as 501 million VND, triggers VAT liability. The discrepancy in calculation compared to personal income tax raises concerns about fairness, reasonableness, and the potential for revenue manipulation in practice.