Vietnam’s seafood exports concluded the final month of the year with a turnover of approximately 840 million USD. With this result, the total export value for 2025 reached around 11.34 billion USD, a 13% increase compared to the previous year. “This marks the first time in the history of Vietnam’s seafood industry that the 11 billion USD threshold has been surpassed,” stated the Vietnam Association of Seafood Exporters and Producers (VASEP).

Among the key products, shrimp remained the cornerstone, generating approximately 4.65 billion USD in 2025, a nearly 20% increase from the previous year. Pangasius followed with an export value of around 2.19 billion USD, up by over 8%. Other marine fish reached about 2.16 billion USD, a 12% increase, while squid and octopus recorded nearly 764 million USD, up by approximately 16%.

At first glance, the seafood industry’s outlook appears promising. However, a deeper analysis reveals that this year’s growth is largely driven by short-term factors—primarily the rush to deliver goods to the U.S. before new tariffs took effect. In the words of many industry insiders, 2025 was the year of “tax evasion.”

| Vietnam’s Seafood Exports Set a New Record in 2025 |

China & Hong Kong and CPTPP were the primary growth drivers, while the EU showed significant recovery. Meanwhile, the U.S. remained a crucial market, but the underlying trends were not entirely favorable.

Many companies acknowledged that the surge in orders from the third quarter was not due to a sudden increase in consumer demand but rather to U.S. customers rushing to import goods before new tariffs were implemented. A large volume of goods was shipped between August and September, leading to slower exports in the final months of the year.

“The slowdown in exports during the final months is a consequence of companies delivering goods early, following the U.S. announcement of preliminary anti-dumping duties at high levels,” noted VASEP.

As we move into 2026, the impact of this “sprint” phase is likely to become more apparent, particularly in terms of tariffs.

For key products like shrimp, the preliminary results of the 19th administrative review (POR19) came as a significant shock. Anti-dumping duties reached as high as 35.29%. When combined with the 20% countervailing duty and anti-subsidy tax, the total burden could approach 60%.

“If the worst-case scenario occurs and these duties remain unchanged, it will be a highly negative outcome for the shrimp industry,” stated VASEP Secretary General Nguyễn Hoài Nam at the 2025 Vietnam-U.S. Trade Forum.

According to Mr. Nam, over the past decade, anti-dumping duties on Vietnamese shrimp have been relatively low. The sudden increase in tariffs is a major shock for companies accustomed to operating in a favorable tariff environment.

However, the current results are preliminary. Law firms are contesting them, regulatory bodies are involved, and the final decision is expected in early 2026. “With transparent data and a production chain linked to farmers, we have reason to believe the final outcome will be more reasonable,” the Association Secretary General added.

The U.S. is increasingly using trade defense measures. Data from the Ministry of Industry and Trade shows that in 2025 alone, the country initiated nine cases, mostly from April, with application periods potentially extending up to 20 years.

“Trade defense measures are prioritized because they are legal, less controversial, and allow for very high taxes, especially when multiple tariffs are combined,” said Trương Thị Thùy Linh, Deputy Director of the Trade Defense Department (Ministry of Industry and Trade). According to Ms. Linh, Vietnam is considered a non-market economy, so the U.S. uses third-country data, which also drives up tariffs.

In 2026, Vietnam’s shrimp industry faces significant risks from anti-dumping duties and trade defense measures in the U.S. market (Illustrative image)

|

Tariffs Are Not the Only Barrier

Beyond tariffs, the U.S. Marine Mammal Protection Act (MMPA) poses a significant barrier to marine fisheries exports.

According to conclusions published in late August, the Trump administration did not recognize the equivalence of 12 Vietnamese fishing methods. From January 1, 2026, products derived from these methods will be banned from import.

“If the EU’s IUU yellow card is a warning, the MMPA is a red card because it comes with a specific import ban,” said Mr. Nguyễn Hoài Nam.

Hundreds of Vietnamese companies exporting marine fisheries products to this market are linked to the livelihoods of hundreds of thousands of coastal fishermen. Following the U.S. decision, ministries, associations, and businesses have implemented various measures. A temporary bright spot emerged for blue crab exports, as the court allowed continued exports for a certain period to complete documentation.

Not only the U.S., but other markets are also increasing compliance requirements. In the EU, animal welfare criteria are gradually becoming a new technical barrier for the shrimp industry, requiring companies to provide information on farming conditions, stocking density, and harvesting processes. These requirements have not yet resulted in specific tariffs but increase compliance costs and demand adjustments from the farming stage.

Simultaneously, the issue of illegal, unreported, and unregulated (IUU) fishing remains unresolved. Despite efforts in fleet management, voyage monitoring, and traceability, the EU’s yellow card warning has not been fully lifted.

U.S. MMPA regulations could directly impact hundreds of thousands of fishermen from 2026 (Illustrative image)

|

The Persistent Challenge of Raw Material Supply

The most glaring bottleneck is the raw material supply. Unstable farming areas, unpredictable weather, and prolonged diseases lead to uneven production, keeping raw material prices high. Diseases do not erupt en masse but silently reduce productivity and increase risks for farmers.

“Orders are available, but there’s a shortage of shrimp for processing,” said Mr. Lê Văn Quang, CEO of Minh Phú Seafood Corporation (UPCoM: MPC), during an extraordinary shareholders’ meeting on December 20.

This reality is also reflected by the Chairman of Sao Ta Food JSC (HOSE: FMC). Global shrimp reserves are low in the final months of the year, while customers continue to request regular quotes, including in the U.S. Supply capacity, according to the company, depends directly on domestic farming conditions. “The concern is that our shrimp farming situation is not good,” FMC Chairman Hồ Quốc Lực noted in a conversation with the author.

The impact of supply shortages is further exacerbated by climate change, making seasons unpredictable. Alternating heavy rains and prolonged heatwaves increase disease risks, while input costs continue to rise. Higher prices for feed, seedlings, and labor erode profit margins from the beginning of the supply chain.

The raw material shortage forces many factories to import semi-processed shrimp from other countries to maintain production. However, according to FMC’s leadership, this is only a temporary solution.

Another industry pressure comes from credit. Aquaculture requires long-term capital, but tightening lending conditions hinder the expansion of farming areas to international standards. This bottleneck makes it difficult to improve the supply chain in the short term.

These factors position the seafood industry to enter 2026 on an uncertain footing, despite remaining potential. Pressure comes not only from external challenges but also from the ability to sustain growth as the favorable conditions of 2025 fade.

The Foundation for 2026 Is Less Favorable

According to VASEP, 2026 will be a more challenging year than the previous one. The growth momentum from early deliveries before tariffs has weakened, while risks from trade defense measures, rising input costs, and raw material supply persist. The Association believes that the industry’s challenge next year is not to expand turnover at all costs but to maintain growth in an increasingly uncertain market and trade policy environment.

In this context, companies are forced to adopt more cautious plans. Production volumes, markets, and cash flows are being recalculated to limit prolonged risks.

For companies heavily reliant on the U.S. market, the situation is even more complex as anti-dumping duties and trade defense measures remain unresolved. Many companies have proactively reduced exports to this market while awaiting final review results. “In the uncertain tariff environment, Vietnamese shrimp exports to the U.S. have nearly halted, except for some unaffected products,” said Mr. Lực.

Even companies with tariff advantages face challenges. Minh Phú is exempt from the 35.29% anti-dumping duty, having escaped the lawsuit in 2016. However, advantages in key markets bring pressure in others. “When Vietnamese companies cannot export to the U.S., they are forced to shift to other markets,” noted CEO Lê Văn Quang. This intensifies competition, reducing profit margins even for leading companies.

The combination of tariffs, technical barriers, and raw material challenges makes 2026 appear more daunting than opportunistic. “To be safe, next year’s growth rate will only be close to double digits,” concluded FMC’s Chairman.

– 12:00 06/01/2026

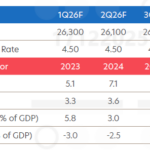

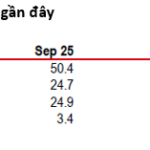

HSBC: Vietnam Withstands Tariff Impact, Yet Caution Remains

Despite a 20% tariff, Vietnam’s exports to the US surged, boosting America’s share in Vietnam’s export structure to 32%. However, HSBC warns of significant risks as Vietnam awaits the final ruling on a potential 40% transshipment tax and semiconductor industry tariffs.