I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

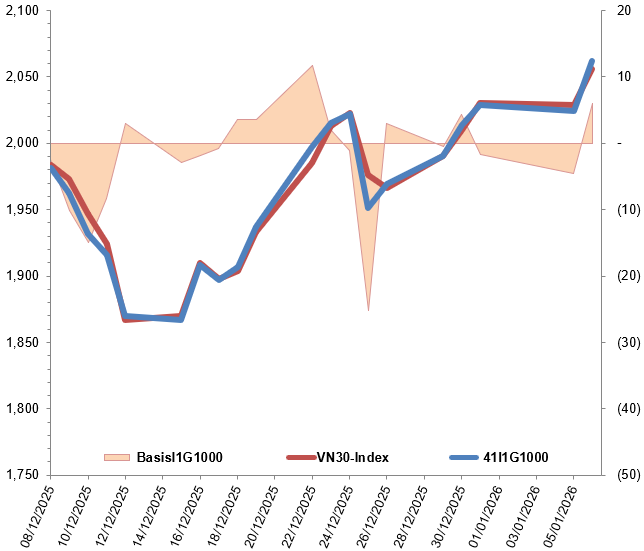

On January 6, 2026, all VN30 futures contracts saw significant gains. Specifically, 41I1G1000 (I1G1000) rose by 1.87% to 2,062 points; 41I1G2000 (I1G2000) increased by 1.88% to 2,058 points; 41I1G3000 (I1G3000) climbed 1.84% to 2,054.5 points; and 41I1G6000 (I1G6000) surged 1.96% to 2,050 points. The underlying index, VN30-Index, closed at 2,055.96 points.

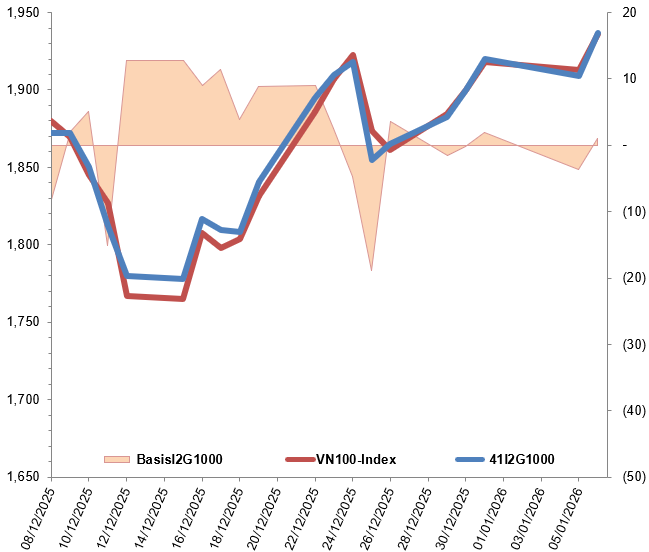

Similarly, VN100 futures contracts also experienced widespread gains. The 41I2G1000 (I2G1000) contract rose by 1.62% to 1,937 points; 41I2G2000 (I2G2000) gained 0.88% to 1,921 points; 41I2G3000 (I2G3000) advanced 1.35% to 1,930 points; and 41I2G6000 (I2G6000) increased by 1.31% to 1,914.8 points. The VN100-Index closed at 1,935.93 points.

During the January 6, 2026 session, the 41I1G1000 contract initially surged after the ATO session but faced increasing selling pressure, causing it to retreat close to the reference level for most of the morning. In the afternoon session, buyers regained control, driving the contract to a strong close at 2,062 points, up 37.9 points.

Intraday Chart of 41I1G1000

Source: https://stockchart.vietstock.vn

By the close, the basis of the I1G1000 contract reversed from the previous session, reaching 6.04 points, indicating renewed investor optimism.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

Meanwhile, the basis of the I2G1000 contract also reversed, reaching 1.07 points, reflecting improved investor sentiment.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN100-Index

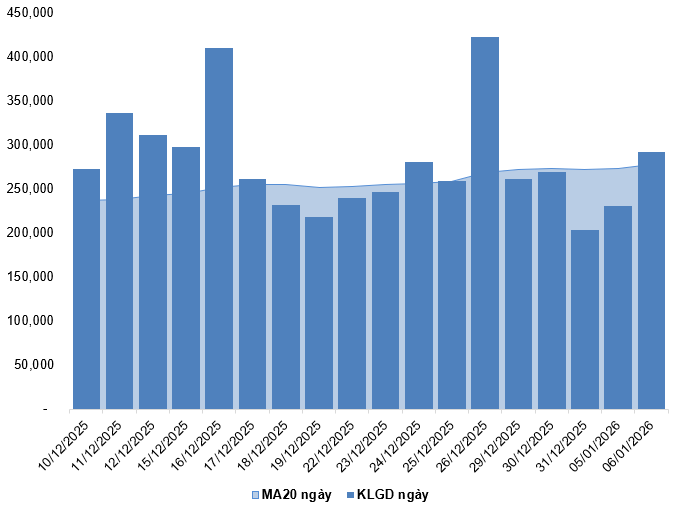

Trading volume and value in the derivatives market increased by 26.81% and 28.04%, respectively, compared to the previous session on January 5, 2026. Specifically, the trading volume of I1G1000 rose by 26.74% to 290,912 contracts, while I2G1000 volume dropped by 37.8% to 79 contracts.

Foreign investors continued to buy net, with a total net purchase of 693 contracts on January 6, 2026.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

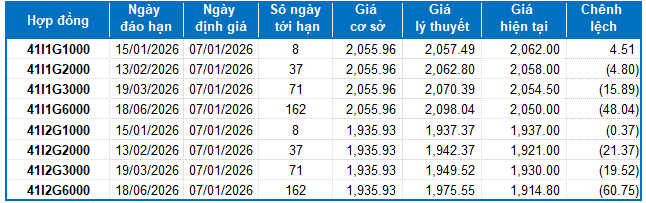

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of January 7, 2026, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

On January 6, 2026, the VN30-Index rose with trading volume exceeding the 20-session average, indicating bullish investor sentiment. The index reached a new 52-week high, while the MACD indicator formed higher highs and higher lows, reinforcing the short-term uptrend.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

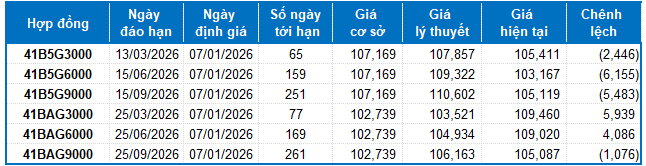

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of January 7, 2026, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, 41B5G9000, and 41BAG9000 are currently attractively priced. Investors should focus on these contracts and consider buying, as they offer excellent value in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 06/01/2026

Vietnam’s Warrant Market on January 7, 2026: VHM Warrants Take Center Stage

As the trading session closed on January 6, 2026, the market witnessed 155 stocks advancing, 77 declining, and 26 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 921.44 million worth of shares.

December 31, 2025: Warrant Market Shows Mixed Performance

As the trading session closed on December 30, 2025, the market witnessed 121 stocks advancing, 112 declining, and 26 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of 1.01 billion VND.