I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

On January 7, 2026, all VN30 futures contracts saw gains. Specifically, 41I1G1000 (I1G1000) rose by 1.27% to 2,088.2 points; 41I1G2000 (I1G2000) increased by 1.5% to 2,088.9 points; 41I1G3000 (I1G3000) climbed 1.83% to 2,088.9 points; and 41I1G6000 (I1G6000) advanced 1.57% to 2,082.2 points. The underlying index, VN30-Index, closed at 2,096.76 points.

Meanwhile, VN100 futures contracts experienced mixed movements. The 41I2G1000 (I2G1000) contract gained 0.92% to 1,954.9 points; 41I2G2000 (I2G2000) surged 2.62% to 1,962 points; 41I2G3000 (I2G3000) remained unchanged at 1,930 points; and 41I2G6000 (I2G6000) rose 1.49% to 1,937 points. The VN100-Index closed at 1,973.69 points.

During the January 7, 2026 session, the 41I1G1000 contract experienced a prolonged tug-of-war in the morning, with a slight advantage for the Long side. In the afternoon, buyers gained momentum, propelling I1G1000 to a strong breakout. The contract closed in the green at 2,088.2 points, up 26.2 points.

Intraday Chart of 41I1G1000

Source: https://stockchart.vietstock.vn

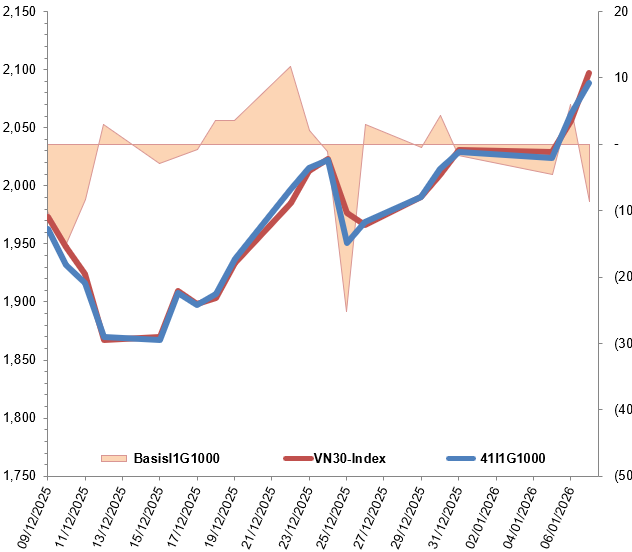

At the close, the basis of the I1G1000 contract reversed from the previous session, reaching -8.56 points. This indicates a return of bearish sentiment among investors.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN30-Index

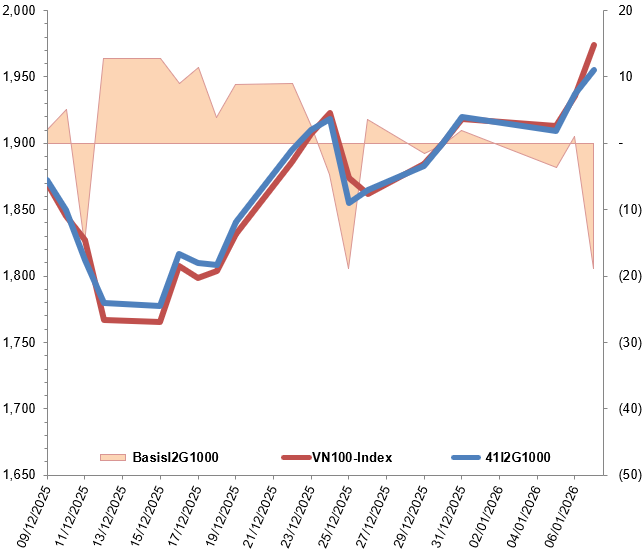

Similarly, the basis of the I2G1000 contract reversed, reaching -18.79 points, reflecting renewed investor pessimism.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as: Basis = Futures Contract Price – VN100-Index

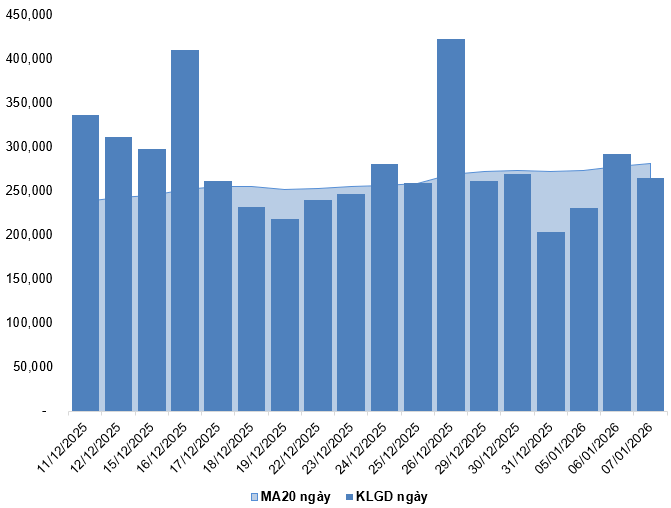

Trading volume and value in the derivatives market decreased by 9.55% and 8.14%, respectively, compared to January 6, 2026. Specifically, I1G1000 trading volume fell by 9.66% to 262,808 contracts. I2G1000 trading volume dropped by 84.81% to just 12 contracts.

Foreign investors returned to net selling, with a total of 26 net sold contracts on January 7, 2026.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

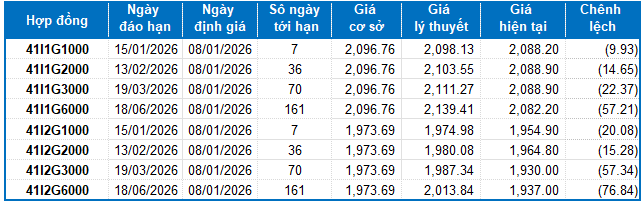

I.2. Futures Contract Valuation

Based on the fair pricing method as of January 8, 2026, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

On January 7, 2026, the VN30-Index continued its upward trend, accompanied by increasing trading volume above the 20-session average. This indicates sustained investor optimism.

Currently, the index remains close to the Upper Band, while the MACD indicator consistently forms higher highs and higher lows. This reinforces the short-term bullish trend.

Technical Analysis Chart of VN30-Index

Source: https://vietstockupdater.vn

II. FUTURE CONTRACTS OF THE BOND MARKET

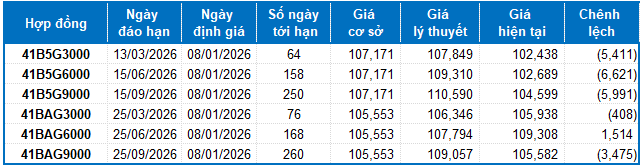

Based on the fair pricing method as of January 8, 2026, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, 41B5G9000, 41BAG3000, and 41BAG9000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer significant value in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 07/01/2026

Derivatives Market Update: Prolonged Tug-of-War on January 6, 2026

On January 5, 2026, both VN30 and VN100 futures contracts experienced a decline during the trading session. The VN30-Index reversed its trend, snapping a three-day winning streak, while forming a near-Doji candlestick pattern. This reversal was accompanied by trading volume surpassing the 20-session average, indicating heightened investor uncertainty.