I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

VN30 futures contracts surged during the trading session on December 31, 2025. Specifically, 41I1G1000 (I1G1000) rose by 0.74% to 2,029 points; 41I1G2000 (I1G2000) increased by 0.85% to 2,028 points; 41I1G3000 (I1G3000) climbed by 1.22% to 2,024.1 points; and 41I1G6000 (I1G6000) advanced by 1.45% to 2,020 points. The underlying index, VN30-Index, closed at 2,030.63 points.

Additionally, VN100 futures contracts also experienced widespread gains on December 31, 2025. Notably, 41I2G1000 (I2G1000) rose by 1.04% to 1,919.9 points; 41I2G2000 (I2G2000) increased by 1.06% to 1,908.1 points; 41I2G3000 (I2G3000) gained 1.81% to 1,913 points; and 41I2G6000 (I2G6000) advanced by 0.8% to 1,894 points. The underlying VN100-Index closed at 1,918 points.

During the trading week from December 29 to 31, 2025, the 41I1G1000 contract extended its upward momentum from the previous week’s final session, as buyers dominated early in the week. Despite selling pressure in the final session, buyers swiftly regained control, closing the contract in positive territory with a 60-point gain compared to the prior week.

Intraday Chart of 41I1G1000 from December 29 to 31, 2025

Source: https://stockchart.vietstock.vn

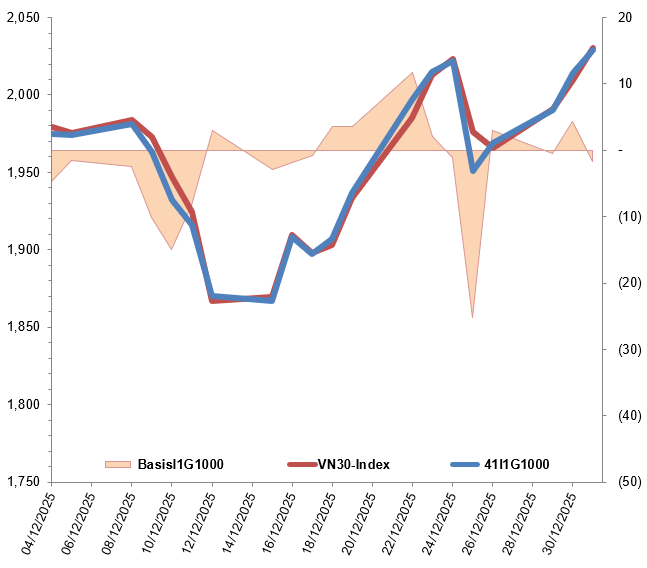

At the close, the basis of the I1G1000 contract reversed from the previous session, reaching -1.63 points, indicating a return of bearish sentiment among investors.

Fluctuations of 41I1G1000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

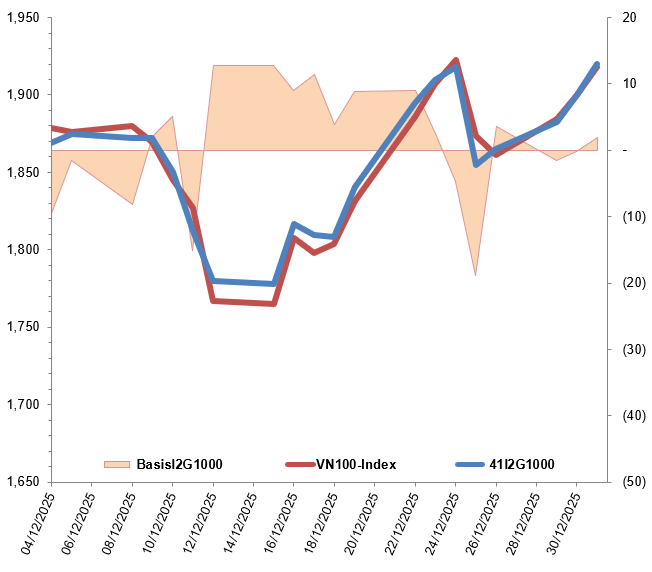

Meanwhile, the basis of the I2G1000 contract reversed to 1.9 points, reflecting a resurgence of bullish sentiment among investors.

Fluctuations of 41I2G1000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

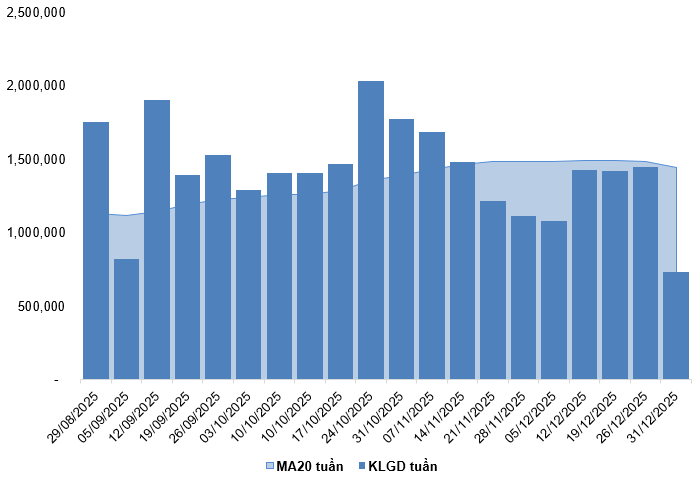

Derivatives market trading volume and value declined by 24.64% and 23.88%, respectively, compared to the session on December 30, 2025. For the week, trading volume and value increased by 16.34% and 19.48%, respectively, compared to the previous week.

Foreign investors resumed net selling, with a total net sell volume of 88 contracts on December 31, 2025. For the week, foreign investors net sold a total of 4,233 contracts.

Weekly Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

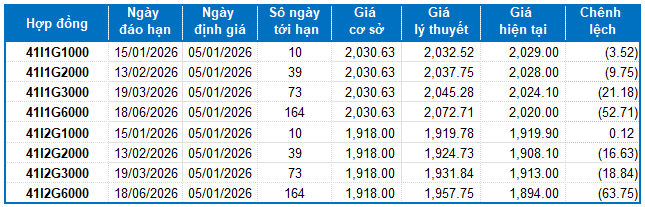

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of January 5, 2026, the fair price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Pricing for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

During the trading session on December 31, 2025, the VN30-Index rose for the third consecutive session, forming a Three White Soldiers candlestick pattern, indicating sustained investor optimism.

Currently, the index is above the Middle Band of the Bollinger Bands, while the MACD indicator continues to rise after generating a buy signal, further supporting short-term upward momentum.

However, trading volume remains unclear and below the 20-session average, with the Stochastic Oscillator still signaling a sell. If these technical factors do not improve, the short-term outlook may become less optimistic.

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURE CONTRACTS OF THE BOND MARKET

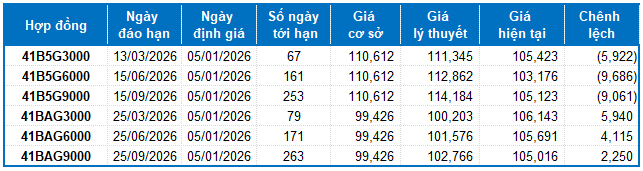

Based on the fair pricing method as of January 5, 2026, the fair price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Pricing

Source: VietstockFinance

Note: Opportunity costs in the pricing model are adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with term adjustments for each futures contract.

According to the above valuation, contracts 41B5G3000, 41B5G6000, and 41B5G9000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer compelling value in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting

– 18:28 December 31, 2025

Technical Analysis for the Afternoon Session of December 30: Pausing at a Strong Resistance Level

The VN-Index is undergoing a correction and experiencing volatility as it retests the October 2025 peak (equivalent to the 1,740-1,795 point range). Similarly, the HNX-Index faces comparable pressure, with both the Stochastic Oscillator and MACD signaling a sell-off.

Derivatives Trading on December 30, 2025: Market-Wide Trading Volume Plummets by Over 38%

On December 29, 2025, both VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index extended its gains, forming a small-bodied candlestick pattern. However, trading volume declined and fell below the 20-session average, indicating investor hesitation and uncertainty in the market.

Vietstock Weekly 29-31/12/2025: Is the Tug-of-War Over Yet?

The VN-Index experienced significant volatility last week, forming a small-bodied candle with a long upper wick, signaling heightened selling pressure as the index approached its October 2025 peak. It is likely that the VN-Index will continue to trade sideways as the market requires additional time to rebalance before a new trend emerges.

Derivatives Market Outlook for December 29-31, 2025: Navigating Heightened Risks Ahead

On December 26, 2025, futures contracts for the VN30 and VN100 indices predominantly declined during the trading session. The VN30-Index extended its losses, accompanied by trading volumes surpassing the 20-session average, indicating persistent bearish sentiment in the market.