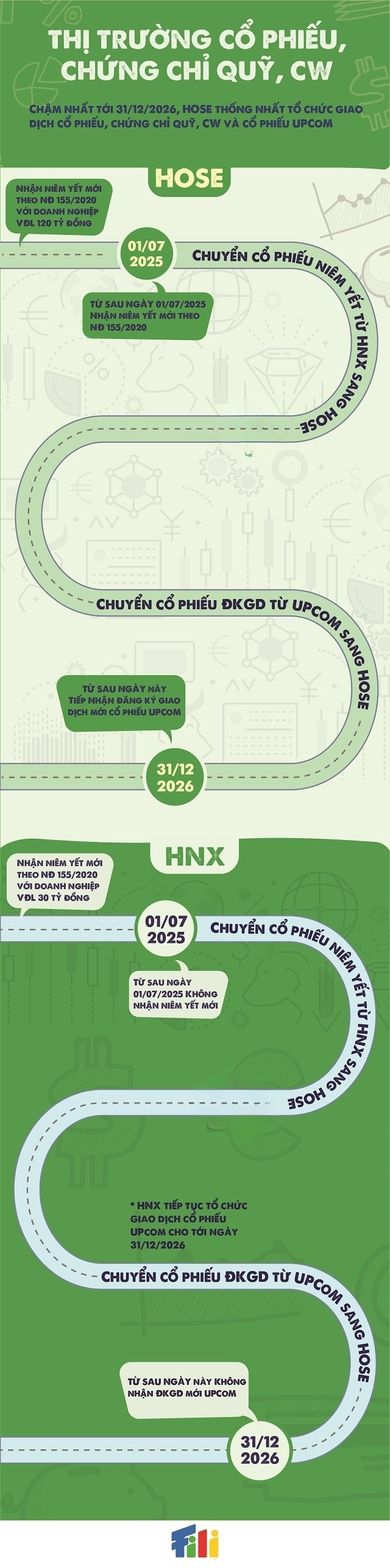

On December 30, 2025, the Minister of Finance issued Circular No. 139/2025, amending and supplementing certain provisions of Circular No. 57/2021. This circular outlines the roadmap for restructuring the stock trading market, bond trading market, derivatives trading market, and other securities trading markets, as previously modified by Circular No. 69/2023.

Circular No. 139/2025 focuses on adjusting the roadmap for reorganizing the stock trading market to ensure synchronization, stability, and alignment with practical implementation conditions within the securities market.

The deadline for transferring stocks of listed organizations from the Hanoi Stock Exchange (HNX) to the Ho Chi Minh City Stock Exchange (HOSE) has been extended to December 31, 2026. Concurrently, HOSE will complete the acceptance of listed stocks according to the specified roadmap. Compared to the provisions of Circular No. 69/2023, this timeline has been postponed by one year.

Previously, Circular No. 57/2021 was issued to implement Decree No. 37/2020 by the Prime Minister, which established and organized the operations of the Vietnam Stock Exchange (VNX). Under this directive, the stock, bond, and derivatives trading markets were restructured to specialize functions between HOSE and HNX.

However, according to the Ministry of Finance, during implementation, certain timelines outlined in Circular No. 57/2021 and Circular No. 69/2023 were found to be incompatible with system capabilities, technical transfer requirements, and market stability objectives.

Regarding market restructuring progress, starting July 1, 2025, HOSE became the sole entity responsible for receiving and reviewing new stock listing applications. Simultaneously, HNX ceased accepting applications, officially focusing on bonds and derivatives.

|

Roadmap for Restructuring the Stock Trading Market According to Circular 139/2025 and Circular 69/2023

|

– 1:24 PM, January 7, 2026

Vietjet Launches Seventh Bond Issuance of 2025

Vietjet has launched its seventh bond issuance since the beginning of 2025, with a total value of 1,000 billion VND.