Aiming to establish a legal framework for digital transformation and enhance the quality of securities professionals to meet the requirements of market upgrading and the securities market development strategy by 2030, the Ministry of Finance has issued Circular No. 135/2025/TT-BTC regulating securities practice. The circular takes effect from February 9, 2026, and replaces Circular No. 197/2015/TT-BTC dated December 3, 2015, by the Ministry of Finance.

Circular No. 135/2025/TT-BTC comprises 5 Chapters and 12 Articles, focusing on three main areas: Professional Securities Certificates and Equivalent Certificates, Electronic Securities Practice Certificates, and Annual Training for Securities Practitioners.

Expanding Professional Securities Certificates and Equivalent Qualifications

Circular No. 135/2025/TT-BTC provides detailed guidance on implementing the provisions of point e, clause 73, Article 1 of Decree 245/2025/NĐ-CP, aiming to broaden the participation of institutions offering professional securities certificates.

In addition to retaining the equivalent certificate regulations from Circular No. 197/2015/TT-BTC, Circular No. 135/2025/TT-BTC expands the recognition of international certificates such as CIIA and CFA Level II or higher as equivalent to Fund and Asset Management Certificates, and Derivatives and Derivatives Market Certificates.

The circular also addresses limitations of Circular No. 197/2015/TT-BTC by specifying the fields of study for which individuals are exempt from professional courses but must pass a competency exam to obtain a professional securities certificate, thereby facilitating practical implementation.

Transitioning from Paper to Electronic Securities Practice Certificates

Circular No. 135/2025/TT-BTC mandates the State Securities Commission (SSC) to issue Electronic Securities Practice Certificates (E-CPC) once the SSC’s information technology system for managing securities practitioners becomes operational (expected in 2026). From this point, the SSC will no longer issue paper certificates.

To ensure a smooth and efficient transition from paper to electronic certificates, Circular No. 135/2025/TT-BTC sets the following deadlines:

Within one year of the SSC issuing transition guidelines, individuals holding paper certificates and organizations employing securities practitioners must convert their paper certificates to electronic ones.

After this period, individuals who fail to convert their certificates will not be recognized as “securities practitioners” in the SSC’s information technology system.

The E-CPC and practice records in the SSC’s system will serve as the basis for managing and supervising certificate holders.

Individuals will only be recognized as active securities practitioners when the system confirms their status as such.

Mandatory Annual Training for Securities Practitioners

Circular No. 135/2025/TT-BTC requires securities practitioners to complete a minimum of 8 hours of annual training.

The SSC’s Research and Training Center for Securities, in collaboration with the Vietnam Stock Exchange, its subsidiaries, and the Vietnam Securities Depository and Clearing Corporation, will organize the training. Based on the SSC’s annual training framework issued by December 31 each year, training providers will develop materials (in print or digital format) and conduct training in-person or online.

Online training options maximize convenience, reduce costs, and allow personalized learning aligned with individual career goals.

Notably, Circular No. 135/2025/TT-BTC requires the SSC to publish a list of practitioners who fail to meet annual training requirements on its electronic portal and information system. This measure strengthens compliance and oversight of annual training mandates.

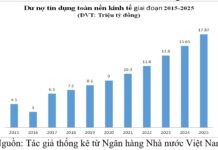

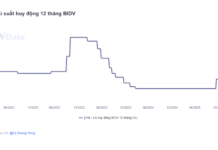

The Light and Shadow Palette of the Banking Industry

In 2025, bolstered by newly adopted policies, the banking sector will continue to serve as a cornerstone of the economy, partnering closely with the government to provide critical support. Simultaneously, the industry will accelerate its restructuring efforts, embrace digital transformation, and enhance risk management capabilities to align with international standards.

Hai Phong Port Targets Pre-Tax Profit of Over VND 1.5 Trillion by 2026

On the morning of December 30th, Hai Phong Port Joint Stock Company (UPCoM: PHP) held an expanded meeting of its Party Executive Committee to review the work of 2025 and outline tasks for 2026. The company is entering a new phase of development, focusing on deep-water ports and comprehensive digital transformation.

SHB and Thanh Nhàn Hospital Sign Comprehensive Partnership Agreement

Through its comprehensive partnership with Thanh Nhàn Hospital, SHB remains steadfast in its commitment to supporting administrative units. As a pioneering bank, SHB delivers cutting-edge financial solutions, drives digital transformation, and enhances operational efficiency. Together, we strive for the sustainable development of the healthcare sector and the well-being of our community.