Positive sentiment dominated the market, driving a robust rally led by several key stocks. By the close of the January 6th session, the VN-Index surged by 28 points to reach 1,816. Trading volume spiked, with transaction values on HOSE exceeding 27 trillion VND.

Foreign investors’ transactions were a notable downside, with net selling of approximately 520 billion VND.

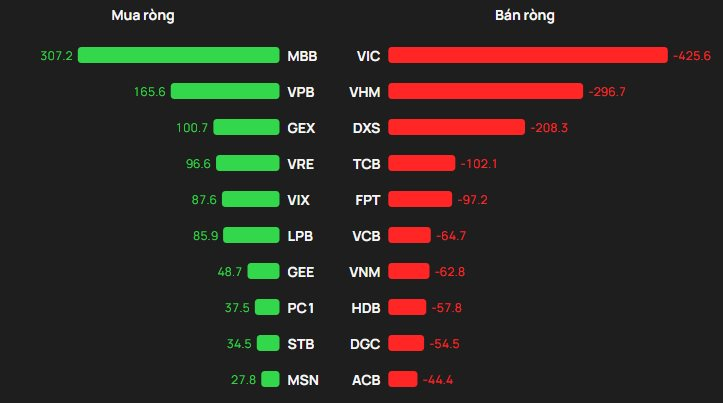

On HOSE, foreign investors net sold 387 billion VND

On the buying side, MBB led foreign purchases on HOSE with over 307 billion VND. VPB followed closely, attracting 166 billion VND. Additionally, GEX and VRE were bought for 101 billion VND and 97 billion VND, respectively.

Conversely, VIC saw the highest foreign selling at 425 billion VND. VHM and DXS were also heavily sold, with 297 billion VND and 208 billion VND, respectively.

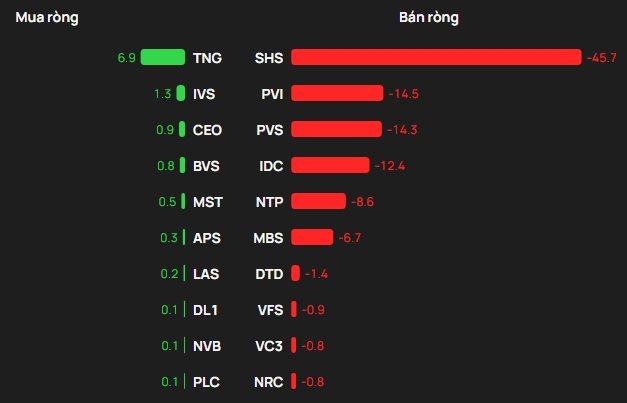

On HNX, foreign investors net sold 95 billion VND

TNG led foreign purchases on HNX with 7 billion VND. IVS followed with 1.3 billion VND. Other stocks like CEO, BVS, and MST also saw modest foreign buying.

On the selling side, SHS faced the most foreign pressure with nearly 46 billion VND sold. PVI followed with 15 billion VND, while PVS, IDC, and NTP saw sales in the billions.

On UPCOM, foreign investors net sold 38 billion VND

TIN led foreign purchases on UPCOM with 0.5 billion VND. DDV and DGT also saw modest buying, each in the hundreds of millions.

Conversely, ACV faced the most foreign selling with 33 billion VND. Other stocks like VEA and TV1 also saw net selling.

HoSE Reduces Margin Requirements for 70 Stocks in Q1/2026: NVL, HVN, VCK, TCX, MCH, NTC, BCG, and Other Top Performers Included

As per regulations, investors are prohibited from using credit limits (financial leverage or margin) provided by securities companies to purchase any of the 70 stocks listed as ineligible for margin trading.

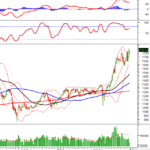

Vietstock Weekly 05-09/01/2026: New Year, Familiar Challenges?

The VN-Index extended its winning streak to a third consecutive week, forming a bullish Big White Candle pattern and reclaiming its October 2025 peak. Currently trading near the Upper Band of the Bollinger Bands, the index faces a critical juncture. While momentum is positive, volume remains a concern, lacking full conviction. To decisively break through this resistance and establish a new uptrend, improved liquidity will be essential in the coming sessions.