Recently, Hodeco (HDC, listed on HoSE) has submitted a report detailing changes to the capital allocation plan for funds raised from its public bond issuance.

On December 25, 2025, Hodeco successfully issued nearly 5 million convertible bonds under the code HDC425001, with a par value of VND 100,000 per bond. The total capital raised amounted to nearly VND 500 billion.

These bonds are convertible into common shares, unsecured, and without warrants. They have a 2-year term, a fixed interest rate of 10% per annum, and interest is paid semi-annually.

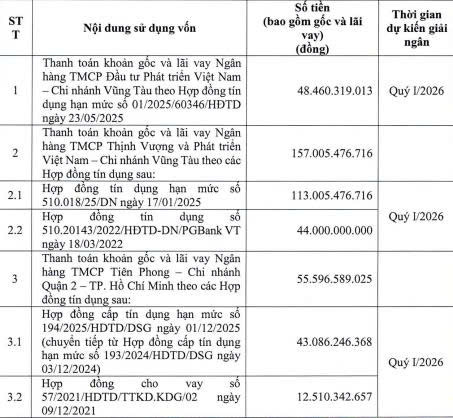

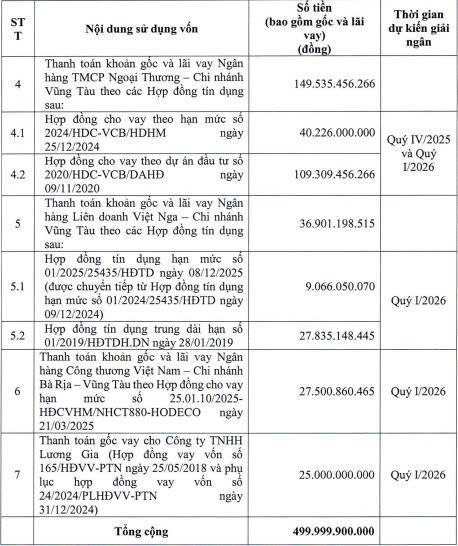

Hodeco has adjusted the allocation of funds raised from the bond issuance as follows:

Source: HDC

According to Hodeco, due to the bond issuance taking longer than anticipated, the company utilized funds from its operations and other sources to settle certain bank debts that matured in Q3 and Q4 of 2025, as per the previously approved plan.

As a result, to align with the current business operations and debt obligations, including principal and interest payments to banks and other institutions, Hodeco has revised its capital allocation plan.

In terms of business performance, in the first nine months of 2025, Hodeco recorded net revenue of over VND 281.2 billion, a 26.3% decrease compared to the same period in 2024. Additionally, the company generated nearly VND 774.9 billion in financial revenue, a 36-fold increase year-on-year.

After deducting taxes and fees, the company reported a net profit of over VND 610.4 billion, 9.4 times higher than the net profit in the first nine months of 2024.

As of September 30, 2025, Hodeco’s total assets increased by 10.8% compared to the beginning of the year, reaching nearly VND 5,404.4 billion. Cash and cash equivalents rose from nearly VND 10.3 billion to over VND 280.3 billion.

Inventory accounted for 26.5% of total assets, totaling over VND 1,433 billion. This includes VND 934.5 billion in work-in-progress costs for The Light City complex project and VND 91.5 billion in real estate inventory.

On the liabilities side, total debt stood at over VND 2,523 billion, a 3.2% decrease from the beginning of the year. Loans and finance leases amounted to nearly VND 1,626 billion, representing 64.4% of total debt.

Dairy Tycoon Announces 25% Dividend Payout: Funds Hit Accounts Just Before Lunar New Year

The company, currently trading on the UPCoM market, has announced a resolution to finalize its shareholder list for the second dividend payment of 2024 in cash. With a controlling ownership stake, the parent company and major shareholders are set to receive tens of billions of dong in cash just before the new year.

Vietcombank’s Shareholders Approve Capital Increase to VND 12,500 Billion

Vietcombank has recently approved a capital increase plan for Vietcombank Securities, raising its chartered capital from VND 2.5 trillion to VND 12.5 trillion—a significant boost of VND 10 trillion.