Term Purchase Channel Takes Center Stage in 2025 Monetary Policy Operations

Open Market Operations (OMO) in 2025 revealed a clear shift in the State Bank of Vietnam (SBV)’s approach, with a pronounced focus on the term purchase channel.

Specifically, during the first two months, the SBV actively utilized the issuance of treasury bills, with a total volume of approximately VND 227.8 trillion issued from the beginning of the year until March 4, 2025, at interest rates ranging between 3.1% and 4% per annum.

However, from March 5th, the issuance of treasury bills was completely halted, only to be briefly reactivated in two small phases: VND 22.5 trillion was issued over three sessions from June 24th to 26th, followed by an additional VND 45.8 trillion issued between July 3rd and 16th, before being officially discontinued for the remainder of the year.

|

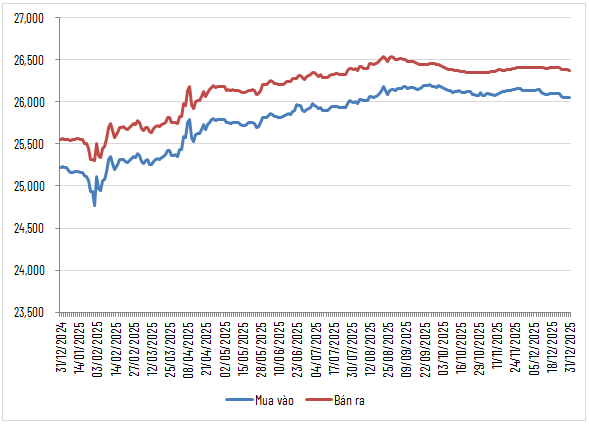

USD/VND Exchange Rate Trends at Vietcombank in 2025

Source: VCB

|

Notably, the periods when the SBV issued treasury bills coincided with phases where the USD/VND exchange rate at Vietcombank consistently rose, indicating that treasury bills were selectively used as a tool to support exchange rate management rather than as a regular “liquidity absorption” tool suitable only for prolonged surplus liquidity conditions.

|

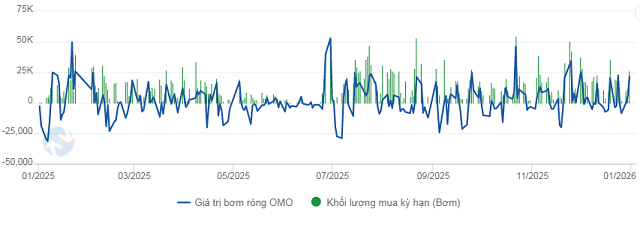

Open Market Operations in 2025. Unit: Billion VND

Source: VietstockFinance

|

In contrast to treasury bills, the term purchase channel was consistently maintained by the SBV throughout 2025 at an interest rate of 4% per annum, becoming the primary pillar in liquidity regulation. This aimed to address maturity mismatches in capital sources, helping to stabilize interest rates to support economic growth.

The total volume pumped through this channel reached approximately VND 3.3 trillion, while the value of maturities returning to the SBV was VND 2.95 trillion, resulting in a net injection of over VND 342.5 trillion for the year.

Notably, there were several instances where the SBV’s weekly net injection was extremely high, reflecting cyclical liquidity pressures linked to credit: the last week of June (23-30/06) saw a net injection of over VND 123 trillion, the last week of October (20-27/10) nearly VND 137 trillion, and particularly the last week of November (21-28/11) reached nearly VND 154 trillion.

|

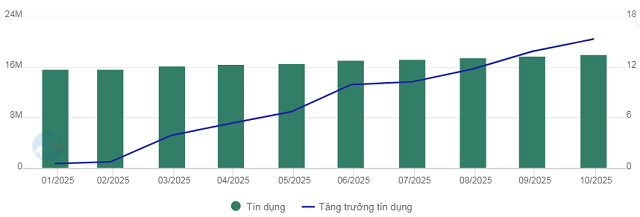

Credit Growth of the Economy in 2025. Unit: Billion VND, %

Source: VietstockFinance

|

These strong injection phases occurred alongside rapid credit growth, with the system’s outstanding balance by the end of June increasing by 9.91% compared to the beginning of the year (equivalent to nearly VND 498 trillion in just one month), and by the end of September reaching 13.86%, with an additional VND 618 trillion in outstanding balance over three months.

For most of the year, the SBV maintained the term purchase interest rate at 4% per annum to anchor short-term interest rates and support liquidity, before adjusting it to 4.5% from December 4th, signaling a more cautious stance amid upward pressure on the USD/VND exchange rate.

The Role of the “Regulating Valve” in the Banking System’s Liquidity

The SBV’s reduction in treasury bill issuance in 2025, coupled with the maintenance of the term purchase channel, indicates a shift in priority from “pure absorption-injection” to flexible liquidity regulation. This aims to control short-term interest rates in a context where the banking system’s maturity mismatches have not been fully resolved.

Banking operations inherently involve natural maturity mismatches, with short-term deposits as the primary funding source and capital utilization needs spanning various maturities. In this context, the central bank’s open market operations allow banks to quickly convert their portfolios of securities—which are safe but less immediately liquid—into cash, without disrupting long-term asset structures. Thus, OMO serves as a “regulating valve” for Asset-Liability Management (ALM), helping banks maintain liquidity safety ratios while pursuing medium- to long-term credit strategies.

In terms of funding costs, interest rates on OMO serve as a benchmark for the system’s short-term interest rates. When interbank liquidity faces pressure, borrowing via OMO helps banks stabilize funding costs, avoiding widespread pressure on deposit and lending rates. This is particularly crucial during peak liquidity periods such as quarter-ends, year-ends, or when credit growth outpaces deposit growth.

Additionally, during periods when the SBV needs to maintain a sufficiently high VND-USD interest rate differential to limit capital outflows from the Dong and reduce exchange rate pressure, the short-term interest rate floor may lack room for deep reductions. In such cases, rising interbank borrowing costs make short-term funding less flexible, while banks’ profit-generating assets remain primarily medium- to long-term, with fixed or slowly adjusting interest rates, making capital management more challenging.

Beyond supporting liquidity, OMO serves as a tool for the SBV to regulate the market through selective capital injection, keeping short-term interest rates at desired levels and avoiding sudden fluctuations in the interbank market. Therefore, increased OMO borrowing by banks reflects adaptation to exchange rate and interest rate management requirements.

Interbank Rates Surge Above 7% by Year-End

|

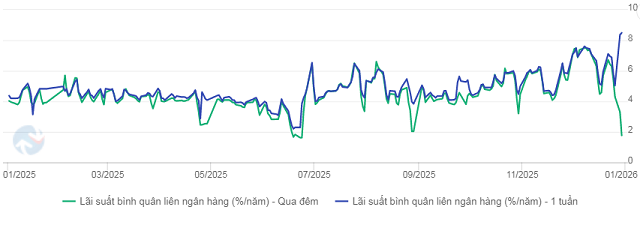

Overnight and 1-Week Interbank Rate Trends in 2025. Unit: %/year

|

|

2-Week and 1-Month Interbank Rate Trends in 2025. Unit: %/year

Source: VietstockFinance

|

In 2025, interbank rates fluctuated significantly and showed a clear upward trend in the last two months across most maturities. For short-term maturities like overnight and 1-week, rates remained around 4-5% per annum in Q1, then dropped sharply to 1-2% per annum by late April before reversing and surging to 6.5% per annum on June 30th and exceeding 7.5% per annum on December 8th.

|

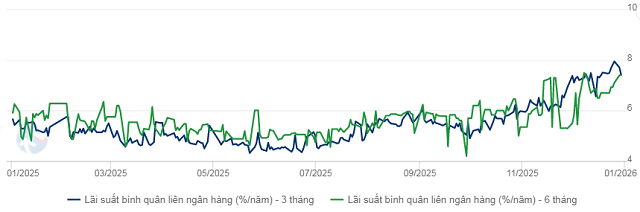

3-Month and 6-Month Interbank Rate Trends in 2025. Unit: %/year

Source: VietstockFinance

|

Notably, the 3-month maturity more clearly reflected mid-term funding cost pressures, with rates peaking at 7.82% per annum on December 25th.

As interbank rates climbed above 7% across many maturities, reaching their highest levels in about three years, the SBV swiftly introduced an additional short-term funding channel for the system through USD/VND swap operations with credit institutions. The maximum scale was set at USD 500 million, with a 14-day maturity, and buying/selling rates of VND 23,945 and VND 23,955 per USD, respectively.

This operation allowed commercial banks to temporarily exchange USD for VND with the SBV at the transaction time, then repurchase USD after two weeks at a predetermined rate. Essentially, this is a form of VND lending secured by foreign currency, with a conversion cost of around 1.1% per annum—significantly lower than the stressed interbank rates.

The impact of the currency swap operation was quick, easing interbank market pressure, cooling rates, and markedly improving liquidity.

However, increasing VND supply through swaps also carries certain risks for the exchange rate. As VND becomes more abundant, the VND-USD interest rate differential may narrow, while the USD is temporarily “locked” in swap transactions. This could exert pressure on the USD/VND exchange rate if not properly managed.

In this context, the SBV’s decision to raise the OMO rate from 4.0% to 4.5% starting December 4th helped establish a minimum funding cost floor in the interbank market, preventing rates from falling too quickly after liquidity improved. This also contributed to maintaining the necessary VND-USD interest rate differential to stabilize the exchange rate. However, this advantage only helps stabilize VND and USD holdings within the system, without creating additional USD supply for the economy.

– 19:00 05/01/2026

What Factors Will Drive USD/VND Exchange Rate Pressure in 2026?

Despite the significant decline in the DXY index in 2025, the USD/VND exchange rate remains under pressure, indicating that domestic factors are playing a dominant role. As we move into 2026, the question arises: will this trend persist, or will new dynamics emerge to ease the exchange rate tensions?

Key Highlights in the Regulation of Bank System Liquidity for 2025

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s forward-buying channel to stabilize exchange rates while balancing system liquidity. By 2025, however, the operational strategy underwent a notable shift.

December 30th Currency Market Update: Overnight Interest Rates Plummet to 3%, Halving Since Last Week

At the close of trading on December 29, the Vietnamese Dong (VND) interbank interest rates saw a sharp decline in the overnight term, while longer-term rates remained elevated. The State Bank of Vietnam continued its net liquidity injection through the Open Market Operations (OMO) channel. Both the central exchange rate and the USD rates across markets experienced a slight downward adjustment.