Kita Invest Fined by Securities Inspectorate for Bond Issuance Violations

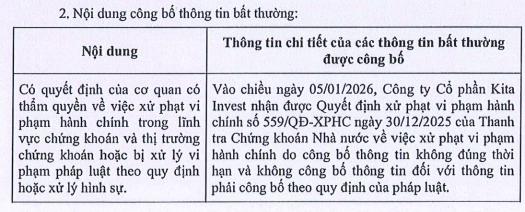

On the afternoon of January 5, 2026, Kita Invest Joint Stock Company received Decision No. 559/QĐ-XPHC dated December 30, 2025, from the State Securities Inspectorate. The decision imposes administrative penalties for failing to disclose information within the prescribed timeframe and omitting mandatory disclosures as required by law.

Source: Kita Invest

|

According to the penalty decision, Kita Invest, chaired by Mr. Đỗ Xuân Cảnh, committed the following violations: failure to publish the Semi-Annual 2021 Bond Proceeds Utilization Report and the 2020 Bond Proceeds Utilization Report. The company also delayed disclosures for the 2021 and 2022 Semi-Annual Financial Statements, 2021 and 2022 Semi-Annual Bond Interest and Principal Payment Status, 2022 Semi-Annual Bond Proceeds Utilization Report, 2020 and 2021 Annual Financial Statements, 2020 Bond Interest and Principal Payment Status, 2021 Bond Proceeds Utilization Report, 2021 Bond Interest and Principal Payment Status, and mandatory disclosures regarding delayed principal and interest payments for the KITA.BOND2020.03 bond, as well as the completion of principal and interest payments for the same bond.

The repeated nature of these violations resulted in a fine of 92.5 million VND.

Data from the Hanoi Stock Exchange (HNX) reveals that in 2020, Kita Invest issued eight bond series, KITA.BOND2020.01 through KITA.BOND2020.08, with a total face value of 2.5 trillion VND and an interest rate of 11.5% per annum. These bonds mature in 2023 and the first half of 2025.

The latest financial report for the first half of 2025 shows a post-tax profit of nearly 37 billion VND. Total liabilities amount to 12,394 billion VND, all classified as other payables.

During the same period, Bình Tân Trade and Investment Joint Stock Company, an affiliate of Kita Invest, repurchased 1.3 trillion VND worth of bonds ahead of schedule. These bonds were originally set to mature on November 1, 2026. The bonds issued by Bình Tân are secured by the Bình Thủy Residential Area project in Cần Thơ, owned by Kita Invest, along with future capital contributions valued at 1.53 trillion VND, representing 46.36% of the charter capital of Tân Thành Investment and Development LLC, owned by Bình Tân. Additionally, the bonds are secured by Kita Invest shares, equivalent to 98% of the charter capital, owned by Tân Thành.

Significant Capital Increase Ahead of the New Year

Founded in 2019 with an initial charter capital of 100 billion VND, Kita Invest’s founding shareholders include Kita Group (30%), Ms. Đặng Thị Thùy Trang (30%), and Mr. Nguyễn Duy Kiên (40%). As of December 25, 2025, the company increased its charter capital from 1.15 trillion VND to 6.65 trillion VND.

Kita Group, established in 2018 with a capital of 300 billion VND, is owned by Mr. Kiên (60%), Ms. Trang (39%), and Mr. Đặng Kim Khánh (1%). Currently, Mr. Tạ Quang Lâm serves as Chairman and legal representative, while Ms. Trang holds the position of CEO. Previously, from 2020 to 2021, Mr. Nguyễn Duy Kiên was the Chairman of Kita Group.

Ms. Đặng Thị Thùy Trang – CEO of Kita Group.

|

In 2025, Kita Group marked its return with the announcement of numerous real estate projects across the country and expansion into new business areas.

In mid-2025, the Ho Chi Minh City People’s Committee approved Kita Group as the investor for the Stella 69 commercial and residential complex. The project spans 5,248 square meters within the Stella 69 – Stella 79 – Stella 89 planning cluster in An Lạc Ward, Ho Chi Minh City.

Source: Kita Group.

|

The company is also developing the Sakura Golf Club Hải Phòng project, featuring shophouses, villas, a golf course, and a hotel, as well as the Sky Nexus apartment project in the Nam Thăng Long urban area, covering nearly 6 hectares in Hanoi.

Kita Group has partnered with China’s Chery Group to introduce the Paidi electric mini truck and van to Vietnam. The assembly plant is located at the Giải Phóng Automobile Factory (a member of Kita Group) in the Thanh Thủy border economic zone, Thanh Thủy Commune, Tuyên Quang Province, with a capacity of 20,000 vehicles per year.

In 2023, Phong Phú Industrial Park Joint Stock Company, owner of the 134-hectare Phong Phú Industrial Park south of Ho Chi Minh City, underwent leadership changes. Mr. Trần Tấn Hồng Cương replaced Mr. Nguyễn Ngọc Quang as Director and legal representative. Mr. Cương is also Vice President of Kita Group, Chairman of HP Sakura Golf Club LLC, Chairman of Northwest Mineral Joint Stock Company, and Director of Ngọc Hà Construction and Trading Service LLC.

Mr. Nguyễn Duy Kiên.

|

The Ecosystem of Mr. Đỗ Xuân Cảnh

A Tycoon’s Bid to Acquire Phúc Sơn Group, Replacing Hậu ‘Pháo’ with a 7 Trillion VND Compensation

– 16:17 07/01/2026

Tôn Đông Á Fined and Taxed Over 7 Billion VND

Tôn Đông Á has been fined and ordered to pay over 7 billion VND in back taxes due to incorrect declarations resulting in tax underpayment.

Over 700 kg of Contaminated Chicken Feet Seized Before Lunar New Year Sales

Uncovered by authorities in Bac Ninh, over 700 kg of frozen chicken feet, purchased from unverified sources and of unknown origin, were found stored in a cold warehouse, ready to be distributed to the market. This poses a direct threat to consumer health, highlighting the risks associated with unregulated food supply chains.