Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 810 million shares, equivalent to a value of more than 24.2 trillion VND; the HNX-Index reached over 78.4 million shares, equivalent to a value of more than 1.6 trillion VND.

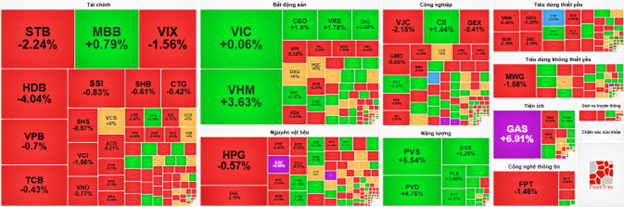

The VN-Index opened the afternoon session with a buyer’s advantage, keeping the index at a high level. However, selling pressure gradually emerged towards the end of the session, causing the upward momentum to stall and closing in the green. The most influential stocks were VHM, VIC, GAS, and VPL, which positively impacted the VN-Index with a gain of over 19.3 points. Conversely, VPB, GEE, LPB, and HPG faced selling pressure, reducing the index by more than 4 points.

| Top stocks influencing the VN-Index on January 5th |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively influenced by stocks such as SHS (-5.83%), MBS (-3.46%), NVB (-1.47%), and NTP (-3.03%).

| Top stocks influencing the HNX-Index on January 5th |

At the close, the market rose by 0.25% with a mix of green and red across sectors. The real estate sector led the gains with a 2.61% increase, primarily driven by VIC (+2.06%), VHM (+6.94%), VRE (+5.79%), and KDH (+1.27%). The utilities and non-essential consumer sectors followed with gains of 2.35% and 2.12%, respectively. Notable performers included GAS (+6.91%), DGW (+6.92%), VPL (+6.16%), FRT (+2.41%), and PNJ (+1.55%).

Conversely, the financial sector saw a significant decline of 1.38%, mainly due to VIX (-6.67%), SSI (-3.64%), HDB (-2.53%), and VPB (-2.62%).

Foreign investors resumed net selling, offloading over 734 billion VND on the HOSE, focusing on VIC (181.28 billion), VIX (160.55 billion), FPT (105.9 billion), and SHB (102.64 billion). On the HNX, they net sold over 2.3 billion VND, concentrated in MBS (23.91 billion), CEO (3.28 billion), TNG (2.42 billion), and HLD (1.62 billion).

| Net buying and selling value of foreign investors across all three exchanges |

11:30 AM: Clear divergence, foreign investors increase net selling

The main indices continued to hover around the reference level in the final morning session, with a clear divergence. The VN-Index took a mid-session break at 1,787.61 points, up 0.17%. The HNX-Index also paused just above the reference level at 249 points. Market breadth showed 338 decliners, 291 advancers, and 964 unchanged stocks.

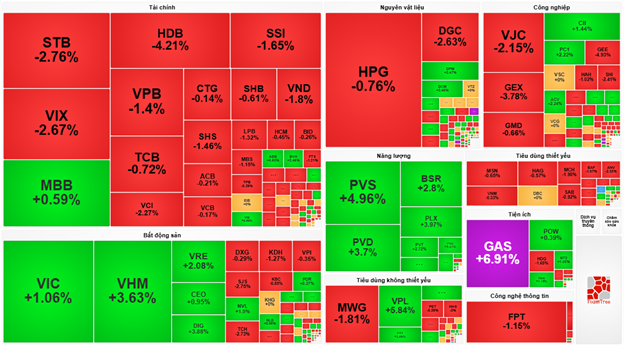

Alongside Vingroup’s major stocks keeping the VN-Index in the green, energy and utilities were the most notable highlights of the morning session. Stocks like PVS, PVD, BSR, PLX, OIL, PVC, PVT, PVB, and GAS attracted strong demand.

Meanwhile, the financial sector, which holds the largest market capitalization, exerted significant pressure on the overall upward trend. Many stocks adjusted sharply with high liquidity, including STB (-2.76%), HDB (-4.21%), VIX (-2.67%), VPB (-1.4%), SSI (-1.65%), VND (-1.8%), and VCI (-2.27%).

Source: VietstockFinance

|

Notably, foreign trading activity was less positive, with net selling reaching over 1,035 billion VND across all three exchanges in the morning session. VIC, VHM, and FPT led the net selling list with values of 172 billion VND, 147 billion VND, and 116 billion VND, respectively. Meanwhile, VRE and STB saw the most net buying, but the values were modest, at around 20-26 billion VND.

| Top 10 stocks with the strongest net buying and selling by foreign investors in the morning session of January 5, 2025 |

10:30 AM: Indices fluctuate, energy & utilities surge

Selling pressure gradually gained the upper hand, preventing the main indices from breaking out. As of 10:30 AM, the VN-Index reversed and fell slightly by 1.87 points, trading around 1,782 points. The HNX-Index rose by 0.57 points, trading around 249 points.

Stocks in the VN30 basket showed a predominance of red, with only a few maintaining green. Specifically, FPT, MWG, HDB, and VJC collectively reduced the index by 3.97 points, 2.72 points, 2.2 points, and 2.15 points, respectively. Conversely, VHM, GAS, VRE, and MBB were bought strongly, contributing over 6.5 points to the VN30-Index.

Source: VietstockFinance

|

The financial sector faced strong selling pressure, with major players like STB down 2.59%, HDB down 4.04%, VIX down 2%, SSI down 1.16%, and VND down 1.03%…

Conversely, the energy sector showed strong growth, supporting the overall market. Notable contributors included BSR up 4.66%, PLX up 3.54%, PVS up 4.37%, and PVD up 4.41%…

Following the energy sector, utility stocks also posted impressive gains. Notable performers included GAS up 6.91%, REE up 1.48%, and POW up 1.18%…

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks unchanged. Sellers gained the upper hand, with 319 decliners (8 stocks hitting the lower limit) versus 245 advancers (10 stocks hitting the upper limit).

Source: VietstockFinance

|

Market Open: Positive start for real estate stocks

At the start of the session on January 5th, as of 9:30 AM, the VN-Index fluctuated around the reference level, near 1,791 points. The HNX-Index saw a slight increase, holding at 249 points.

Real estate was among the top-performing sectors, with leading stocks like VHM up 4.44%, VIC up 1.3%, VRE up 2.67%, and DIG up 2.69%…

The energy sector showed the most stable growth from the opening, driven by oil and gas stocks. The most impressive gains were seen in BSR, PVD, PVS, and OIL.

In addition to these two sectors, many large-cap stocks also performed positively. VPL, MBB, and GAS contributed to supporting the index.

– 15:05 05/01/2026

Market Pulse 08/01: VN-Index Closes in the Red Amid Unexpected Correction

The VN-Index seemed poised for another bullish session as it kicked off the afternoon with promising momentum. However, a sudden downturn erased all gains, pushing the index back below the reference point.

Vietstock Daily 09/01/2026: Cooling Off After a Strong Rally

The VN-Index retraced after a six-session winning streak, accompanied by trading volume surpassing its 20-day average. Short-term outlook remains positive as the index closely tracks the upper Bollinger Band and MACD sustains its upward trajectory, though volatility risks may rise with the Stochastic Oscillator venturing deeper into overbought territory.

Vietstock Daily 07/01/2026: Embarking on a New Journey?

The VN-Index extended its winning streak to a fifth consecutive session, marked by a robust green candle, decisively breaching the previous October 2025 peak to reinforce the prevailing uptrend. Short-term outlook remains highly optimistic, supported by both the Stochastic Oscillator and MACD indicators sustaining their upward trajectories following buy signals.

Vietstock Daily 06/01/2026: Intense Tug-of-War in the Market

The VN-Index continues to fiercely oscillate around its October 2025 peak (equivalent to the 1,740-1,795 point range). With the Stochastic Oscillator signaling a buy opportunity and the MACD sustaining its upward momentum, short-term risks appear manageable. However, investors should remain cautious of potential volatility as the index navigates a robust resistance zone.