Saigon Maritime Transport Joint Stock Company (Code: SGS) has announced the final registration date for the payment of dividends for 2023 and 2024 in cash, with a total rate of 92.5%. This means that each shareholder holding one share will receive 9,250 VND.

Specifically, the 2023 dividend will be paid in cash at a rate of 25% (2,500 VND per share), and the 2024 dividend will be paid in cash at a rate of 67.5% (6,750 VND per share).

The record date for shareholders to receive the dividend payment is January 15, 2026. The company plans to disburse the dividend on February 3, 2026. With over 14.4 million shares outstanding, SGS is expected to pay out more than 133 billion VND in total.

Historically, from 2017 to 2020, SGS maintained a consistent cash dividend policy with rates ranging from 15% to 28%. However, the company ceased dividend payments to shareholders after that period.

At the 2025 Annual General Meeting held in October, SGS shareholders did not approve any of the proposals, including the 92.5% dividend distribution plan.

However, at the Extraordinary General Meeting held on January 5, all 11 proposals were approved. Shareholders agreed not to distribute dividends for 2021 and 2022 but approved a 25% dividend for 2023 and a 67.5% dividend for 2024.

For 2025, the company plans to distribute an 11% dividend.

Additionally, shareholders approved the cancellation of Article 6 of Resolution 01/NQ-ĐHĐCĐ-SSC dated April 28, 2021, related to the capital plan for the project to upgrade and expand the warehouse at 27B National Highway 1A, Linh Xuan Ward, Thu Duc City. The reason is that the project is still awaiting land planning approval and has not yet required the use of retained earnings from 2021 and 2022.

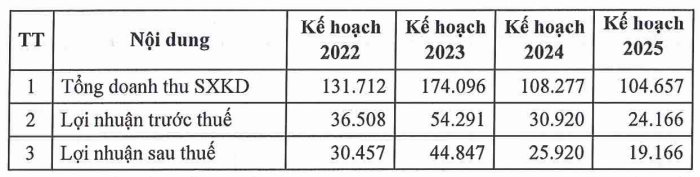

In the first nine months of the year, SGS recorded revenue of over 100 billion VND, a 24% decrease compared to the same period last year. After-tax profit reached 14 billion VND, a 33% decline year-on-year. With these results, the company has achieved approximately 95% of its annual revenue target (nearly 105 billion VND) and 74% of its after-tax profit goal (19 billion VND).

Hodeco Revises Capital Allocation Strategy for Convertible Bond Issuance

Hodeco has recently revised its capital allocation plan for the proceeds from the issuance of nearly 5 million convertible bonds under the code HDC425001, totaling approximately VND 500 billion in raised funds.

Dairy Tycoon Announces 25% Dividend Payout: Funds Hit Accounts Just Before Lunar New Year

The company, currently trading on the UPCoM market, has announced a resolution to finalize its shareholder list for the second dividend payment of 2024 in cash. With a controlling ownership stake, the parent company and major shareholders are set to receive tens of billions of dong in cash just before the new year.

Vietcombank’s Shareholders Approve Capital Increase to VND 12,500 Billion

Vietcombank has recently approved a capital increase plan for Vietcombank Securities, raising its chartered capital from VND 2.5 trillion to VND 12.5 trillion—a significant boost of VND 10 trillion.