On January 5th, at the opening bell ceremony for the 2026 stock market, hosted by the Hanoi Stock Exchange (HNX), Minister of Finance Nguyen Van Thang emphasized the significance of 2026. This year marks not only the beginning of a new economic development cycle but also the dawn of a new era for the nation, striving towards prosperity and strength. Thus, the ceremony symbolizes more than just the market’s opening; it reflects the stock market’s commitment to supporting the nation’s overall growth.

The opening bell ceremony for the 2026 stock market

According to Minister Nguyen Van Thang, the global economy in 2025 remained complex and unpredictable. Financial and monetary markets experienced significant volatility, impacting global growth prospects. Vietnam’s economy faced external challenges, including natural disasters and floods that affected production, business, and livelihoods. However, under the Party’s leadership and the Government’s proactive management, macroeconomic stability was maintained, inflation was controlled, and GDP growth reached over 8%, surpassing the National Assembly’s targets.

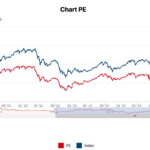

Vietnam’s stock market in 2025 operated stably, transparently, and with high liquidity. The VN-Index consistently reached new highs, increasing nearly 38% by early December compared to the previous year. Average trading value remained high at over 29 trillion VND per session, a 40% increase year-on-year. Market capitalization grew by 35%, and the number of investor accounts exceeded 11.6 million, achieving the 2030 Stock Market Development Strategy goals ahead of schedule.

Additionally, the launch of the new KRX information technology system and FTSE Russell’s upgrade of Vietnam’s stock market from frontier to secondary emerging status fueled positive market momentum in 2025. These developments also laid the groundwork for future growth.

Key Focus Areas for 2026 Stock Market Development

In 2026, Vietnam’s economy is expected to recover further, driven by public investment disbursement and FDI inflows in high-tech, semiconductors, AI, and renewable energy. Institutional reforms, digital transformation, and green development will be accelerated. However, global uncertainties pose risks, requiring the securities sector to innovate proactively. Minister Nguyen Van Thang outlined key focus areas for market development.

First, continue refining the legal framework to ensure stable, sustainable market growth, leveraging the upgrade opportunity. Second, implement approved solutions from the Market Upgrade Plan. To achieve official upgrade status by September 2026, promptly address challenges, meet international rating criteria, enhance market openness, and improve global investor access.

The securities sector will also accelerate digital transformation, modernize trading infrastructure, and enhance market surveillance technology. Diversifying products—bonds, derivatives, fund certificates, green finance tools—will be prioritized.

Minister Nguyen Van Thang speaking – Photo: VGP/HT

Diversifying the investor base is a top priority, attracting foreign investors and fostering investment funds. Inspection and supervision will be strengthened to enforce market discipline. Public awareness campaigns will promote long-term, transparent, and law-abiding investment strategies.

Toward a Safe and Sustainable Stock Market

SSC Chair Vu Thi Chan Phuong acknowledged that FTSE Russell’s upgrade reflects the Government, Ministry of Finance, and regulators’ reform efforts. In 2026, the focus is on building a transparent, stable, and resilient market, not just growth.

The SSC will refine the legal framework, maintain upgrade criteria, modernize IT infrastructure with KRX, and introduce a central counterparty clearing mechanism by 2027.

Regulators will develop new markets—carbon, digital assets, and startups—while enhancing inspections, administrative reforms, and intermediary capacity.

Key priorities include balancing the investor base, encouraging institutional and long-term investors, diversifying products, promoting IPOs and listings for FDI firms, and establishing PPP bond issuance for infrastructure and energy projects.

Undervalued Stocks to Accumulate in 2026: Expert Highlights Oversold Opportunities

At present, for investors adopting a constructive and value-oriented perspective, the expert believes there are numerous compelling narratives to explore.