The core objective of the State Bank of Vietnam’s (SBV) monetary policy has consistently been to maintain macroeconomic stability, control inflation, and support (or stimulate) economic growth. This dual goal presents a challenging task in the implementation and management of the SBV’s monetary policy.

According to Mr. Nguyen Duc Lenh, Deputy Director of SBV Branch in Region 2, the past period, particularly in 2025, witnessed numerous challenges stemming from unpredictable developments in the international financial market, gold market, and U.S. tax policies. These factors significantly impacted the domestic market, exerting considerable pressure on the achievement of the 2025 monetary policy objectives. Despite these challenges, the SBV’s successful fulfillment of its dual mandate—promoting economic growth while maintaining macroeconomic stability—stands as a remarkable achievement, highlighting its effective policy management.

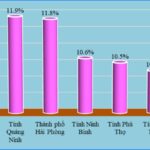

First, the SBV maintained reasonable and low-interest rates to foster economic growth. Over the past two years, these rates have remained stable and low, supporting businesses, households, and cooperatives in expanding their production and operations. This policy has particularly benefited key growth drivers such as exports, investment, and consumption. Credit growth in 2025 reached its highest level in recent years, with a growth rate of nearly 19%. In Ho Chi Minh City and Dong Nai Province, credit growth is estimated at 13.5%, effectively meeting the capital demands of the economy and contributing to economic growth—a testament to the role of bank credit and the SBV’s 2025 monetary policy objectives.

Second, the SBV flexibly managed the open market operations to support liquidity and employed various tools to ensure interest rate stability. Notably, this flexible management helped maintain exchange rate stability amidst significant pressures in 2025, demonstrating the SBV’s adept handling of the interplay between interest rates, exchange rates, and inflation.

The SBV’s use of combined policy tools, including foreign exchange swaps, not only supported liquidity but also ensured exchange rate stability. As a result, the exchange rate stabilized, and the gap between buying and selling rates in the banking system and the free market narrowed to below 1,000 VND/USD, returning to normal levels. This achievement significantly reflects the SBV’s effective management of monetary policy, exchange rates, and the foreign exchange market in 2025.

Third, the foreign exchange market remained stable, and export growth achieved impressive results. The 2025 export turnover not only reflects export performance but also underscores the role of the foreign exchange market and exchange rates. A reasonable exchange rate, coupled with credit activities (in VND and foreign currencies), supported and boosted export growth. This outcome highlights the convergence of foreign exchange and credit policies, showcasing the SBV’s successful management of monetary and exchange rate policies to support import-export growth in 2025.

Achieving the dual objectives of monetary policy in 2025 provides valuable lessons for implementing banking solutions and tasks in 2026. With the demand for high economic growth and anticipated challenges in a deeply integrated global economy, these lessons will be crucial for navigating the complexities ahead.

– 11:40 02/01/2026

State Bank Injects Nearly VND 17 Trillion via OMO in First 2026 Session

In the first trading session of 2026 (January 5), the State Bank of Vietnam (SBV) continued to prioritize the use of forward purchase channels in the open market operations (OMO) to support system liquidity. This move comes amid interbank interest rates for 7-day and 14-day terms surpassing the 8% per annum mark at the end of 2025.

What Strategies Do Hanoi and Ho Chi Minh City Propose to Achieve Double-Digit Growth by 2026?

On the morning of January 8th, the government convened a nationwide online conference with local authorities to evaluate the achievements of 2025 and outline the objectives for 2026. During the conference, numerous regions highlighted their positive outcomes from the past year and proposed key solutions, demonstrating a strong commitment to achieving double-digit growth in 2026 and beyond.