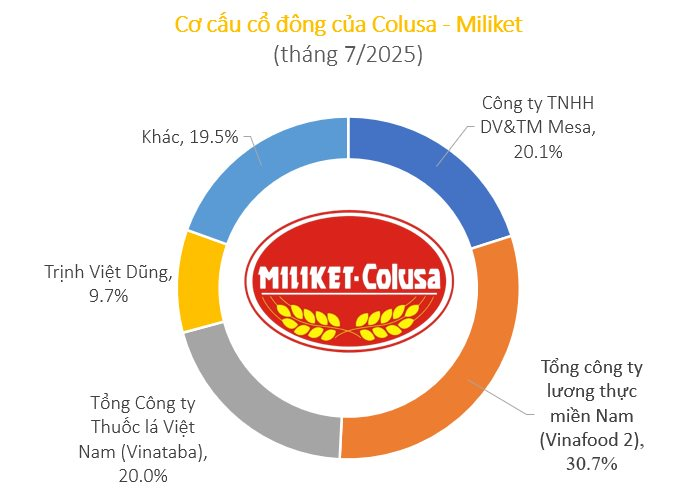

According to Vinataba’s recently released transaction report, the company successfully sold its entire stake of 960,000 shares, representing 20% of the charter capital in Colusa – Miliket. The transaction was executed between December 18, 2025, and December 24, 2025, through a public auction of the entire lot at the Hanoi Stock Exchange (HNX).

The sole winning investor paid over 206 billion VND to acquire the entire block of shares, equivalent to approximately 214,600 VND per share.

Price movement of MCN stock

Compared to CMN’s latest closing price of 71,900 VND per share, the auction price was three times higher. This valuation even propelled Colusa – Miliket, a company with a modest charter capital of 48 billion VND, to a theoretical valuation of approximately 1,000 billion VND.

Following the transaction, Vinataba is no longer a shareholder of Colusa – Miliket, reducing its ownership from 20% to 0%.

Colusa – Miliket, formerly known as Colusa Food Enterprise and Miliket Food Enterprise, is widely recognized for its kraft paper packaging featuring two shrimps.

Although no longer dominating 90% of the market share as it did in the 1990s, the company maintains a healthy financial position, operates debt-free, and consistently pays cash dividends of 20-30% annually to shareholders.

Miliket’s appeal to investors also lies in its asset quality. As of June 30, 2025, the company’s total assets were recorded at 286 billion VND. Of this, cash and bank deposits amounted to 160 billion VND, accounting for 56% of total assets.

Additionally, the company manages and utilizes strategically located land assets. Notably, it holds a 2-hectare plot on Kha Van Can Street (Ho Chi Minh City) with a lease until 2065 and an 8,590 m² plot on To Vinh Dien Street (Thu Duc).

While much of the land is leased annually or undergoing legal completion, these assets remain significant commercial advantages when assessing the company’s long-term potential.

Chairman Dang Thanh Tam’s Affiliated Enterprises Fully Settle VND 1.6 Trillion Bond Issuance

Experience the pinnacle of investment and tourism with Sài Gòn – Lâm Đồng, a venture associated with Chairman Đặng Thành Tâm. We are proud to announce the successful settlement of the SLTCH2328001 bond issuance, valued at over 1.6 trillion VND, marking a significant milestone in our commitment to excellence and financial stability.

Why Do Many Auctions of State-Owned Enterprise Shares Fail?

Numerous auctions for state-owned share lots in several companies have been canceled due to a lack of participant interest.