OCB’s new “Quick Business Capital Supplement Loan” is a game-changer for SMEs, offering swift access to funds during the year-end peak season. With just one year of operation, businesses can secure loans of up to 10 billion VND, approved within 8 working hours upon complete documentation. The product features flexible terms of up to 36 months and a preferential interest rate, 0.5% lower than standard rates, empowering businesses to seize opportunities and manage finances effectively.

OCB’s “Quick Business Capital Supplement Loan” supports SMEs during the year-end peak season.

|

What sets this product apart is its streamlined process and tailored evaluation criteria for SMEs, focusing on cash flow, operational capabilities, and business prospects rather than solely relying on collateral. The loan can be utilized for working capital, trade financing, guarantees, and other essential business needs.

A senior OCB representative stated, “Our strategy goes beyond meeting short-term capital needs; we aim to be long-term financial partners for SMEs. Moving forward, we’ll continue developing modern financial products, simplifying processes, and leveraging technology to optimize time and costs for businesses, thereby driving private sector credit growth in Vietnam.”

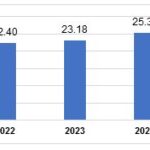

As of December 31, 2025, Ho Chi Minh City’s total credit balance reached 5.09 trillion VND, up 0.95% from November and 13.5% from 2024. The city’s credit growth for the first 11 months was robust at 12.43%, projected to hit 13.5% by year-end. Nationally, with trade surpassing 800 billion USD and double-digit industrial growth, year-end credit demand surged, exceeding the 16% annual target by November, per the State Bank of Vietnam.

Year-end is critical for SMEs, which comprise 95% of Vietnamese businesses, contribute nearly 50% of GDP, and employ over 40 million workers. Despite their economic backbone role, only 9.3% access bank loans due to collateral shortages, informal financials, or non-traditional business plans. However, banks are increasingly flexible in SME credit assessments, addressing core barriers to their growth.

At OCB, CEO Phạm Hồng Hải emphasizes SMEs, especially startups, as a strategic focus alongside retail banking. Beyond strict compliance and risk management, OCB offers tailored credit policies for startups, evaluating business models, founder expertise, and cash flow stability for lending decisions.

OCB has partnered with Aozora Bank-backed funds like Genesia Ventures to provide comprehensive financial solutions for SMEs. The “Quick Business Capital Supplement Loan” exemplifies OCB’s commitment to swiftly meeting SME capital needs during peak seasons.

– 07:50 31/12/2025

Investment Outlook 2026: Capital Seeks Opportunities in the New Growth Cycle

Amidst a global economy fraught with uncertainties, Vietnam’s high growth coupled with macroeconomic stability positions it as an increasingly attractive investment destination.

Vietnam’s FDI Disbursement Projected to Hit $27.62 Billion in 2025, Marking a 5-Year High

According to data from the General Statistics Office (Ministry of Finance), the total registered foreign investment capital in Vietnam as of December 31, 2025, comprises newly registered capital, adjusted registered capital, and the value of capital contributions and share purchases by foreign investors, reaching USD 38.42 billion. The realized foreign direct investment (FDI) in Vietnam for 2025 is estimated at USD 27.62 billion, a 9.0% increase compared to the previous year, marking the highest level in the past five years.

Secretary-General Tô Lâm: Firmly Abandon the Mindset of ‘If It Can’t Be Managed, Then Ban It’

The General Secretary has called for a significant enhancement of the investment and business environment, emphasizing the need to expand decentralization and delegation of authority. This includes a thorough review and reduction of administrative procedures, empowering officials and civil servants with greater decision-making autonomy and accountability. Simultaneously, efforts must be made to minimize compliance time and costs for citizens and businesses. The directive firmly rejects the outdated mindset of “if it can’t be managed, it should be banned,” advocating instead for proactive and efficient governance.

American Robotics Giant Selects Ho Chi Minh City as Global Hub for Robotic Dog Production

AMC Robotics Corporation has announced plans to establish a 100% wholly-owned subsidiary in Ho Chi Minh City. This strategic move will serve as a critical link in the company’s global supply chain, dedicated to the production of the advanced intelligent canine robot, Kyro.