Vietnam’s stock market kicked off the year with a bang, opening with a significant gap up on January 7th. While leading sectors like banking and insurance flourished, mining stocks unexpectedly stole the spotlight with a powerful surge.

Numerous mining stocks hit their ceiling prices, with no sellers in sight. Notable examples include Bac Kan Minerals (code: BKC), Cao Bang Minerals and Metallurgy (code: KCB), TKV Minerals (Vimico – code: KSV), Ha Tinh Minerals and Trading Corporation (code: MTA), TKV Geological and Mining Corporation (code: MGC), Yen Bai Industrial Minerals (code: YBM), and more.

Following closely, Masan High-Tech Materials (code: MSR) and Binh Duong Minerals and Construction (code: KSB) also saw gains ranging from 1.5% to nearly 4%.

Precious Metal Prices Skyrocket

The mining sector’s surge isn’t just a fleeting trend; it’s fueled by a strong push from the global commodities market. Amid ongoing economic uncertainty and geopolitical tensions, savvy investors are flocking to precious metals as a safe haven, driving gold and silver prices to record highs.

After surpassing $4,500/ounce in 2025, gold prices are expected to remain above this level in 2026. Both individual and institutional investors continue to accumulate gold. Meanwhile, silver, another highly sought-after metal, is also poised for continued growth.

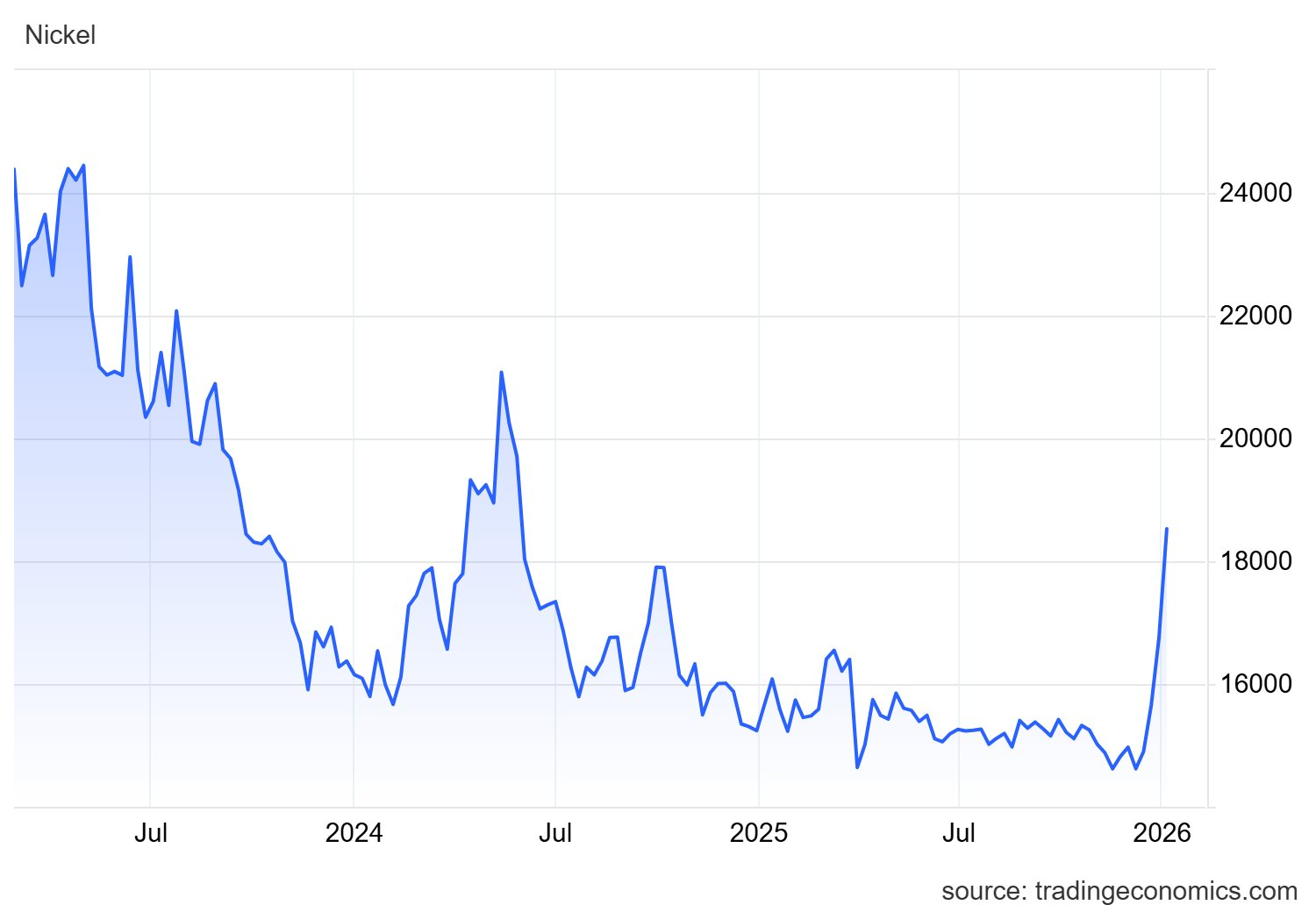

The momentum extends beyond precious metals to industrial minerals. Notably, nickel prices have seen dramatic increases recently. On January 6th, global nickel prices rose over 6%, reaching $18,500/ton, the highest level in nearly two years. This metal has surged nearly 25% in just one month.

Copper, often seen as a barometer of global economic health, is also experiencing a significant surge. Prices on the largest U.S. commodities exchange have surpassed the historical peak reached in July 2025.

Looking ahead to 2026, the copper market is expected to remain volatile due to conflicting forces. Tariffs could harm the global economy, while rising geopolitical instability tends to strengthen the U.S. dollar, weakening purchasing power for manufacturers using other currencies.

However, the Federal Reserve’s potential interest rate cuts could have the opposite effect. Global electric vehicle sales are also projected to grow fast enough to significantly increase demand for copper and nickel, essential components in batteries, wiring, and motors. Additionally, supply chain disruptions, delays in new mining projects, or an unexpected rebound in Chinese manufacturing could all shift the supply-demand balance.

Mining Companies Project Positive 2025 Results

Thanks to favorable metal prices, many mining companies reported strong results for 2025.

For instance, Vimico reported consolidated revenue of VND 14,454 billion for 2025, a 9% increase from the VND 13,252 billion achieved in 2024.

Notably, 2025 pre-tax profit is projected to reach VND 2,399 billion, a 14% increase from the VND 2,100 billion recorded in 2024.

Vimico’s growth in 2025 was primarily driven by stable production lines and favorable metal prices. Specifically, gold production reached 918 kg, copper sheets reached 31,200 tons, and copper concentrate reached 64,260 tons.

For 2026, Vimico is taking a cautious approach due to anticipated market volatility and rising input costs. The company targets consolidated revenue of VND 13,842 billion and profit of VND 2,042 billion, slightly lower than 2025 results.

Key focuses for 2026 include accelerating land clearance and advancing key projects like the Na Rua Iron Mine and the Sin Quyen Copper Mine expansion. The company also needs to secure mining licenses and adjust existing permits to ensure a stable supply of raw materials for its processing plants.

Meanwhile, Vietnam National Coal and Mineral Industries Group (TKV) estimates December 2025 consolidated revenue at VND 13,450 billion, with full-year revenue reaching VND 161,000 billion.

December 2025 consolidated profit is estimated at VND 874 billion, with full-year profit reaching VND 7,660 billion, 225% of the annual plan, 111% of the same period last year, and 110% of the growth plan.

Looking ahead to January 2026, favorable weather conditions are expected to continue supporting coal and mineral extraction. Demand for coal in power generation is expected to rise during the dry season, while prices and demand for key minerals like copper, silver, aluminum, and alumina remain high globally.

TKV aims to produce 3.17 million tons of raw coal, 3.4 million tons of clean coal, and sell 4.11 million tons of coal in January 2026. The company also targets 105,000 tons of alumina, 9,600 tons of copper concentrate, 780 tons of zinc ingots, 2,700 tons of copper sheets, and 912 million kWh of electricity. Consolidated revenue for January 2026 is projected at VND 14,170 billion.

Undervalued Stocks to Accumulate in 2026: Expert Highlights Oversold Opportunities

At present, for investors adopting a constructive and value-oriented perspective, the expert believes there are numerous compelling narratives to explore.

Stock Market Week 29-31/12/2025: Closing the Year with a Historic High

The VN-Index concluded 2025 by setting a new all-time high in closing price, despite a significant decline in liquidity during the past week due to holiday sentiment. The upward momentum was primarily sustained by large-cap stocks, while capital flows remained highly selective and fragmented.