|

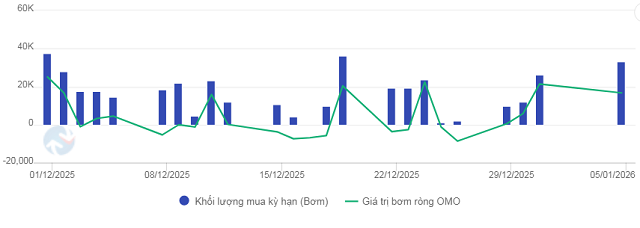

Open Market Operations (OMO) Net Injection Trends from December 2025 to Early 2026. Unit: Billion VND

Source: VietstockFinance

|

Specifically, the State Bank of Vietnam (SBV) injected 33,151 billion VND into the market through repurchase agreements, with an annual interest rate of 4.5%. The 14-day term saw the largest injection at 12,399 billion VND, followed by the 7-day term with 11,000 billion VND. The remaining amounts included 28-day (7,000 billion VND) and 91-day (2,752 billion VND) terms.

Conversely, 16,483 billion VND matured and returned to the SBV during the session, resulting in a net injection of 16,668 billion VND by the regulator.

For the week from December 29 to January 5, the SBV injected a total of 81,268 billion VND, primarily concentrated in the final session of the year (26,351 billion VND) and the first session of the new year (33,151 billion VND), against total maturities of 36,957 billion VND. The net injection for the week reached 44,311 billion VND. As of January 5, the outstanding volume in the open market stood at 359,203 billion VND.

|

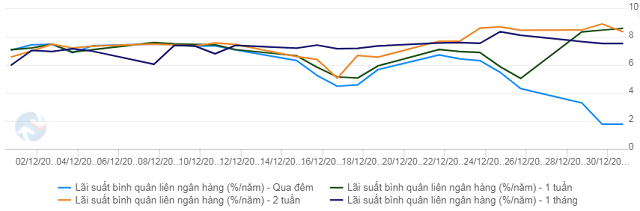

Interbank Interest Rate Trends in December 2025. Unit: %/year

Source: VietstockFinance

|

During the final week of 2025, interbank interest rates exhibited significant volatility and clear differentiation by term. Overnight rates continued their downward trend from the previous week, reaching a 6-month low on December 31.

|

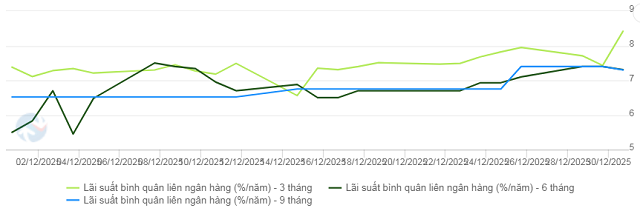

Interbank Interest Rate Trends in December 2025. Unit: %/year

Source: VietstockFinance

|

In contrast, rates for terms of one week and longer surged in the final days of the year. The one-week rate spiked to 8.61% on December 31, a 357 basis point increase from the previous week. The two-week rate peaked at 8.93% on December 30 before cooling to 8.38% on December 31. The three-month rate also climbed to 8.42% in the final trading session of the year.

|

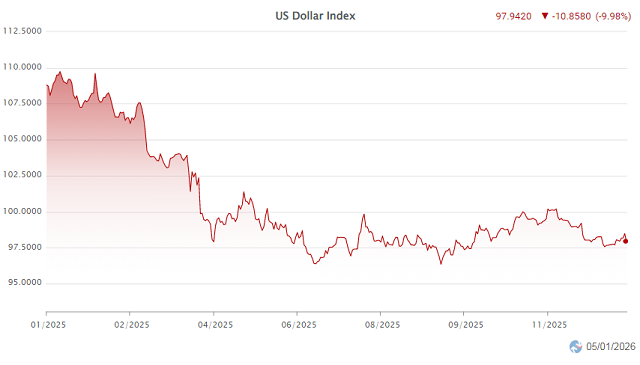

DXY Index Trends from Early 2025 to January 5

Source: VietstockFinance

|

Internationally, the DXY index saw a slight recovery in the final week of 2025, closing the week at 98 points, up 0.3 points from the previous week, thus ending a five-week consecutive decline.

The USD regained strength following the Federal Reserve’s release of the December meeting minutes. The Fed anticipates only one rate cut in the coming year and signaled a likelihood of maintaining current interest rates until inflation shows clearer signs of cooling or unemployment rises unexpectedly. This cautious stance bolstered the greenback’s appeal.

Domestically, Vietcombank listed the USD exchange rate at the end of the year at 26,047-26,377 VND/USD (buy-sell), a 7 VND decrease in both directions compared to the previous week.

– 11:07 06/01/2026

December 30th Currency Market Update: Overnight Interest Rates Plummet to 3%, Halving Since Last Week

At the close of trading on December 29, the Vietnamese Dong (VND) interbank interest rates saw a sharp decline in the overnight term, while longer-term rates remained elevated. The State Bank of Vietnam continued its net liquidity injection through the Open Market Operations (OMO) channel. Both the central exchange rate and the USD rates across markets experienced a slight downward adjustment.