Join the dynamic surge in the stock market, boasting a remarkable 45-point rise, as state-owned conglomerates and corporations witness a collective upswing, with numerous stocks hitting their upper limits.

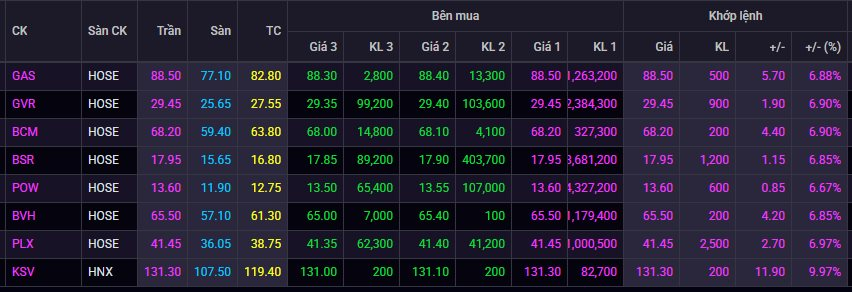

Leading the charge is GAS, the stock of Vietnam Gas Corporation, which has seen three consecutive sessions of hitting the ceiling, soaring to 88,500 VND per share. This impressive rally brings GAS close to its historical peak of around 90,000 VND per share, last seen in June 2022.

Following suit, BVH of Bao Viet Group also experienced its second consecutive session of hitting the upper limit, closing at 65,500 VND per share – the highest level in five years.

The euphoria extends to other state-owned giants. KSV of Vietnam National Coal and Mineral Industries Group continues its fourth consecutive session of hitting the ceiling, while GVR of Vietnam Rubber Group, BSR of Binh Son Refining and Petrochemical Company, PLX of Petrolimex, and BCM of Becamex all surged to their upper limits, contributing to the market’s dominant purple hue.

According to MB Securities (MBS), state-owned listed enterprises are poised to become the new focal point of the stock market in 2026, driven by the anticipated issuance of a separate resolution on the State-owned Economy, which is expected to provide a significant institutional boost.

Currently, state-owned enterprises contribute approximately 29% to GDP, leading in total assets, revenue, and market share, and even holding monopolies in critical sectors such as aviation and petroleum. However, their operational efficiency generally falls short of their scale and potential due to underutilized capital resources. MBS believes that if these bottlenecks are removed, state-owned enterprises could enter a new phase of acceleration.

Similar to the boost that Resolution 68 brought to the private sector, expectations for 2026 are high for state-owned listed enterprises. These leading companies boast robust financial foundations, ample cash reserves, decent operational efficiency (ROE above 10%), and attractive valuations.

Additionally, the new resolution is expected to establish a clear legal framework for restructuring state-owned enterprises’ investments, thereby accelerating divestment, listing, and equitization processes that have stagnated in recent times.

In this context, several large state-owned enterprises face challenges in maintaining their public company status. Recently, Vietnam Gas Corporation – PV GAS (GAS), with a market capitalization exceeding 7 billion USD, announced it no longer meets the criteria for a public company due to its majority shareholder PVN holding nearly 96% of voting rights, leaving only 4.24% of shares to minority shareholders. A similar situation occurs at PV GAS D (PGD). Earlier, in November 2025, KSV also reported failing to meet public company criteria as Vietnam National Coal and Mineral Industries Group (TKV) holds 98.1% of its charter capital.

Under the Securities Law, to maintain public company status, a company must ensure that at least 10% of its voting shares are held by a minimum of 100 non-major shareholders. However, in many state-owned enterprises and companies with dominant shareholders, the free-float ratio has dropped to very low levels.

Beyond the aforementioned cases, other large-scale enterprises also risk violating this regulation, including BIDV (BID – State Bank holding 79.7%), Vietnam Rubber Group (GVR – Ministry of Finance holding 96.8%), Binh Son Refining and Petrochemical Company (BSR – PVN holding 92.1%), and Becamex IDC (BCM – State holding 95.4%). On the UPCoM, companies like ACV, Viettel Global (VGI), Vietnam Maritime Corporation, and FPT Telecom also fail to meet the minimum minority shareholder ratio.

Nevertheless, experts assess that the risk of large state-owned enterprises losing their public company status is relatively low. The Law on Management and Investment of State Capital in Enterprises (Law No. 68/2025/QH15) provides a special mechanism: during the implementation of approved state capital restructuring plans, state-owned enterprises transitioning to joint-stock companies but not yet meeting public company criteria will not immediately lose their status during the restructuring phase.

Based on this, the market anticipates a renewed wave of state-owned enterprise divestment, similar to the 2016–2018 period, which would not only meet legal requirements but also enhance the quality and depth of Vietnam’s stock market.

“We assess the risk of losing public company status and delisting as low. Simultaneously, we expect a resurgence in state-owned enterprise divestment akin to the 2016–2018 period,” said Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Securities.

Vietstock Daily 07/01/2026: Embarking on a New Journey?

The VN-Index extended its winning streak to a fifth consecutive session, marked by a robust green candle, decisively breaching the previous October 2025 peak to reinforce the prevailing uptrend. Short-term outlook remains highly optimistic, supported by both the Stochastic Oscillator and MACD indicators sustaining their upward trajectories following buy signals.

Former BWE Subsidiary Becomes Major Shareholder After Acquiring 8.3 Million Additional Shares

On December 29th, Biwase Construction – Installation Electricity JSC (Biwelco) acquired nearly 8.3 million shares of BWE, becoming a major shareholder in Binh Duong Water Supply – Sewerage JSC (HOSE: BWE). This transaction increased Biwelco’s ownership stake from 2.803% to 6.568%, equivalent to over 14.4 million shares.

Two-Year Low: Real Estate Stock Suddenly Plunges into the Red for Two Consecutive Sessions

This business has unveiled its 2025 financial results alongside an ambitious 2026 operational plan, highlighting several key strengths and opportunities.