|

|

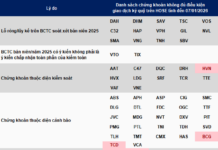

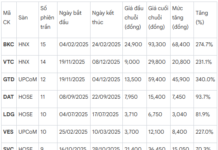

Here are the top 10 stocks with the most significant declines in the calendar year 2025, based on an average trading volume of over 100,000 shares per session. |

|

|

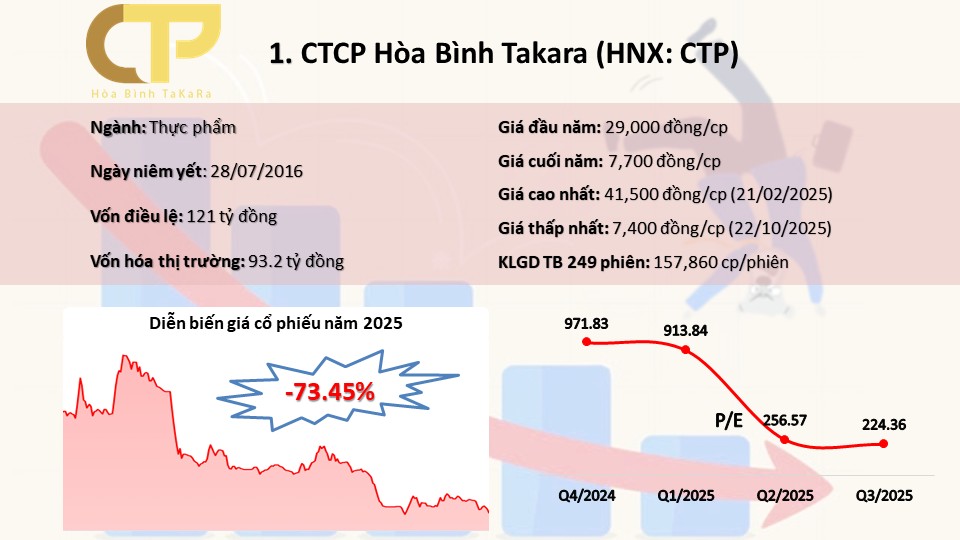

CTP began 2025 with a 152 million VND fine in February for disclosure violations, triggering a steep decline that made it the year’s worst-performing stock, plummeting over 73%. Later in the year, the company faced additional penalties from tax authorities for VAT and CIT misdeclarations. Amid these challenges, senior executives, including the Chairman and CEO, engaged in frequent stock transactions. |

|

|

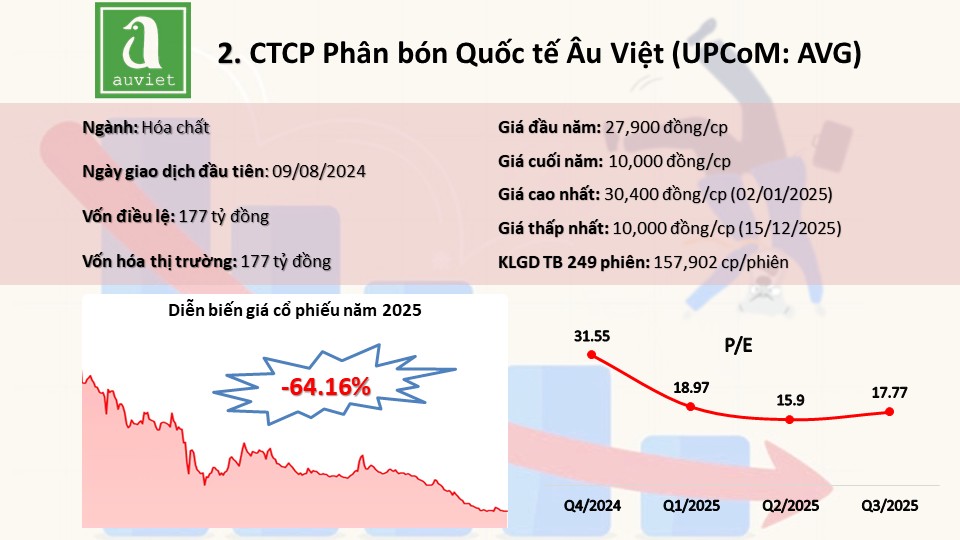

AVG dropped 64% in 2025, becoming the second-worst performer. Its closing price on the final trading day matched its par value and marked the year’s lowest point. |

|

|

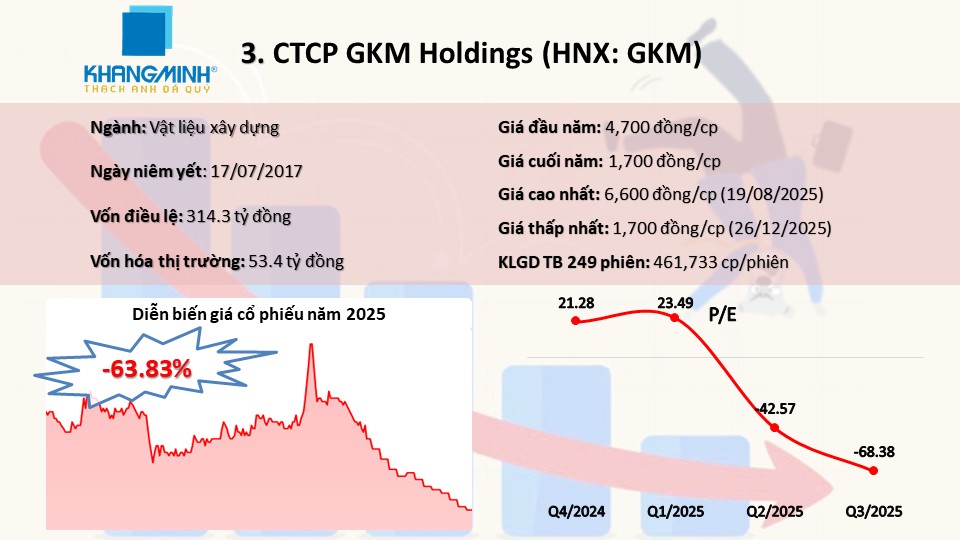

GKM fell nearly 64% in 2025, ending at 1,700 VND per share, its yearly low. Notably, GKM had formed a “Christmas tree” pattern in August, peaking at 7,000 VND per share. |

|

|

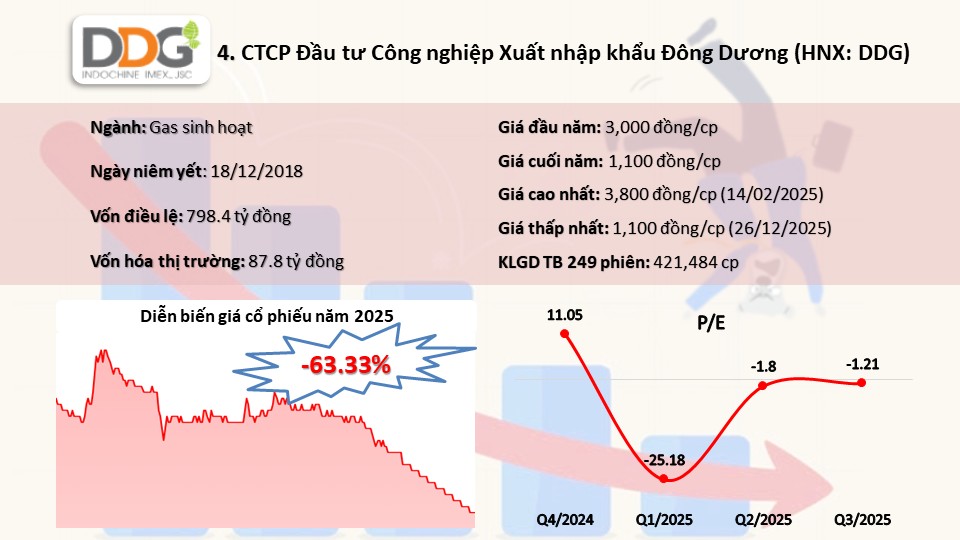

DDG started 2025 promisingly, reaching nearly 3,900 VND per share, but faced sharp declines in February-April and from October, ending the year 63% lower at 1,100 VND per share. |

|

|

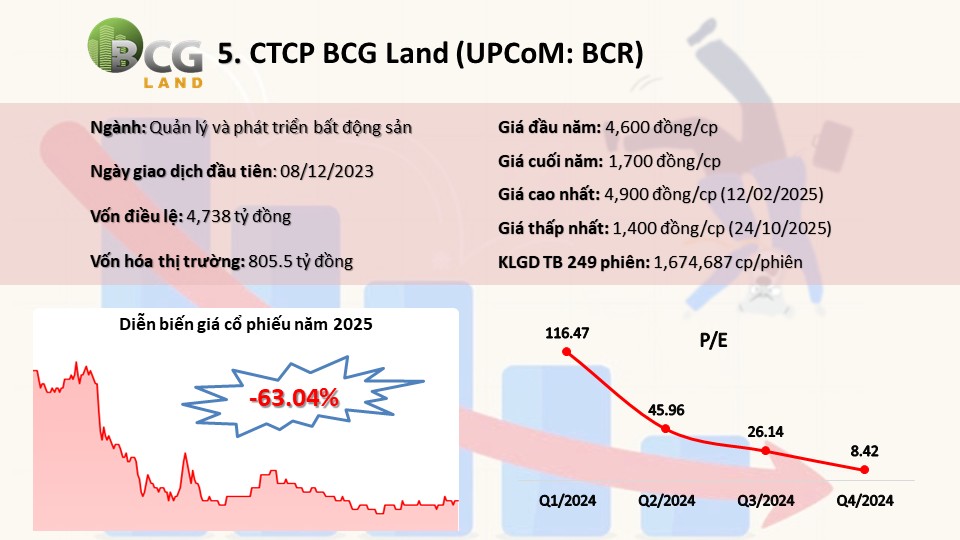

Stocks within the Bamboo Capital ecosystem faced turmoil after founder Nguyễn Hồ Nam was indicted. This triggered a steep decline, leaving investors distressed. Among them, BCR fell 63%. |

|

|

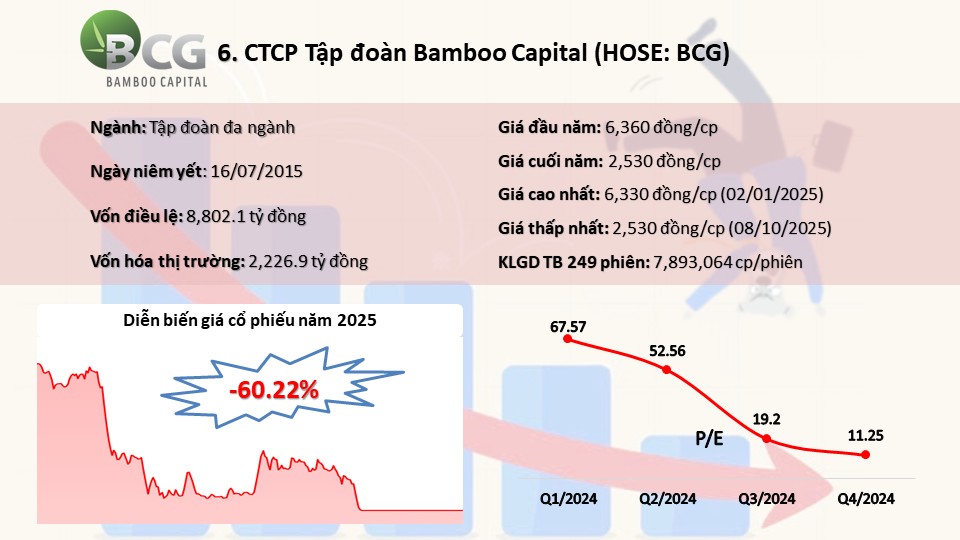

Similar to BCR, the ecosystem’s flagship BCG also dropped 60% in 2025. |

|

|

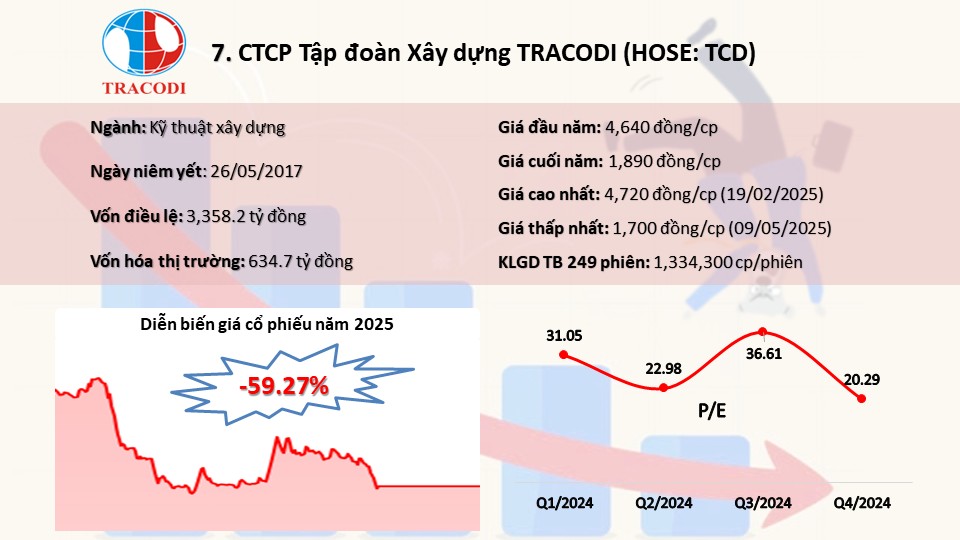

TCD faced a 59% decline in 2025, with no signs of recovery. |

|

|

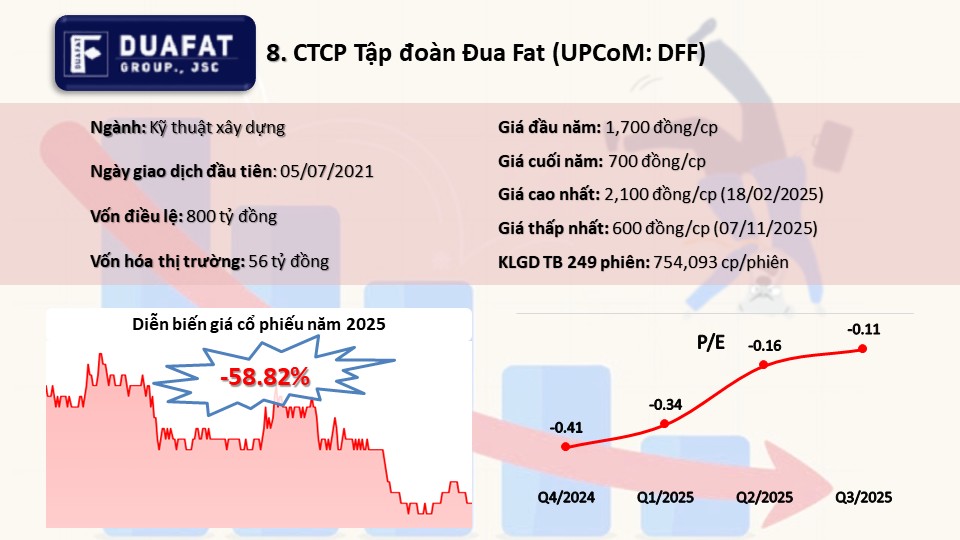

DFF experienced a catastrophic year, with negative equity due to record losses, leading to trading restrictions. Chairman Lê Duy Hưng‘s stake fell from 47.18% to 12.25% by September, down from 62% in 2021, as brokers liquidated collateral. |

|

|

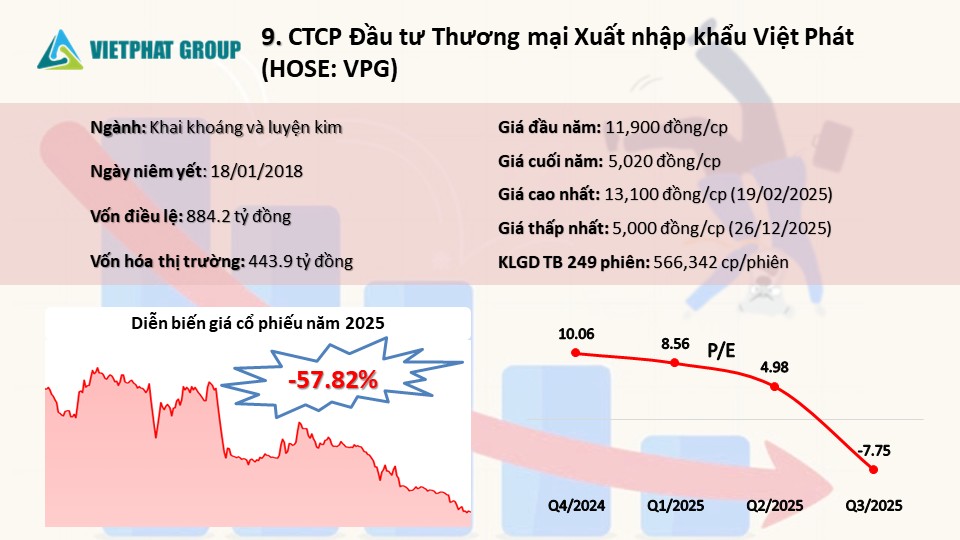

VPG saw sharp declines in April and June 2025, linked to insider trading concerns and the indictment of former Chairman Nguyễn Văn Bình for bribery. Despite a mid-year recovery, it ended the year 58% lower at 5,020 VND per share. |

|

|

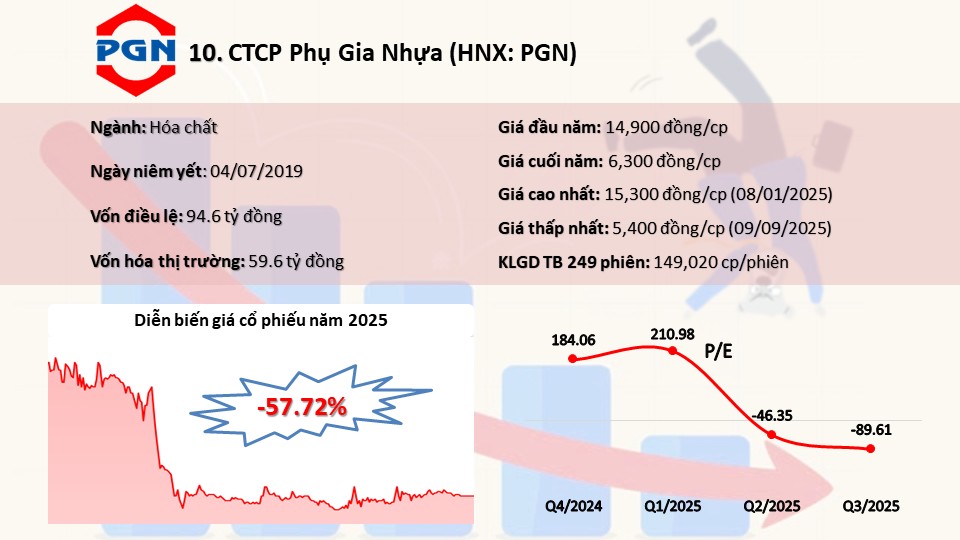

PGN joined the top decliners due to an April slump, reflecting weak Q2 earnings with an 88% drop in net profit to just 250 million VND. |

– 19:00 31/12/2025

SHB: Capital Increase Strategy and Foreign Investment Signals Set Stage for Major Capital Inflow

In 2026, bank stocks may witness significant divergence rather than a uniform industry-wide rally. Shares that combine strong fundamentals with compelling narratives—such as capital raises or foreign investment inflows—will likely attract prioritized capital allocation.

New Year 2026 Greetings from the Chairman of the State Securities Commission

“The entire securities sector will continue to uphold its traditions, proactively innovate, and develop the market in a modern, transparent, sustainable, and integrated manner. This will significantly enhance the position of Vietnam’s financial market in the region and globally,” emphasized the Chairman of the State Securities Commission (SSC).

Year-End Stock Market Wrap-Up: VN-Index Nears 1,800 Points, Rally Favors Blue-Chip Stocks

The final trading session of 2025 concluded with the VN-Index surging over 17 points, closing at a historic high just shy of the 1,800 mark.