This morning, January 7th, shares of Truong Son Investment and Construction JSC (TSA) officially began trading on the Ho Chi Minh City Stock Exchange (HOSE), marking the first listing of 2026. The opening reference price was set at VND 13,800 per share.

TSA Rings in the New Year on HOSE

The sound of the bell echoing through the listing ceremony marked a significant milestone in Truong Son Investment and Construction JSC’s 23-year journey.

Speaking at the event, Mr. Nguyen Van Truong, Chairman of Truong Son’s Board of Directors, emphasized the listing on HOSE as a pivotal moment for the company.

According to Chairman Truong, entering the stock market, particularly listing on HOSE, signifies a strong commitment to transparency, high standards of corporate governance, and sustainable development. This move not only enhances brand recognition and expands access to capital but also underscores the company’s responsibility towards shareholders and society.

“We fully understand that listing is not the destination but the starting point for a new phase of growth – one driven by strategy, disciplined capital management, and long-term value creation for shareholders. Entering the stock market opens up a broader space for us in terms of capital, governance, and responsibility,” he stated.

“The Board of Directors and Management Board of Truong Son are firmly committed to sustainably increasing the company’s value with transparency and professionalism. We deeply appreciate our investors not just as capital contributors but as strategic partners sharing our long-term vision for sustainable value creation, positively contributing to the development of Vietnam’s stock market and economy,” Chairman Truong emphasized.

Outlining future directions, Truong Son’s Board of Directors and Management Board pledged to effectively utilize capital, continuously innovate to enhance competitiveness, fulfill information disclosure obligations, protect shareholder rights, and align business growth with social responsibility.

Truong Son’s leadership receives the HOSE listing certificate. Photo: TSA.

Solid Foundation with Strong Growth Drivers

Truong Son brings a solid operational foundation to its HOSE listing, built over many years. The company operates in two main segments: manufacturing spun concrete piles and poles, and electrical construction.

Manufacturing spun concrete piles and poles is the core business, contributing significantly to revenue. The company operates a factory producing spun concrete poles and piles, adhering to ISO 9001:2015 standards and Japan’s 5S management system. Truong Son’s concrete poles are widely used in infrastructure projects.

Production of spun concrete piles and poles has seen strong growth over the years. To meet rising market demand, Truong Son is constructing a second production plant in Chau Son Industrial Park, Ninh Binh province. This project, with a total investment of nearly VND 140 billion, is expected to commence operations in the first half of this year.

The second plant has a designed capacity of 1-1.3 million linear meters per year. Management stated that the new plant’s early operation will enable Truong Son to better handle large orders and enhance market penetration efficiency, given the sustained high demand for infrastructure investment from both public and private sectors.

Electrical construction is the second key segment. Truong Son specializes in constructing power transmission infrastructure, including transmission lines at various voltage levels (110kV, 220kV, 500kV), substations up to 500kV, and related steel structures, serving as a primary contractor.

Additionally, the company is investing in shopping center projects to diversify its business portfolio, expand into new sectors, and optimize resource utilization in the future.

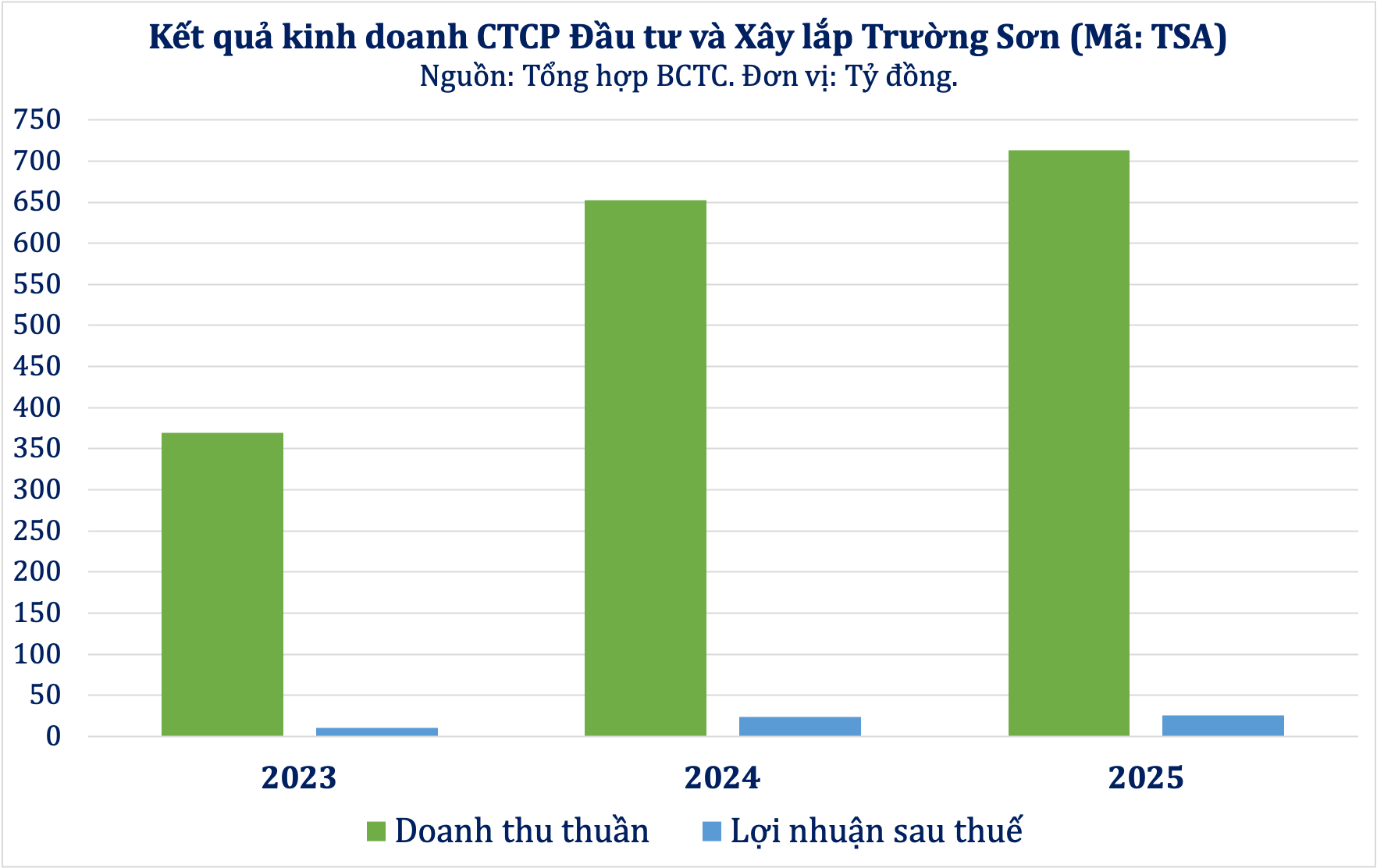

Truong Son’s (TSA) impressive business results from 2023 to 2025. Source: Consolidated Financial Statements.

15% Profit Growth in 2025, Targeting VND 800 Billion Revenue in 2026

With a robust foundation built over more than 20 years, Truong Son is on an upward trajectory. Over the past three years, the company has shown positive business results, with revenue and profit consistently breaking records.

According to estimated business results, Truong Son’s 2025 net revenue exceeded VND 713.3 billion, up 9.3%, with profit growing approximately 15% compared to 2024. The company thus surpassed its 2025 business targets.

In 2024, the company reported net revenue of VND 652.6 billion and after-tax profit of VND 23.5 billion, increases of 77% and 135% respectively from 2023.

Achieving both its 2025 business results and listing on HOSE in early 2026 demonstrates Truong Son’s leadership commitment to a dual objective: fulfilling shareholder promises and realizing two key initiatives approved by the General Meeting of Shareholders.

Building on this momentum, Truong Son’s management has set a double-digit revenue growth target of VND 800 billion for 2026. Given past achievements, reaching VND 1 trillion in revenue may not be far off.

Precious Metals Surge: Gold, Silver, Copper Rally Sparks Stock Market Celebration

The surge in mining stocks is not a fleeting trend, but a robust response fueled by a significant boost from the global commodities market.

Vietnamese Stock Market Surges Past 1,800 Points, Setting an All-Time Record

The 1.6% surge propelled the HoSE market capitalization by an impressive 130 trillion VND, bringing it tantalizingly close to the 8.5 quadrillion VND milestone.