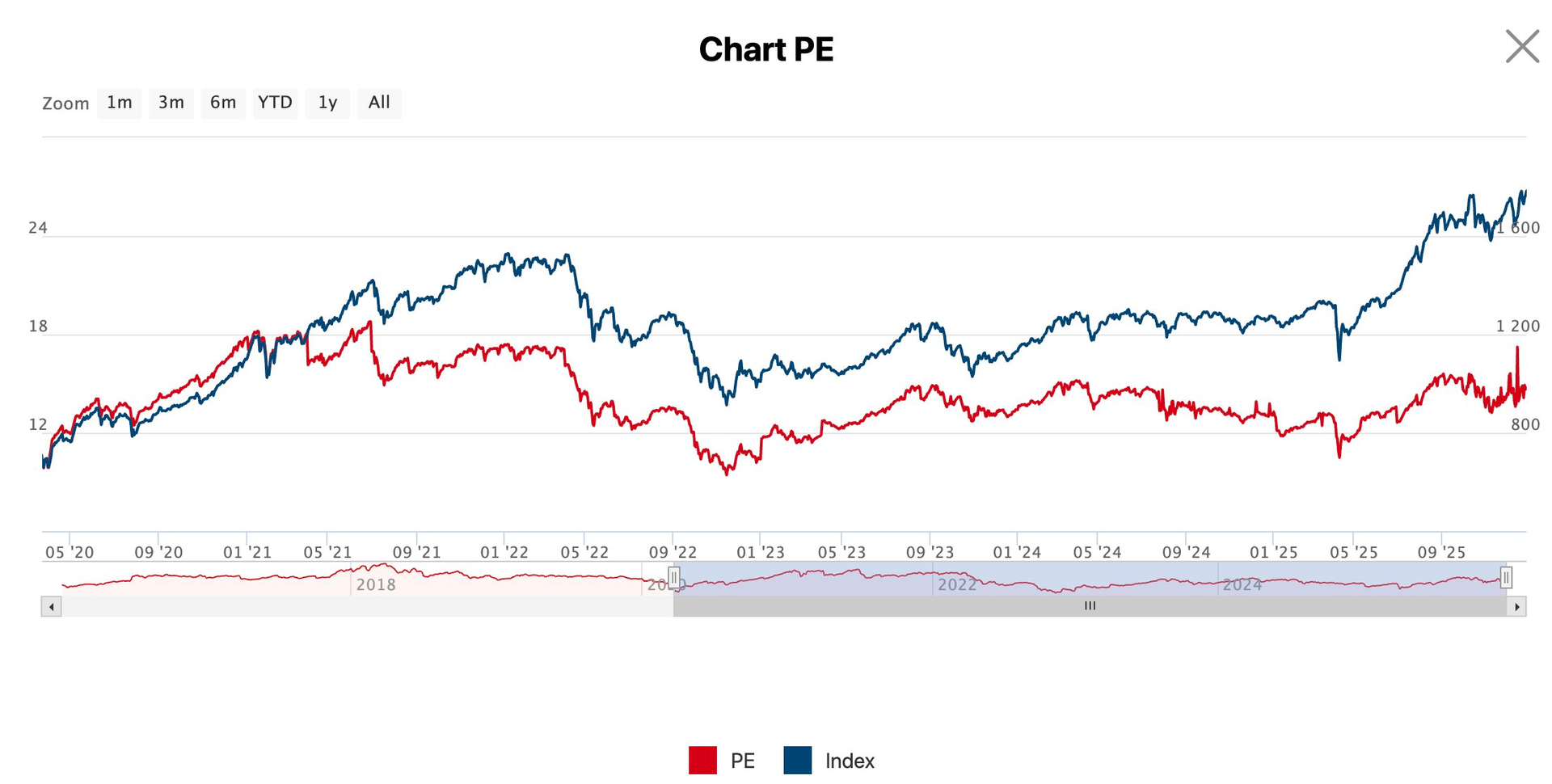

Vietnam’s stock market concluded 2025 with a historic milestone. Closing the session on December 31, the VN-Index settled at 1,784.49 points, officially surpassing its all-time high (based on closing prices).

Throughout 2025, the VN-Index recorded a remarkable increase of over 40%, marking the highest growth in its 25-year history. The capitalization of HoSE reached a record-breaking 8.3 million billion VND. Including all three trading floors, the total market capitalization of Vietnam’s stock market approached nearly 10 million billion VND, the highest ever recorded.

However, this growth was largely concentrated among a select group of blue-chip stocks. Excluding the Vingroup stocks, the market index stood at approximately 1,430 points, reflecting a more modest increase of around 12% for the year.

Apart from the gains in blue-chip and banking stocks, the performance of most other stocks in 2025 was less than impressive.

Several Sectors Currently in Oversold Territory

Commenting on market dynamics, Mr. Nguyễn Đức Khang, Head of Securities Analysis at Pinetree, predicted that the likelihood of a sharp market decline is relatively low, as many stocks have entered oversold territory and are forming mid-term bottoms.

From an asset and value investment perspective, the expert believes there are numerous compelling opportunities at present.

Firstly, the industrial zone sector, which has been shunned by the market throughout the past year due to tariff concerns, is poised for a turnaround. According to Mr. Khang, as tariff issues subside and FDI capital returns in 2026, the market will enter a ‘revaluation’ cycle. The consistent profit growth despite previous concerns will act as a catalyst for capital inflows into this sector.

Secondly, export-oriented stocks are also trading at attractive levels and face similar circumstances. However, investors should exercise greater caution with this group, considering the specific products and target export markets of each company.

Additionally, the oil and gas sector warrants attention, with companies like PVD and PVS making a comeback. The oil and gas industry is expected to benefit significantly from the continued ‘public investment wave’ in 2026.

Gold, Silver, or Stocks: Asset Allocation Strategies for 2026

Given the meteoric rise of gold and silver prices, should investors remain committed to stocks, or is it time to consider a more diversified asset allocation strategy for 2026?

According to Pinetree’s expert, the growth potential of precious metals in 2026 may not be as appealing as in 2025. Silver, in particular, has seen a 2.7-fold increase over the past year, pushing its value into high-risk territory. Historical data over the past 50 years indicates that rapid price increases in silver are often followed by significant declines. Investors should approach silver with caution.

Regarding gold, Mr. Khang offers a more optimistic outlook, suggesting that its long-term growth trend remains intact. However, the price increase in 2026 is unlikely to match the strength seen during 2024-2025.

In Vietnam, investors face two significant challenges: the difficulty of purchasing gold and the substantial price gap between domestic and international gold prices.

In terms of allocation strategy, Mr. Khang highlights the fundamental difference between investing in stocks and gold: the level of proactiveness required. While stock investing demands constant market monitoring and flexible thinking, gold is more about wealth preservation.

For 2026, the expert believes both gold and stocks remain optimal choices, but the allocation focus will depend entirely on individual risk appetite and investment style.

Avoiding Psychological Traps in Investment

Regardless of risk tolerance, building a proactive investment strategy for 2026 should adhere to the following principles:

According to Mr. Khang, emotions like fear during market corrections or FOMO (fear of missing out) during rallies are natural human reactions. Instead of attempting to eliminate them entirely – an almost impossible feat – investors should learn to recognize and manage these emotions to a reasonable degree.

To avoid psychological traps, the expert recommends establishing and strictly adhering to a personalized investment framework. When stock prices decline, instead of panicking, investors should ask themselves: Do the initial investment reasons still hold? Is the market overreacting? Answering these questions will help investors maintain composure amid short-term fluctuations.

Furthermore, Mr. Khang emphasizes the importance of disciplined stop-loss strategies to prevent significant losses. A common paradox in the market is that investors often take profits too early but are overly patient with losing positions. He asserts that this is not a sound long-term approach.

Ultimately, a well-structured investment system serves as the most robust defense against emotional decision-making, enabling investors to remain calm amidst market turbulence.

Vietnamese Stock Market Surges Past 1,800 Points, Setting an All-Time Record

The 1.6% surge propelled the HoSE market capitalization by an impressive 130 trillion VND, bringing it tantalizingly close to the 8.5 quadrillion VND milestone.

Vietstock Weekly 05-09/01/2026: New Year, Familiar Challenges?

The VN-Index extended its winning streak to a third consecutive week, forming a bullish Big White Candle pattern and reclaiming its October 2025 peak. Currently trading near the Upper Band of the Bollinger Bands, the index faces a critical juncture. While momentum is positive, volume remains a concern, lacking full conviction. To decisively break through this resistance and establish a new uptrend, improved liquidity will be essential in the coming sessions.