On January 4, 2026, the People’s Committee of Thai Nguyen Province approved the investment policy for the Construction and Infrastructure Business Project of the Tay Pho Yen Industrial Park (IP) – Phase 1 (over 499 hectares). Viglacera Thai Nguyen JSC, a subsidiary of VGC, was designated as the project investor.

The project spans over 499 hectares, with a total investment capital of nearly VND 5.4 trillion. Viglacera Thai Nguyen contributes approximately VND 810 billion, accounting for 15% of the total.

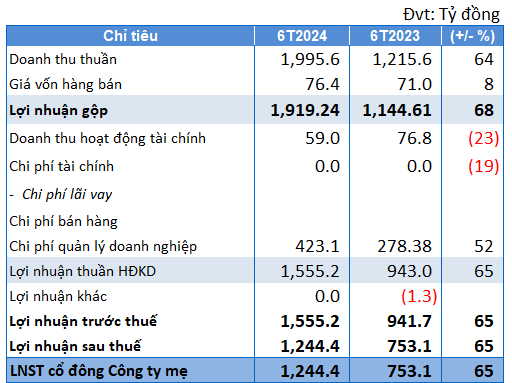

Location of the Tay Pho Yen Industrial Park – Service – Urban Complex (based on administrative boundaries before July 1, 2025)

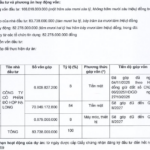

|

The project aims to develop a multi-sector industrial park. With a 50-year operational term and a 36-month implementation timeline from land handover, it is expected to become a key investment attraction in the region.

The approval of Viglacera Thai Nguyen as the investor for Tay Pho Yen IP Phase 1 increases VGC‘s industrial park portfolio to 18, with a total land area exceeding 5,500 hectares. This marks the second Viglacera-branded IP in Thai Nguyen, following Song Cong II – Phase 2.

Previously, on December 24, 2025, the company contributed over VND 413 billion of the total VND 810 billion capital increase in Viglacera Thai Nguyen JSC, maintaining a 51% ownership stake to support the Tay Pho Yen IP project.

Established in December 2022, Viglacera Thai Nguyen JSC specializes in industrial park infrastructure investment and business. According to VGC‘s June 27, 2023 resolution, the company has a charter capital of VND 600 billion, with VGC holding 51% (VND 306 billion).

In contrast, VGC recently approved a restructuring plan for its sanitaryware division.

On December 29, 2025, the company transferred ownership of Viglacera Thanh Tri JSC (UPCoM: TVA), Viet Tri Viglacera JSC, and Viglacera Trading JSC to Viglacera Sanitaryware LLC, a 100% VGC-owned entity. As a result, these three companies are no longer direct subsidiaries of VGC.

Recent restructuring efforts by VGC have been extensive. In November 2025, the company closed four branches and three transaction offices to streamline operations and approved a detailed plan to innovate its tile and brick segment.

In leadership changes, Mr. Bui Le Cao Ke was appointed Deputy General Director, replacing Mr. Luong Thanh Tung. In December 2025, Mr. Quach Huu Thuan, Deputy General Director overseeing tiles and communications, was relieved of his duties.

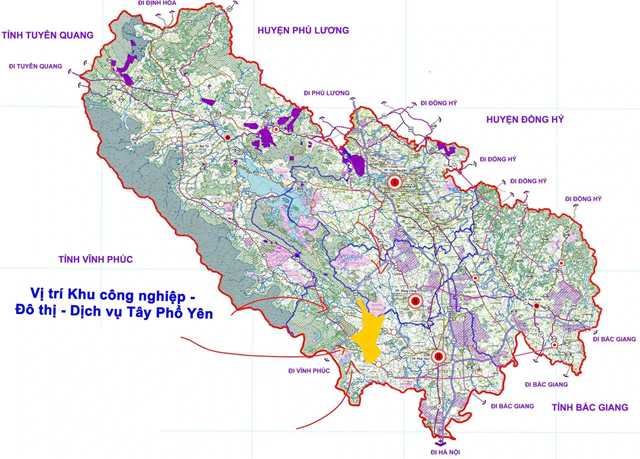

Revised 2026 business plan announced just one day after initial release

Notably, on December 31, 2025, VGC revised its 2026 revenue target from VND 13.299 trillion to VND 15.3 trillion, just one day after the initial approval.

The revised target is 15% higher than the previous announcement and 6% above the 2025 plan.

VGC stated that other aspects of the 2026 business and investment development report remain unchanged. These include parent company revenue of VND 4.078 trillion (down 27% from 2025) and consolidated pre-tax profit of VND 1.82 trillion (up 4%), with parent company pre-tax profit decreasing 16% to VND 1.2 trillion. These figures are expected to be approved at the 2026 Annual General Meeting.

The numbers indicate VGC‘s focus on consolidated growth, despite a decline in parent company performance.

Source: VGC

|

In the first nine months of 2025, VGC reported net revenue of over VND 9.337 trillion, a 14% year-on-year increase, driven by leased land infrastructure, tiles, glass, and mirrors. Pre-tax profit reached nearly VND 1.322 trillion, with net profit at VND 851 billion, up 45% and 49%, respectively.

Compared to the 2025 targets of VND 14.437 trillion in revenue and VND 1.743 trillion in pre-tax profit, the company achieved 65% and 76% of its goals in the first three quarters.

|

VGC‘s 9-Month Net Profit Trends in Recent Years |

– 3:07 PM, January 5, 2026

Vietnam Unveils New 500 Billion VND Stadium with 22,000 Seats, the Largest in Northern Mountainous Region

Upon completion, this will stand as the largest stadium in the Northern Midlands and Mountainous regions of Vietnam.

Viglacera Relieves Deputy General Director of Duties

The Viglacera Board of Directors has officially relieved Mr. Quách Hữu Thuận of his duties as Deputy General Director, following his submitted resignation.