Vietnam’s stock market closed the session on January 6th with a remarkably positive performance. A strong afternoon rally propelled the VN-Index up nearly 28 points, surpassing the 1,816 mark and setting a new all-time high. Trading value on the HoSE also improved, reaching approximately VND 24,850 billion. The 1.6% gain further boosted the HoSE’s market capitalization by VND 130,000 billion, nearing the VND 8.5 trillion threshold.

The notable aspect wasn’t just the numbers, but the quality of the rally: liquidity flowed into various stock groups rather than relying solely on a few blue-chip stocks. Within the broader picture, the “Vin group” remained in the spotlight, with Vinhomes (VHM) and Vincom Retail (VRE) hitting their ceiling prices, providing significant support for the index. Additionally, the energy sector continued its upward trend, while the banking sector also played a leading role in driving the market.

In reality, the VN-Index had been hovering around its peak for several months, repeatedly testing but failing to achieve a truly convincing breakout. The January 6th session, therefore, held significant meaning: the market not only surged in points but also demonstrated a clearer liquidity spread as multiple stock groups rallied, making the breach of the 1,800-point mark a collective achievement rather than the story of a single group.

From a broader perspective, historical data shows that the stock market often starts the year on a positive note. Specifically, Vietnam’s stock market typically experiences a positive start in Q1 and the first trading week of the new year. In the past five years, only the first week of 2025 saw a decline, while the other four years recorded gains. However, these short-term statistics should be considered as reference points only.

For the first half of 2026, Mr. Nguyen Tien Dung – Head of Industry and Equity Research, MB Securities (MBS) maintains a positive outlook due to the “positive news at the beginning of the year” effect and the potential for Vietnam’s stock market to be officially upgraded after the mid-term review in March. Consequently, the VN-Index could target the 1,860-point range in the first half of the year.

On the other hand, from a more optimistic perspective, if price movements remain positive and the VIN group continues to thrive, Mr. Nguyen Duc Khang – Head of Securities Analysis at Pinetree forecasts that the VN-Index could reach the 2,500-point level in 2026.

Regarding liquidity, Mr. Khang believes that the government’s push for public investment disbursement and increased money supply into the system could push market liquidity back to the average level of VND 40-50 trillion per session.

Conversely, despite the historic milestone of the FTSE upgrade, experts believe this factor is unlikely to create a sudden liquidity surge. Foreign trading volume accounts for only about 10-15% of total market trading value. Even considering the estimated buying power from ETFs (approximately VND 18,000 – 20,000 billion) and active funds (around USD 3-4 billion over the next two years), these figures remain modest compared to the current domestic strength.

From a practical investment standpoint, the expert suggests focusing on the price levels of key sectors such as banking, real estate, and securities, rather than solely on the VN-Index or VN30.

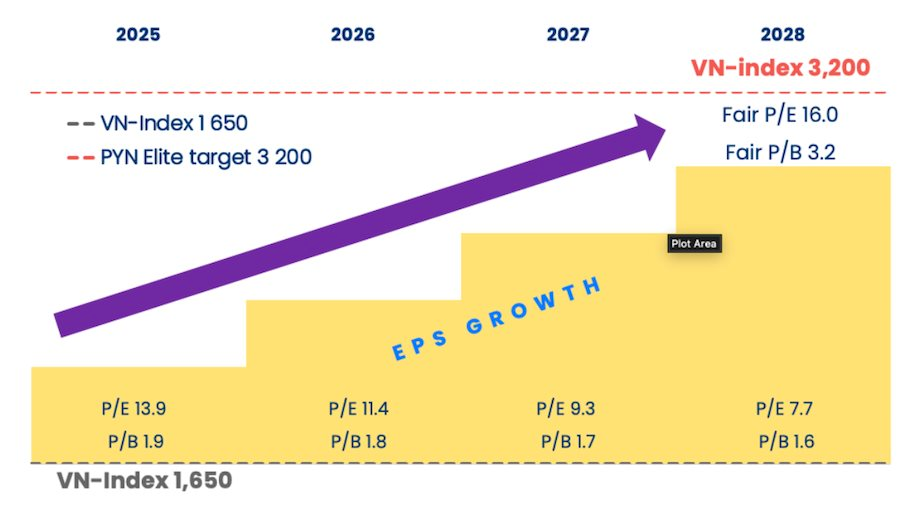

Also holding an optimistic view, Petri Deryng – Head of Pyn Elite Fund asserts that the fund’s target of 3,200 points for the VN-Index is entirely feasible within the next three years, based on an average annual profit growth rate of 18-20% for enterprises. With this growth rate, the market’s P/E ratio in 2028 would reach a reasonable level of 16 (compared to the current undervalued level).

According to this foreign fund, the biggest driver for Vietnam’s stock market’s new leap comes from its macroeconomic foundation. The goal of achieving over 10% GDP growth annually over the next 10-15 years could elevate the economy’s scale and living standards to a higher level. The fund believes this direction is not only reflected in policy statements but has been concretized through strong administrative reforms, unleashing enormous resources for the economy.

PYN Elite’s optimism also stems from the advancements in capital market modernization. FTSE’s upgrade of Vietnam to Secondary Emerging Market status in October is the clearest evidence. This foreign fund also believes that MSCI will soon follow suit once reforms such as the new trading system, elimination of pre-funding requirements, and implementation of a central clearing mechanism are completed.

How to Avoid “Psychological Traps” in Investing

The market is constantly fluctuating, and despite the VN-Index’s gains, profiting is never easy. Therefore, building a proactive investment strategy for 2026 still requires adhering to the following principles:

According to Pinetree’s expert, psychological states like fear during market corrections or FOMO (Fear Of Missing Out) during rallies are natural human reactions. Instead of trying to completely eliminate them—which is nearly impossible—investors should learn to recognize and control them to a moderate extent.

To avoid falling into ‘psychological traps,’ the expert recommends that each individual establish and strictly adhere to a personal investment principle. When stock prices decline, instead of panicking, investors should ask themselves: Do the initial buying reasons still exist? Is the market overreacting? Answering these questions will help investors maintain composure during short-term fluctuations.

Additionally, Mr. Khang emphasizes the importance of disciplined stop-loss strategies to avoid sinking into significant losses. A common paradox in the market is that investors tend to “take profits too early” but are overly patient with losing positions, hoping for a turnaround. He asserts that this is not a sound long-term approach.

Ultimately, a well-structured investment system is the strongest safeguard against emotional decision-making, helping investors remain calm amidst the market’s turbulent waves.

Vietstock Weekly 05-09/01/2026: New Year, Familiar Challenges?

The VN-Index extended its winning streak to a third consecutive week, forming a bullish Big White Candle pattern and reclaiming its October 2025 peak. Currently trading near the Upper Band of the Bollinger Bands, the index faces a critical juncture. While momentum is positive, volume remains a concern, lacking full conviction. To decisively break through this resistance and establish a new uptrend, improved liquidity will be essential in the coming sessions.

Market Pulse 05/01: Financial Sector Faces Heavy Selling, VN-Index Narrows Gains

At the close of trading, the VN-Index rose 3.91 points (+0.22%) to 1,788.4 points, while the HNX-Index fell 2.03 points (-0.82%) to 246.74 points. Market breadth was predominantly negative, with 437 decliners outpacing 255 advancers. Similarly, the VN30 basket saw red dominate, with 22 decliners, 7 advancers, and 1 unchanged stock.

Vietstock Daily 09/01/2026: Cooling Off After a Strong Rally

The VN-Index retraced after a six-session winning streak, accompanied by trading volume surpassing its 20-day average. Short-term outlook remains positive as the index closely tracks the upper Bollinger Band and MACD sustains its upward trajectory, though volatility risks may rise with the Stochastic Oscillator venturing deeper into overbought territory.

Vietstock Daily 07/01/2026: Embarking on a New Journey?

The VN-Index extended its winning streak to a fifth consecutive session, marked by a robust green candle, decisively breaching the previous October 2025 peak to reinforce the prevailing uptrend. Short-term outlook remains highly optimistic, supported by both the Stochastic Oscillator and MACD indicators sustaining their upward trajectories following buy signals.