MARKET ANALYSIS FOR THE WEEK OF DECEMBER 29-31, 2025

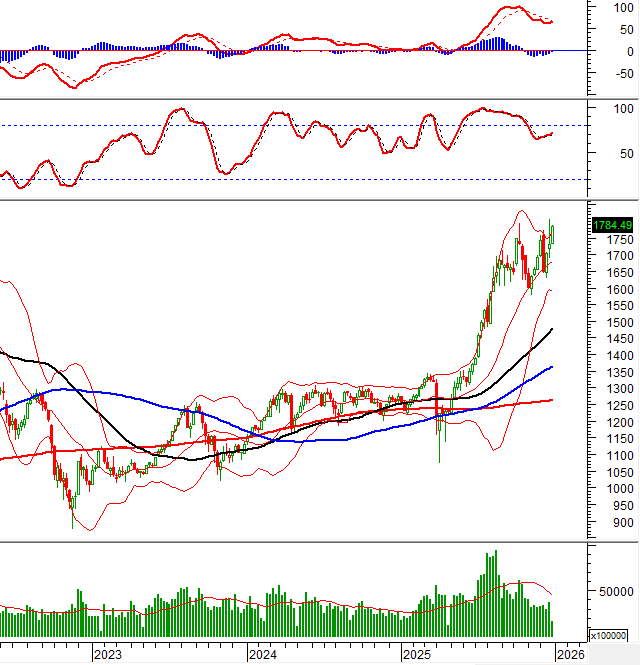

During the week of December 29-31, 2025, the VN-Index continued its third consecutive week of recovery, forming a Big White Candle pattern and revisiting the October 2025 peak levels.

The index is currently trading near the Upper Band of the Bollinger Bands, although trading volume remains inconsistent. Improved liquidity will be crucial in the coming weeks for the VN-Index to decisively break through this resistance zone and establish a new upward trend.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Third Consecutive Session Gain

On December 31, 2025, the VN-Index marked its third straight session of gains, forming a Three White Soldiers candlestick pattern alongside increasing trading volume, indicating optimistic investor sentiment.

Currently, the VN-Index is testing the October 2025 highs (around 1,740-1,795 points) and remains above the Middle Band of the Bollinger Bands. Additionally, the MACD indicator continues to rise, further supporting the short-term recovery momentum.

HNX-Index – Re-testing the 200-Day SMA

On December 31, 2025, the HNX-Index experienced sideways movement, forming a small-bodied candlestick and re-testing the 200-Day Simple Moving Average (SMA).

The Middle Band of the Bollinger Bands will continue to act as strong resistance in the near term. Meanwhile, the formation of lower highs and lower lows suggests a potential short-term downtrend.

Liquidity Analysis

Smart Money Flow Dynamics: The Negative Volume Index for the VN-Index remains above the 20-Day Exponential Moving Average (EMA). If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Investor Flow Dynamics: Foreign investors continued to net buy on December 31, 2025. Sustained buying activity from foreign investors in upcoming sessions would further bolster market optimism.

Technical Analysis Team, Vietstock Advisory Department

– 16:58 January 4, 2026

Market Pulse 05/01: Financial Sector Faces Heavy Selling, VN-Index Narrows Gains

At the close of trading, the VN-Index rose 3.91 points (+0.22%) to 1,788.4 points, while the HNX-Index fell 2.03 points (-0.82%) to 246.74 points. Market breadth was predominantly negative, with 437 decliners outpacing 255 advancers. Similarly, the VN30 basket saw red dominate, with 22 decliners, 7 advancers, and 1 unchanged stock.

Vietstock Daily 09/01/2026: Cooling Off After a Strong Rally

The VN-Index retraced after a six-session winning streak, accompanied by trading volume surpassing its 20-day average. Short-term outlook remains positive as the index closely tracks the upper Bollinger Band and MACD sustains its upward trajectory, though volatility risks may rise with the Stochastic Oscillator venturing deeper into overbought territory.

Vietstock Daily 07/01/2026: Embarking on a New Journey?

The VN-Index extended its winning streak to a fifth consecutive session, marked by a robust green candle, decisively breaching the previous October 2025 peak to reinforce the prevailing uptrend. Short-term outlook remains highly optimistic, supported by both the Stochastic Oscillator and MACD indicators sustaining their upward trajectories following buy signals.

Vietstock Daily 06/01/2026: Intense Tug-of-War in the Market

The VN-Index continues to fiercely oscillate around its October 2025 peak (equivalent to the 1,740-1,795 point range). With the Stochastic Oscillator signaling a buy opportunity and the MACD sustaining its upward momentum, short-term risks appear manageable. However, investors should remain cautious of potential volatility as the index navigates a robust resistance zone.

![Record-Breaking Trade: Exports and Imports Surpass $900 Billion for the First Time [Infographic]](https://xe.today/wp-content/uploads/2025/12/1infograph-100x70.png)