The US Dollar Loses Its Safe-Haven Status

Source: Author’s compilation

|

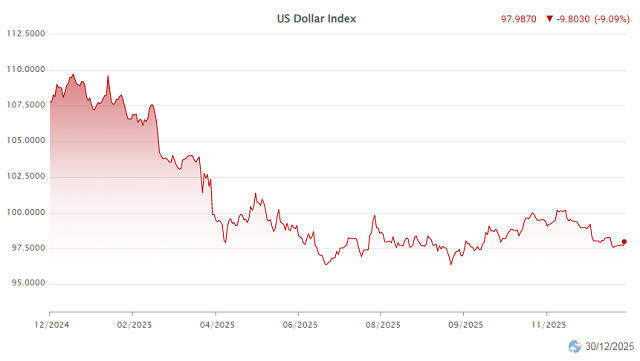

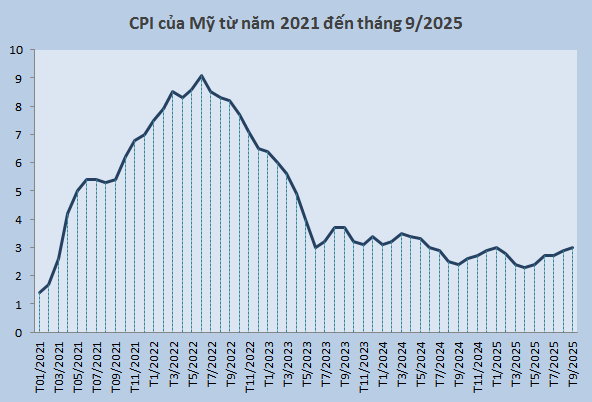

Amid persistent inflation above the 2% target, the Federal Reserve (Fed) delayed monetary easing in early 2025. However, a surge in imports due to businesses stockpiling goods to hedge against potential tariff hikes unexpectedly pushed US economic growth into negative territory. This eroded confidence in the greenback, sending the US Dollar Index (DXY) into a downward spiral.

In Q2/2025, the US economy rebounded strongly, driven by improved consumer spending and a slowdown in imports after the initial stockpiling phase. Yet, overall growth for the first half of the year remained sluggish, and the Fed noted a “significant slowdown” in job growth compared to the beginning of the year. This forced the Fed to pivot towards monetary easing to support growth, despite higher import tariffs pushing inflation to around 3%.

Source: Author’s compilation

|

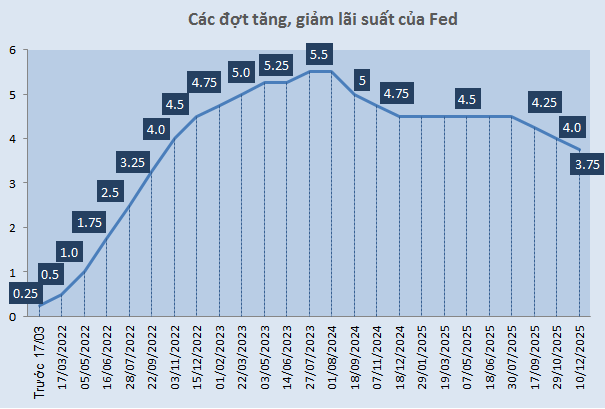

On September 18th, the Fed initiated its first rate cut of the year, lowering the benchmark rate by 25 basis points to a range of 4-4.25%. Subsequent cuts followed in October and December, each by 25 basis points, bringing the federal funds rate down to 3.5-3.75%, the lowest since November 2022.

|

US Dollar Index (DXY) Performance in 2025

Source: VietstockFinance

|

The Fed’s shift to monetary easing quickly pressured the US Dollar. By year-end 2025, the DXY had fallen approximately 9.5% from the beginning of the year, settling around 97 points – its lowest level in over three years.

A Weaker DXY Doesn’t Necessarily Mean a Weaker USD/VND

|

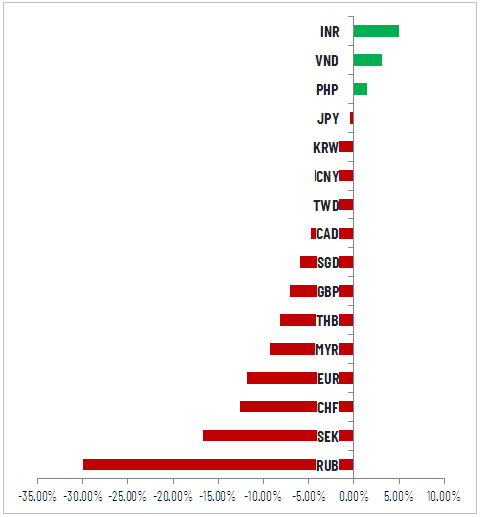

USD Performance Against Other Currencies (Year-to-Date)

Source: investing.com

|

While the DXY, which measures the USD’s strength against a basket of six major currencies, weakened, the USD/VND exchange rate strengthened significantly. This suggests that Vietnam’s exchange rate pressures stem more from domestic factors than external conditions.

A key factor is the narrowing interest rate differential between VND and USD, as VND supply increased rapidly while USD supply remained stagnant.

|

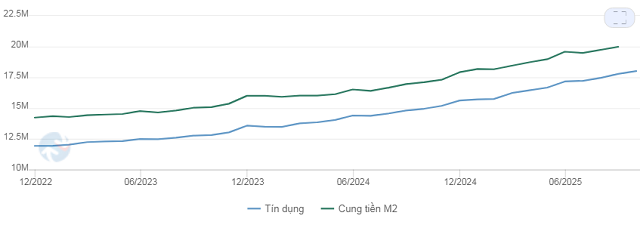

Credit Growth and Money Supply in 2025

Source: VietstockFinance

|

According to the State Bank of Vietnam (SBV), the money supply (M2) increased by 11.53% in the first nine months of 2025 compared to the end of 2024, nearly double the growth rate of the same period last year.

|

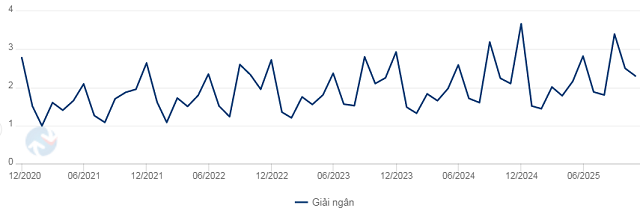

Disbursed FDI by Month in 2025

Source: VietstockFinance

|

Meanwhile, disbursed FDI reached $18.8 billion, up 8% year-on-year; the trade surplus stood at $16.8 billion, down 19% from the previous year.

Vietnam’s foreign exchange reserves reached approximately $80.3 billion as of July 2025, equivalent to 2.2 months of imports. Compared to the IMF’s recommended minimum of 3 months of imports, the SBV’s buffer for exchange rate intervention is not overly abundant.

The rapid increase in VND supply, coupled with stagnant USD supply, has pressured the USD/VND exchange rate upward even as the DXY declined.

Another pressure point is the narrowing interest rate differential between VND and USD. Since March 2025, the SBV has halted treasury bill issuance and increased net liquidity injection through open market operations (OMO) with an OMO interest rate maintained at 4% per annum until December 3rd. This signals the regulator’s priority to keep interest rates low, supporting credit institutions’ access to affordable capital and maintaining low lending rates to stimulate credit demand and economic growth.

From late 2024 to mid-September 2025, the Fed kept its benchmark rate at 4.5%, pushing the VND-USD interest rate differential into negative territory. This encouraged USD holdings, further pressuring the exchange rate.

|

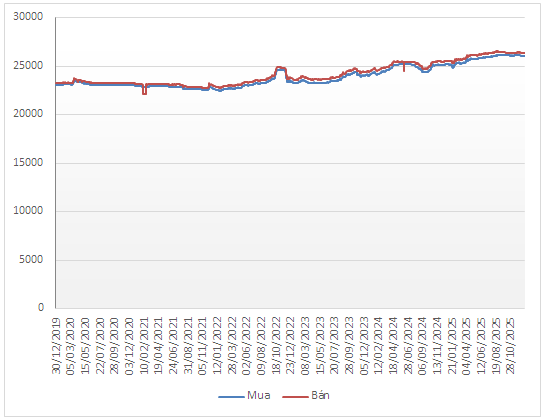

USD/VND Exchange Rate at Vietcombank

Source: VCB

|

Under these influences, the USD/VND exchange rate rose steadily from the beginning of the year, peaking in Q3/2025. The selling rate at Vietcombank reached a high of 26,536 VND/USD on August 21st, up 3.86% from the start of the year.

Shortly after, on August 25th, the SBV intervened technically by selling cancellable forward foreign exchange for 180 days at a rate of 26,550 VND/USD. These transactions were limited to credit institutions with negative foreign exchange positions, aiming to balance their foreign exchange status.

Analysts view the SBV’s provision of cancellable forward foreign exchange contracts as a “soft” intervention measure, reassuring the market as 26,550 VND/USD became a psychological ceiling. This limits the risk of depleting foreign exchange reserves if exchange rate pressures are short-term. It also shifts foreign exchange demand to the final months of the year, when supply improves due to remittances and the prospect of further Fed rate cuts, thereby delaying short-term exchange rate pressures and stabilizing the foreign exchange market.

Following the intervention, the USD/VND exchange rate at Vietcombank eased somewhat. Concurrently, the Fed’s first rate cut on September 18th, 2025, lowered the benchmark rate to 4.25%, widening the VND-USD interest rate differential.

However, USD selling rates at banks remained at the ceiling, prompting the SBV to intervene again in early October. This time, the SBV continued selling cancellable forward foreign exchange for 180 days at 26,550 VND/USD to credit institutions with negative foreign exchange positions. This measure is expected to push USD demand into Q1/2026, stabilizing the exchange rate in the short term.

Positively, the Fed implemented two more rate cuts in October and December, bringing the benchmark rate down to 3.75%. Meanwhile, from December, the SBV raised the OMO interest rate by 50 basis points to 4.5% per annum. This shifted the VND-USD interest rate differential into positive territory, easing exchange rate pressures by year-end.

Where Will Exchange Rate Pressures Come From in 2026?

According to Mr. Nguyen Khanh, Founder of Hedge Academy, the SBV’s deployment of 180-day cancellable forward foreign exchange sales and the OMO rate hike to 4.5% per annum primarily stabilize expectations and control short-term exchange rate volatility until the forward contracts mature. For medium- and long-term exchange rate prospects, additional factors must be considered, including potential increases in USD supply and the Fed’s monetary policy direction.

According to Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, the exchange rate landscape during this period is shaped by multiple factors. The most critical variable in the short term remains the strength of the US Dollar, but the outlook for 2026 is expected to be more favorable as the greenback enters a mild decline phase alongside global monetary easing. As pressure from the USD weakens, pressure on the VND will correspondingly ease, facilitating exchange rate stability without overly aggressive intervention measures.

Vietnam’s robust external economic foundation acts as a natural buffer, helping the exchange rate maintain balance in the medium and long term. This stability is reinforced by a healthy trade surplus, stable FDI disbursements, and positive remittance growth, enabling the domestic market to withstand global volatility.

“However, the pivotal turning point in 2026 will be the impact of Vietnam’s stock market upgrade. This event will attract long-term foreign capital, increasing market size and depth while significantly reducing foreign investor net selling pressure. More importantly, elevating Vietnam’s status in the eyes of international investors will unlock foreign exchange inflows into the capital market, providing a stable USD supply and directly reducing exchange rate pressures,” Mr. Huy emphasized.

Based on these advantages, Mr. Huy expects the regulator to maintain a flexible approach, coordinating monetary, foreign exchange, and macroeconomic policies while increasing foreign exchange reserves to create a safety buffer against risks.

“In essence, the 2026 management strategy involves keeping interest rates at a reasonable level to support a 10% growth target while ensuring system safety. The exchange rate will aim for flexible stability, underpinned by the inherent strength of the trade balance, investment flows, and the stock market’s upgraded status,” Mr. Huy shared.

MB Securities (MBS) raises the question for 2026: Will the Fed only cut rates once more, or will it concede to President Trump’s demands and lower the benchmark rate to 3% or below?

According to MBS, the Fed will likely implement only one more 25-basis-point rate cut, at least until May 2026, during the remaining three meetings under Chairman Powell’s tenure. This is primarily due to persistent inflation driven by tariff policies, immigration restrictions, AI-related energy demand, and tax cuts that significantly narrow the scope for reduction.

However, MBS still predicts the DXY will continue falling to around 95 points in 2026. This weakness reflects diverging monetary policies among major central banks. Some major central banks, such as those in Europe and the UK, have signaled the end of their easing cycles, reducing concerns about the negative impacts of new tariff policies and increasingly focusing on inflation.

With the projected DXY weakness and an expected increase in USD supply by year-end due to exports and remittances, MBS forecasts the USD/VND exchange rate to rise by only 2.2-2.5% in 2026.

– 10:00 05/01/2026

Key Highlights in the Regulation of Bank System Liquidity for 2025

In 2024, the State Bank of Vietnam proactively employed a flexible approach, utilizing both injection and withdrawal operations through treasury bills and the OMO’s forward-buying channel to stabilize exchange rates while balancing system liquidity. By 2025, however, the operational strategy underwent a notable shift.

December 30th Currency Market Update: Overnight Interest Rates Plummet to 3%, Halving Since Last Week

At the close of trading on December 29, the Vietnamese Dong (VND) interbank interest rates saw a sharp decline in the overnight term, while longer-term rates remained elevated. The State Bank of Vietnam continued its net liquidity injection through the Open Market Operations (OMO) channel. Both the central exchange rate and the USD rates across markets experienced a slight downward adjustment.

USD Price Plunges to New Lows

During the week of December 22–26, 2025, the US dollar extended its decline in international markets amid escalating geopolitical tensions, driving investors to seek refuge in safe-haven assets such as precious metals.

Interbank Overnight Rates Plummet, USD Exchange Rate Tumbles in Latest Currency Market Update

At the close of the December 25th session, VND interbank interest rates cooled for short-term maturities, while USD rates edged up slightly for longer terms. The State Bank of Vietnam conducted a net withdrawal of over 1,240 billion VND through OMO operations, and the central exchange rate saw a significant drop of 13 dong.